Definition & Meaning

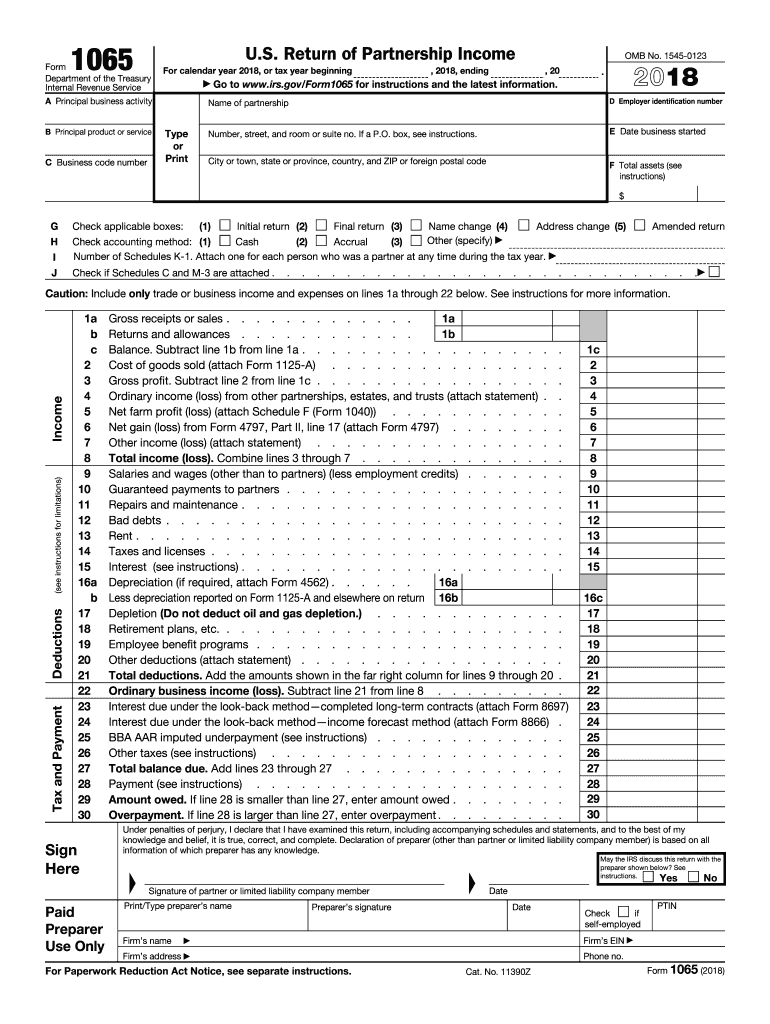

Form 1065, known as the U.S. Return of Partnership Income, is an IRS tax form used by partnerships to report their financial activities. This includes income, deductions, gains, losses, and other pertinent financial details. Unlike individual tax forms, partnerships do not pay tax directly. Instead, they pass the responsibility to the individual partners who report their share of the partnership's income or loss on their personal tax returns. Understanding the specific sections of Form 1065 is crucial for ensuring accurate reporting and compliance with IRS regulations.

Key Sections of Form 1065

- Partnership Information: Includes the partnership's name, address, and employer identification number (EIN).

- Income and Deductions: Captures the gross income and allowable deductions, helping to determine the partnership's net income or loss.

- Schedule K: Lists each partner's share of income, credits, and deductions.

- Schedules L, M-1, and M-2: Used to reconcile the financial balance sheet, book income and taxable income differences, and analysis of partner's capital accounts, respectively.

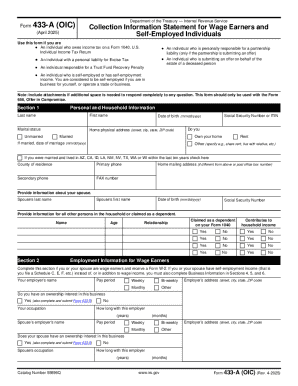

Steps to Complete the Form 1065

Completing Form 1065 involves multiple steps that ensure all financial activities of the partnership are accurately documented.

- Gather Necessary Information: Collect all financial statements, records of income, expenses, and partner details.

- Enter General Information: Fill out the partnership's name, EIN, and address in the designated fields.

- Calculate Income and Deductions: Enter the detailed calculations of the partnership’s total income and allowable deductions.

- Complete Schedule K-1: Prepare a Schedule K-1 for each partner, indicating their share of income, deductions, and credits.

- Attach Supporting Schedules: Complete and attach necessary schedules like L, M-1, and M-2 for detailed reconciliation.

- Review and Submit: Verify all information for accuracy before submitting the form to the IRS.

Who Typically Uses the Form 1065

Form 1065 is primarily used by business entities structured as partnerships. This includes:

- General Partnerships: Businesses with two or more partners sharing management and profits.

- Limited Partnerships (LP): Partnerships including both general and limited partners where limited partners have restricted liability.

- Limited Liability Partnerships (LLP): Partnerships where all partners have some degree of liability protection.

- Limited Liability Companies (LLC) taxed as Partnerships: LLCs with more than one member that elect to be taxed as partnerships.

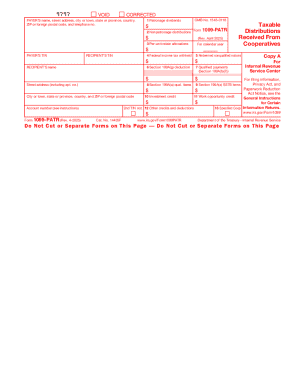

Important Terms Related to Form 1065

- Partnership Agreement: A formal document outlining management roles, profit-sharing ratios, and other critical aspects of the partnership's operation.

- Distributive Share: The portion of income and expenses assigned to each partner as per the partnership agreement.

- Schedule K-1: A supplementary form provided to each partner for reporting their share of the partnership's earnings on their personal tax return.

IRS Guidelines

The IRS provides specific instructions for completing Form 1065, which include detailed guidelines on calculating income, deductions, and the proper way to report each partner's share of tax items using Schedule K-1. The guidelines stress the importance of maintaining accurate records to support all figures reported on the form.

Filing Process

- E-filing Recommendations: The IRS encourages partnerships to file electronically for increased accuracy and efficiency.

- Recordkeeping: Partnerships should maintain comprehensive financial records liable for inspection by the IRS to verify the reported information.

Filing Deadlines / Important Dates

Partnerships must file Form 1065 by the 15th day of the third month following the end of their tax year. For partnerships operating on a calendar year basis, the deadline is typically March 15. If the due date falls on a weekend or public holiday, the deadline extends to the next business day.

Extensions

- Partnerships can file Form 7004 to request a six-month filing extension. However, this does not extend the deadline for partners to pay any taxes owed on their share of partnership income.

Penalties for Non-Compliance

The IRS imposes penalties on partnerships that fail to file Form 1065 on time or provide incomplete or inaccurate information. The standard penalty is assessed per partner for each month the form is late or incomplete.

Avoiding Penalties

- Timely Filing: Ensure the form is filed before the deadline.

- Accuracy: Double-check all entries for errors and omissions.

- Communication: Confirm that all partners receive their correct Schedule K-1 promptly to avoid discrepancies in their personal filings.

Form Submission Methods

Partnerships can submit Form 1065 electronically or via mail, though e-filing is preferred for its efficiency and potential error reduction.

Online Filing

- Advantages: Faster processing time and immediate confirmation of receipt.

- Requirements: Partnerships must use IRS-certified tax software or engage a professional tax preparer to file electronically.

By adhering to these guidelines, partnerships can ensure compliance with IRS requirements, manage their tax obligations effectively, and avoid common pitfalls associated with Form 1065 filing.