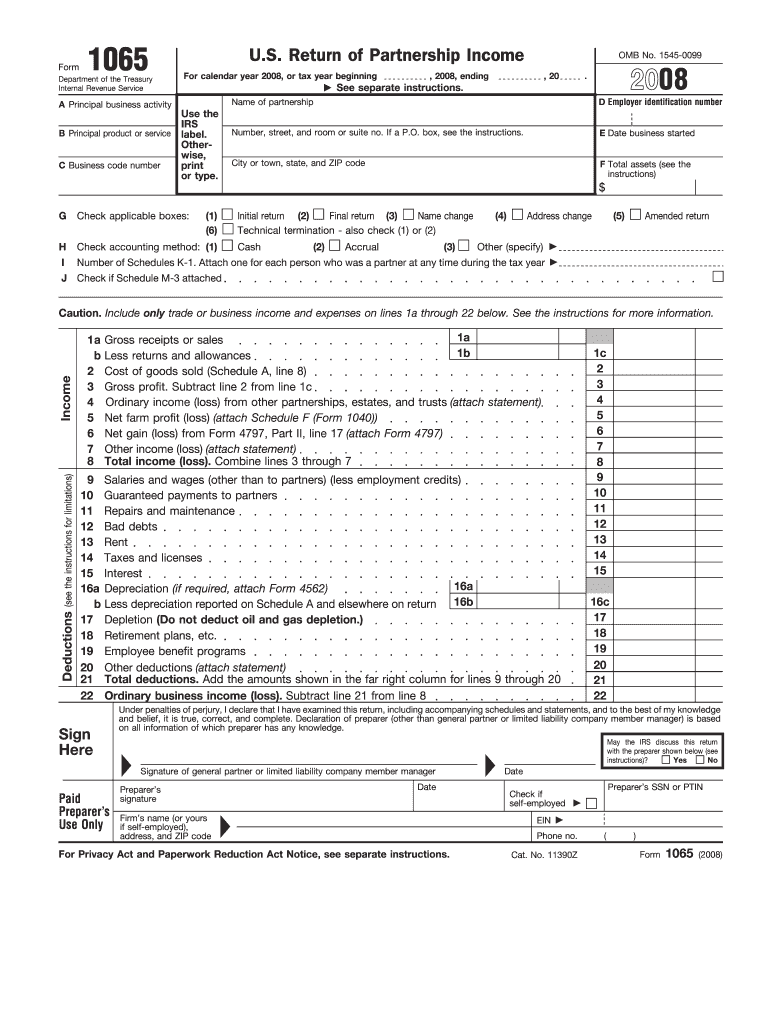

Definition and Purpose of IRS Form 1065, 2008

IRS Form 1065, also known as the U.S. Return of Partnership Income, is a crucial tax document used by partnerships. In 2008, this form was specifically designed to help partnerships report their income, deductions, and other pertinent financial details to the IRS. It includes sections for partnership details, partner distributions, and schedules for cost of goods sold and balance sheets. The inclusion of checks and declarations ensures accurate representation of the partnership’s tax status.

Key Elements of IRS Form 1065, 2008

- Partnership Details: Capture the essential information of the partnership, including name, address, and EIN.

- Income: Report the total income earned by the partnership during the tax year.

- Deductions: Detail the deductions that the partnership claims to reduce taxable income.

- Partner Distributions: Document the method and amounts distributed to partners.

- Cost of Goods Sold: Summarize the costs directly associated with the production of goods sold by the partnership.

- Balance Sheets: Provide a detailed overview of the partnership's finances at the beginning and end of the tax year.

How to Obtain IRS Form 1065, 2008

Obtaining IRS Form 1065 for the tax year 2008 is a simple process. The form can be downloaded directly from the IRS website in PDF format. For those who prefer physical copies, the IRS’s customer service can be contacted to request a mailed version. This form was widely available in tax software during 2008 for electronic filing.

Steps to Complete IRS Form 1065, 2008

- Gather Required Information: Collect all essential documents and details about the partnership, its income, deductions, and partners.

- Complete General Information: Fill in the partnership's name, address, and EIN.

- Report Income and Deductions: Accurately enter all income received and deductions applicable during the year.

- Prepare Partner Distribution Schedules: Detail how the income and deductions are distributed among the partners.

- Compile Other Necessary Schedules: Complete additional schedules such as the balance sheet and cost of goods sold.

- Review for Accuracy: Ensure all entries are accurate and complete before submission.

Required Documents for Filing

To successfully complete IRS Form 1065, partnerships must gather several necessary documents:

- Financial Statements: Balance sheet, income statement, and cash flow statement.

- Partnership Agreement: Documentation detailing the roles and profit-sharing ratios among partners.

- Previous Year’s Tax Return: If applicable, the return for contextual financial information.

- Receipts and Invoices: Documentation to support any deductions claimed.

Filing Deadlines and Important Dates

For the 2008 tax year, IRS Form 1065 was required to be filed by the 15th day of the fourth month after the end of the partnership’s tax year, which is typically April 15 for calendar-year partnerships. If the deadline falls on a weekend or public holiday, the due date is extended to the next business day. Partnerships can request a six-month extension by filing Form 7004.

Who Typically Uses IRS Form 1065, 2008

IRS Form 1065 is used primarily by partnerships within the United States, encompassing various business structures like:

- General Partnerships: Businesses where all partners share in liability and management.

- Limited Partnerships: Organizations with both general and limited partners, where limited partners have restricted liabilities.

- Limited Liability Partnerships (LLPs): Partnerships offering liability protection for all partners.

This form is critical for accurately reporting partnership financial activities to avoid potential penalties.

Penalties for Non-Compliance

Failure to file IRS Form 1065 or filing an incomplete form can lead to significant penalties:

- Filing Late Penalty: $210 per month, per partner, up to 12 months for returns filed late without reasonable cause.

- Incomplete or Incorrect Filing: Can result in additional fines or increased scrutiny from the IRS.

Ensuring prompt and accurate filing mitigates these risks.

Digital vs. Paper Version

The IRS provides partnership entities with both digital and paper options for completing and submitting IRS Form 1065. In 2008, an increasing number of partnerships opted for electronic filing due to its efficiency and speed. Digital submission allows for faster processing and acknowledgment of receipt. Meanwhile, the paper version remains available for partnerships preferring traditional methods, although it might involve longer processing times.

Importance of Electronic Filing and Software Compatibility

In 2008, electronic filing of IRS Form 1065 became significantly encouraged due to increased accuracy and faster processing. Partnerships use software like TurboTax and QuickBooks, which provide guided entry, error checking, and streamlined submissions. This compatibility reduces the likelihood of errors and assists in managing complex financial scenarios within the form.