Definition and Purpose of Form

Form 1098, also known as the Mortgage Interest Statement, is a crucial document for both borrowers and lenders in the United States. This form is used to report mortgage interest of $600 or more received by lenders from borrowers during the tax year. The significance of Form 1098 lies in its requirement for accurate reporting to the Internal Revenue Service (IRS), enabling borrowers to claim mortgage interest deductions when filing their federal income tax returns. Understanding this form can aid in maximizing potential tax benefits, making it essential for homeowners and financial institutions alike.

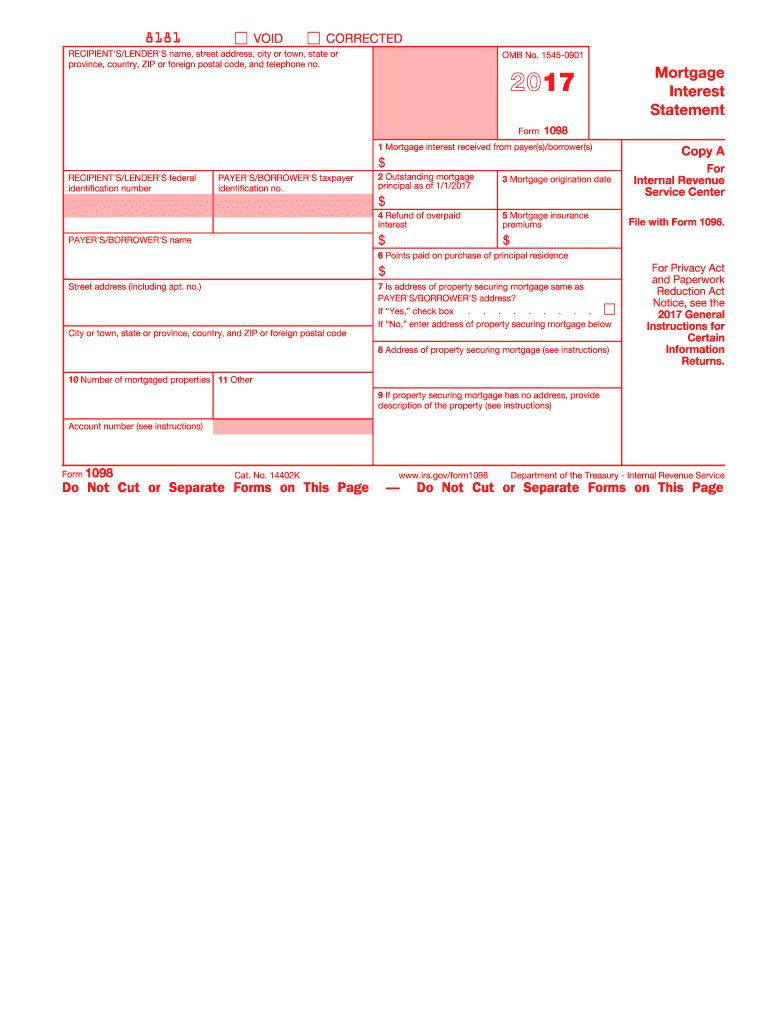

Key Components of Form 1098

The primary sections of Form 1098 include:

- Mortgage Interest Paid: This section provides the total amount of mortgage interest the borrower paid during the tax year.

- Outstanding Principal: This indicates the balance of the loan at year-end.

- Property Address: The location of the mortgaged property is documented for verification purposes.

Importance for Borrowers

Utilizing Form 1098 is vital for homeowners to ensure they receive proper credit for interest paid, potentially leading to significant tax savings. Furthermore, lenders utilize this form to maintain compliance with IRS regulations.

Steps to Complete Form

Completing Form 1098 involves several key steps, ensuring all necessary information is accurately reported. Here’s a comprehensive guide on how to fill out the form correctly.

- Obtain the Official IRS Form: Start by downloading the official copy of Form 1098 from the IRS website or obtaining it through your lender.

- Fill in Borrower Details:

- Input the name and address of the borrower.

- Include the borrower's taxpayer identification number (Social Security Number).

- Enter Mortgage Interest Information:

- Report the total mortgage interest received in Box 1.

- Input the outstanding principal balance in Box 2.

- Fill in the property address in Box 3 for clarity.

- Additional Reporting: Include any applicable real estate taxes and any refunds if applicable, in the respective boxes, ensuring accuracy.

- Review for Accuracy: Ensure all entries are double-checked for correctness to avoid complications during tax filing.

Important Terms Related to Form

Understanding essential terminology associated with Form 1098 can enhance comprehension and ensure proper usage. Here are some key terms related to this form:

- Mortgage Interest: The interest charged on a home loan, which is usually eligible for tax deduction when reported correctly.

- Taxpayer Identification Number (TIN): A number assigned by the IRS to individuals for tax purposes, often the Social Security Number.

- IRS Penalties: Failure to accurately report can lead to penalties and interest, making it crucial to complete Form 1098 correctly.

Filing Deadlines and Important Dates for Form

Filing deadlines are critical when dealing with Form 1098 to ensure compliance and to avoid penalties. Here’s a breakdown of important dates:

- Tax Year Deadline: Form 1098 must be issued to borrowers by January 31 of the year following the tax year (e.g., for the tax year 2017, it must be issued by January 31, 2018).

- Filing with the IRS: Lenders must file Form 1098 with the IRS by February 28 if filing by paper and by March 31 if filing electronically.

- Record Keeping: Borrowers should retain their copy of Form 1098 for at least three years from the date of filing their tax return, as it serves as documentation for tax purposes.

Who Typically Uses Form ?

Form 1098 is primarily utilized by specific individuals and entities involved in the mortgage process. Here are the typical users:

- Lenders: Financial institutions, banks, and mortgage companies that provide loans to homeowners use Form 1098 to report interest.

- Borrowers: Homeowners or individuals who have taken out a mortgage benefit from this form by federal income tax benefit claims.

- Tax Professionals: Accountants and tax advisors rely on Form 1098 to provide accurate tax filing services.

Understanding the audience utilizing this form can assist in ensuring that accurate information is reported and submitted.

Legal Use of Form

Form 1098 plays a significant role in legal and regulatory compliance for financial institutions. Knowing the legal aspects of this form can prevent potential legal issues.

- IRS Regulations: Compliance with IRS requirements ensures that lenders fulfill their obligations related to reporting mortgage interest.

- Tax Benefits: Accurate completion and distribution of Form 1098 allow borrowers to qualify for tax deductions, thus promoting lawful financial practices.

Non-compliance with the legal requirements associated with Form 1098 can lead to fines, penalties, and adverse legal consequences for both lenders and borrowers.

Digital vs. Paper Version of Form

With the advent of technology, the choice between digital and paper versions of Form 1098 has become an important consideration. Each version has its advantages:

- Digital Version: Allows for faster processing and easier storage. It minimizes paper clutter and can be tracked electronically.

- Paper Version: Traditional approach that is still widely accepted. Some lenders may prefer or require paper copies for legal records or tax submission.

- Preference: The choice typically depends on the lender's infrastructure and the borrower's comfort level with technology.

Choosing the appropriate format can streamline the workflow and enhance record-keeping practices.

Examples of Using Form

Practical examples illustrate the importance and use of Form 1098. Consider the following scenarios:

- Homeowner Deduction: A homeowner pays $10,000 in mortgage interest during the year and receives a Form 1098 outlining this amount. This documentation supports their tax return, enabling them to deduct this expense from taxable income.

- Lender Compliance: A bank that issues a $200,000 mortgage must record and report the interest received as well as the borrower’s details. Accurate completion of Form 1098 is necessary to avoid regulatory scrutiny from the IRS.

These examples help to clarify how this form operates in real-world situations, underscoring its importance in the financial documentation landscape.