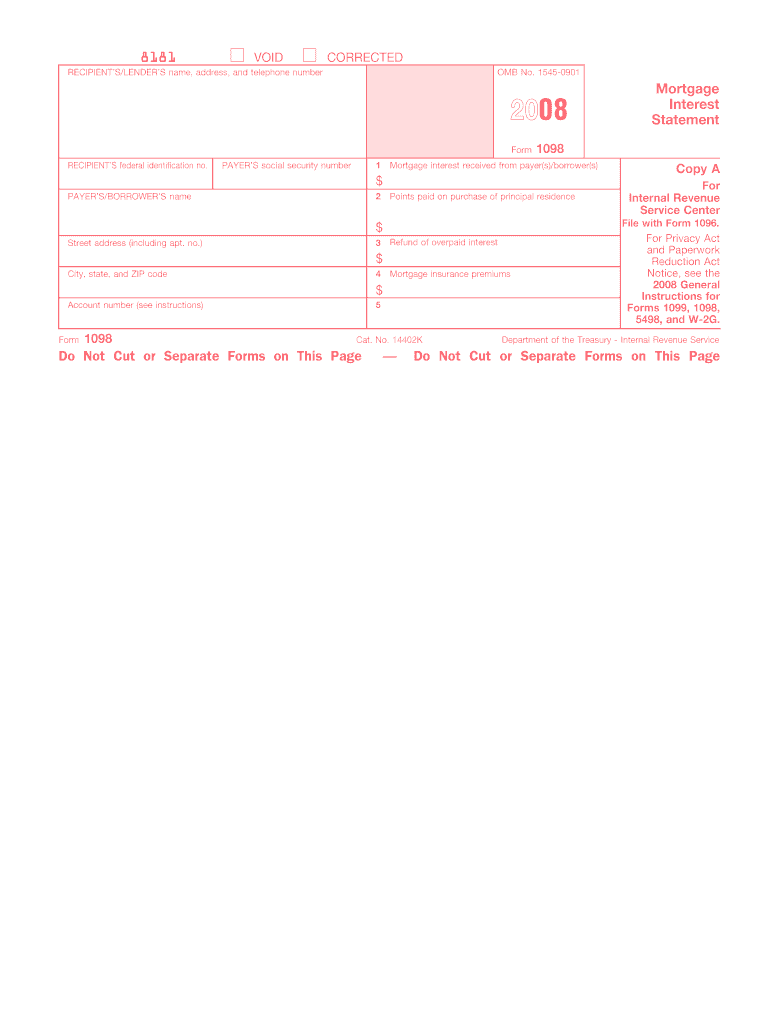

Definition and Meaning of the 2008 Form 1098 Mortgage Interest

The 2008 Form 1098, also known as the Mortgage Interest Statement, is a crucial tax form issued by lenders to report mortgage interest received from borrowers throughout the tax year. It serves as a vital document for both the recipient (lender) and the payer (borrower), particularly for tax purposes. The information provided on this form can significantly affect the taxpayer's deductions when filing annual income taxes.

Key Components of Form 1098

- Borrower Information: Includes the name, address, and taxpayer identification number of the borrower.

- Lender Information: Contains details about the lender, including their name, address, and taxpayer identification number.

- Interest Paid: The total amount of mortgage interest paid during the tax year, which is often tax-deductible for the borrower.

- Points Paid: Any points (prepaid interest) that were paid for the mortgage, which may also be deductible.

- Mortgage Insurance Premiums: This section may reflect any premiums paid by the borrower for mortgage insurance, which can be deductible under certain conditions.

Understanding the significance of the 2008 Form 1098 helps borrowers take advantage of potential tax deductions, transforming it into an essential document for financial planning.

How to Use the 2008 Form 1098 Mortgage Interest

Using the 2008 Form 1098 requires an understanding of its role in tax preparation. This form helps taxpayers determine how much mortgage interest they can deduct on their federal tax returns, thereby reducing their taxable income.

Steps to Utilize the Form Effectively

- Receive the Form: Borrowers need to receive the Form 1098 from their lender, usually by January 31 of the following year.

- Review Information: Check the accuracy of the details on the form, including the total mortgage interest and any points.

- Include in Tax Returns: Input the total mortgage interest paid figure from the 1098 on Schedule A of the IRS Form 1040, if itemizing deductions.

- Consult IRS Guidelines: Refer to IRS Publication 936 for detailed guidance on mortgage interest deductions, especially for unique situations such as home equity loans.

By following these steps, borrowers should maximize their benefits from the deductions allowed.

Important Terms Related to the 2008 Form 1098 Mortgage Interest

To effectively navigate the complexities of the 2008 Form 1098, familiarity with specific terminology is essential. Understanding these terms enables borrowers to accurately interpret important data in their mortgage-related documentation.

Common Terms Defined

- Mortgage Interest: The interest charged on a mortgage loan which can typically be deducted from taxable income.

- Points: Fees paid directly to the lender at closing in exchange for a reduced interest rate on the loan.

- Tax Deduction: An expense deducted from taxable income, reducing the overall tax liability.

- Itemized Deductions: Deductions that individuals can claim on their tax returns for specific expenses, including mortgage interest.

Acquiring knowledge of these terms supports better comprehension of the financial implications of the 2008 Form 1098.

Steps to Complete the 2008 Form 1098 Mortgage Interest

Completing the 2008 Form 1098 involves collecting various components and filling them out accurately. It is essential for lenders to ensure that all required information is included to prevent potential discrepancies that could lead to tax complications.

Completion Process

- Gather Required Information: Collect the necessary borrower and lender information, including taxpayer identification numbers and addresses.

- Fill Out the Form: Complete all sections of the form, including mortgage interest paid, points, and any mortgage insurance premiums.

- Double-Check Data: Review the information for accuracy and completeness prior to submission.

- File with the IRS: Submit the form to the IRS along with copies sent to the respective borrowers by the required tax deadlines.

Completing the form correctly is essential for both lenders and borrowers to avoid legal issues and penalties associated with incorrect reporting.

Who Typically Uses the 2008 Form 1098 Mortgage Interest

The 2008 Form 1098 is relevant to various parties involved in mortgage transactions. Understanding who uses this form helps clarify its significance in tax reporting and financial consultation.

Primary Users

- Borrowers: Homeowners and individuals who have taken out a mortgage rely on this form to claim mortgage interest deductions.

- Lenders: Financial institutions or individuals who issue mortgages prepare and distribute this form to borrowers.

- Tax Professionals: Accountants or tax preparers who assist clients in preparing tax returns often refer to this form to ensure accurate reporting of taxable income.

Recognizing these user groups emphasizes the form's critical role in both individual financial management and professional tax services.