Definition and Importance of IRS Form 1098-T 2017

IRS Form 1098-T, also known as the Tuition Statement, serves as an essential document for reporting qualified tuition and related expenses that eligible educational institutions receive from students. This form is specifically used in the context of U.S. tax law to help students, families, and educational institutions keep track of costs associated with higher education. The information on the form is crucial for individuals and families seeking education-related tax credits, such as the American Opportunity Credit and the Lifetime Learning Credit.

The form primarily includes details such as the amount of tuition billed, scholarships or grants received, and the student's identification information. Understanding the contents of Form 1098-T is vital for accurately filing your taxes. The form only includes the tuition expenses that have been billed during the calendar year and does not necessarily reflect the payments made, which can lead to confusion if not correctly interpreted.

Key elements of the form are particularly relevant to taxpayers for claiming tax benefits. These components include:

- Amount of payments received for qualified tuition and related expenses

- Scholarships or grants that reduce the total cost of education

- The institution's information, including its Employer Identification Number (EIN)

For students or parents who primarily depend on grants or financial aid, this form provides clarity about what expenses can be deducted on their tax returns.

How to Use IRS Form 1098-T 2017 for Tax Reporting

Using Form 1098-T effectively requires understanding how its details relate to potential tax credits and deductions. Taxpayers should start by confirming that the educational institution properly issued the form, which must be sent to both the IRS and the student.

Steps for Utilizing the Form for Tax Benefits:

- Review the Form: Ensure that the tuition amounts and scholarship details listed are accurate.

- Determine Eligibility: Check qualifications for tax credits based on the reported figures. The American Opportunity Credit is applicable for expenses incurred during the first four years of higher education. The Lifetime Learning Credit is available for any year of higher education.

- Complete Your Tax Return: Report the amounts as needed on your tax return forms (like Schedule 8863 for education credits).

- Keep Records: Maintain copies of the form along with any other documentation for future reference or IRS inquiries.

It is advisable to consult a tax professional if you're uncertain about the taxation rules related to education credits, especially if you have multiple sources of funding or educational institutions involved.

Obtaining IRS Form 1098-T 2017

Students and parents can receive Form 1098-T through their educational institutions. Here are key points on how to obtain this document:

- Directly From the Institution: Most schools provide this form electronically via student portals. Check your institution’s website for instructions on how to access it.

- Contact the Registrar's Office: If the form is not available online, you can request a physical copy by contacting the school’s registrar or the financial aid office.

- IRS Website: While students cannot obtain their 1098-T directly from the IRS, they can find general information and guidelines regarding the form on the IRS website.

Educational institutions are required by law to issue Form 1098-T to students who meet specific criteria, so ensure to check with your institution if you have not received one by early February each year.

Key Elements to Complete IRS Form 1098-T 2017

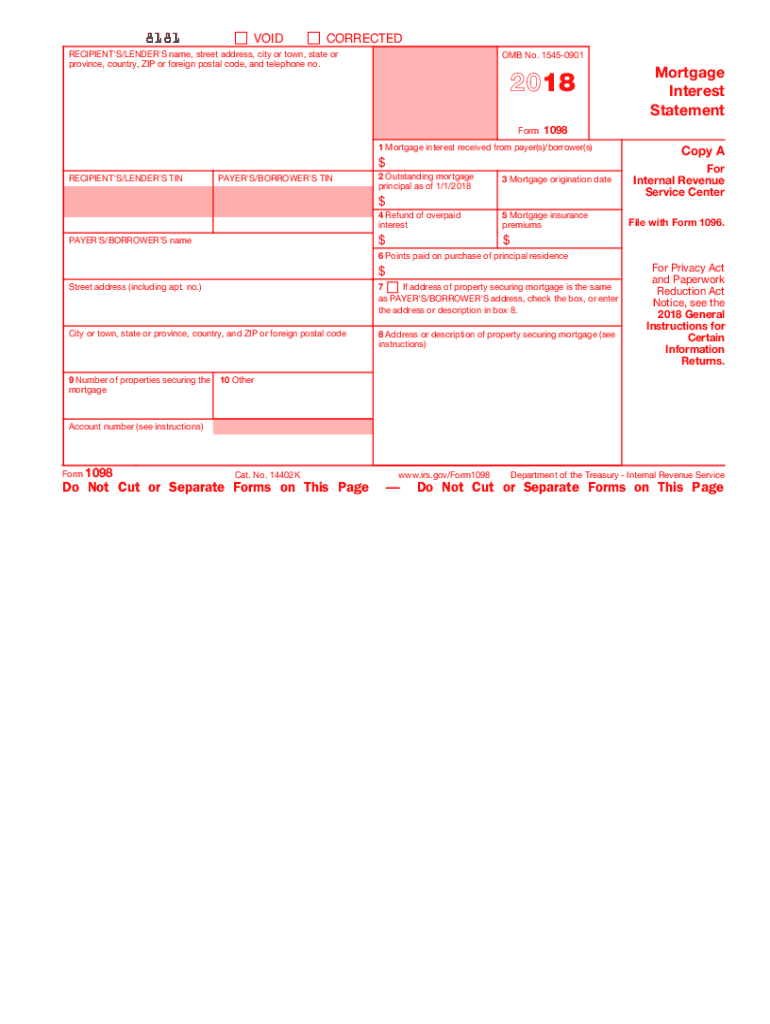

Completing the Form 1098-T can present its challenges, especially when distinguishing between billed amounts and actual payments. It's crucial to understand each section of the form:

- Box 1: The total payments received for qualified tuition and related expenses.

- Box 2: The amount billed (this box is deprecated for tax years after 2017, so students should only refer to Box 1).

- Box 5: The total amount of scholarships and grants that were applied to the tuition costs.

Understanding the Details:

- Qualifying Expenses: Be aware that not all fees qualify; only those that are necessary for enrollment or attendance at the eligible institution qualify.

- Scholarship Impact: Review how any scholarships received may impact potential credits, as they are often reported in conjunction with tuition awarded.

- Identification Information: Ensure that all personal details, such as your social security number and the institution’s EIN, are accurately listed as these are crucial for IRS processing.

Accurate completion of these sections facilitates successful claim applications for tax benefits, ensuring you maximize your educational investment.

Filing Deadlines and Important Dates Related to Form 1098-T 2017

Filing your tax return accurately and on time is fundamental to avoiding penalties. The deadlines associated with IRS Form 1098-T are integral to this process. Educational institutions must send this form out by the end of January following the tax year in question.

Key Dates to Remember:

- January 31: Deadline for educational institutions to provide Form 1098-T to students and the IRS.

- April 15: Standard deadline for individual tax returns unless extended due to weekends or holidays.

Failure to receive the form by the deadline may require following up with your institution, as failure to report tuition taxes could result in errors that lead to IRS audits or penalties. It is also prudent to request an extension for your tax return if you are still awaiting this form.

Common Questions and Scenarios Involving IRS Form 1098-T 2017

There are numerous circumstances in which individuals may find themselves using Form 1098-T. Here are several common scenarios:

- Students with Multiple Funding Sources: When a student receives both scholarships and loans, they must accurately report each on their tax return. Understanding how these affect eligibility for educational credits becomes crucial.

- Parents Claiming Dependents: Parents often utilize Form 1098-T when claiming their child as a dependent for tax purposes. It is essential to determine who can rightfully claim educational credits.

- Students in Transition: If a student transfers between institutions during the tax year, they may receive multiple 1098-T forms. Understanding how to aggregate costs from different sources is important for accurate tax reporting.

Each scenario includes unique factors that may influence tax benefits or obligations. Familiarizing yourself with these situations prepares you to handle complexities efficiently.

The above sections cover crucial aspects of IRS Form 1098-T for 2017, offering a comprehensive overview of its purpose, usage, and requirements. This detailed breakdown aids students and taxpayers in effectively navigating their educational tax benefits.