Definition and Purpose of Form W-3 2012

Form W-3, known as the Transmittal of Wage and Tax Statements, serves a critical role in the annual payroll reporting process. This form is utilized by employers to transmit Copy A of Form W-2, which reports employee wages and the taxes withheld, to the Social Security Administration (SSA). For the 2012 version, this involved collecting data for the tax year ending December 31, 2012. Form W-3 consolidates information from all W-2s issued by an employer, providing a summary of wages paid, federal income tax withheld, Social Security tax withheld, and other relevant payroll data.

How to Use Form W-3 2012

- Gather Necessary Data: Before filling out Form W-3, collect all W-2 forms issued to your employees for the 2012 tax year. Ensure that all fields are correctly completed and match payroll records.

- Enter Employer Information: Fill in your organization's name, address, and Employer Identification Number (EIN) on the form. This data must be consistent with what appears on the corresponding W-2 forms.

- Summarize W-2 Data: Form W-3 must reflect the totals from all W-2s. Specific sections include wages paid, total tax withheld under various categories, and benefits information.

- Sign and Date the Form: The authorized person should sign the form to certify its accuracy.

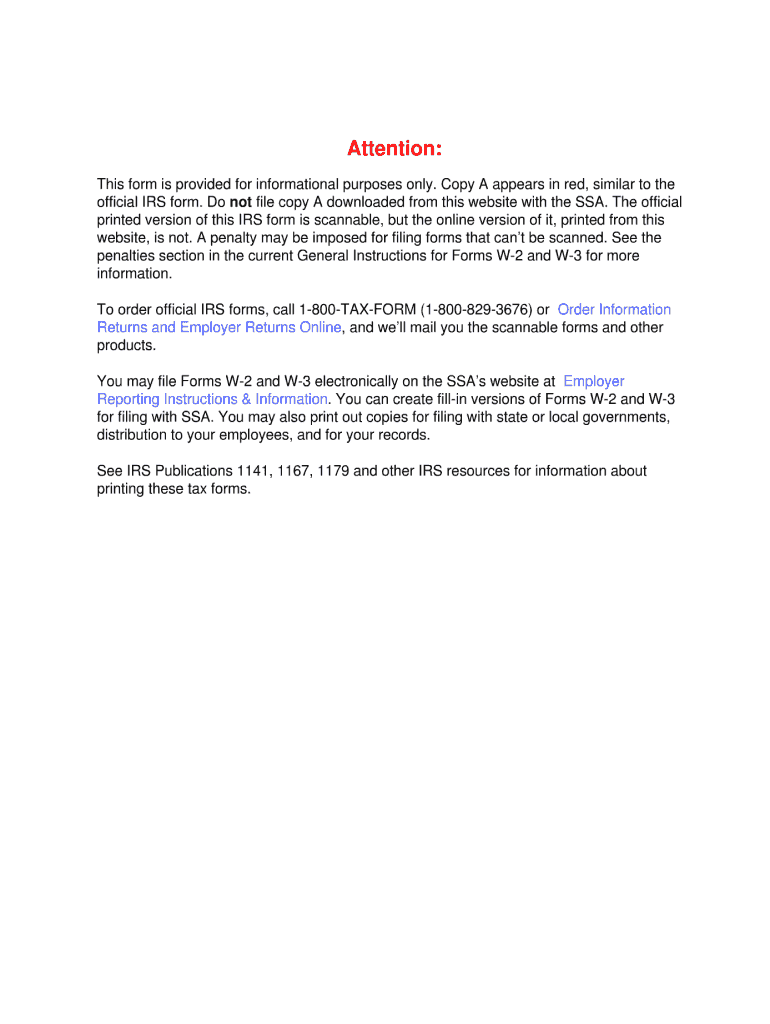

How to Obtain Form W-3 2012

- Direct from the IRS: Forms are available directly from the Internal Revenue Service (IRS) by ordering online or downloading from their official site. It's important to use official forms, as they are formatted to be scanned and processed accurately.

- Tax Preparation Software: Many commercial tax preparation software packages include the ability to generate Form W-3. Check if your software includes the 2012 version.

Steps to Complete Form W-3 2012

- Complete all Employer Information: Fill in the employer's name, EIN, and address ensuring accuracy as any errors can delay processing.

- Accumulate Totals: Add up the totals from all W-2s for wages paid, federal income tax withheld, and Social Security/Medicare wages and taxes.

- **Fill Out Boxes onsistent with Form W-2 and W-3 instructions to ensure accuracy across all submissions.

- Review for Accuracy: Double-check the information against payroll records to avoid discrepancies.

- Sign and Submit: Once completed, submit to the SSA, ensuring compliance with filing deadlines appropriate for the 2012 tax year.

Why Use Form W-3 2012

Employers use Form W-3 to comply with federal tax regulation requirements, specifically transmitting W-2 data to the SSA. Correct completion of Form W-3 is essential to verify employee earnings and tax withholdings, supporting accurate tax records for both employers and employees.

Important Terms Related to Form W-3 2012

- Employer Identification Number (EIN): A unique number assigned to a business by the IRS used for tax purposes.

- Payroll Taxes: These include federal income tax, Social Security tax, and Medicare tax collected from employee wages.

- Transmittal Form: A summary document, such as Form W-3, which accompanies individual employee records for transmission to an agency.

Filing Deadlines and Important Dates

For the 2012 tax year, Form W-3 and Copy A of all attached W-2 forms were required to be submitted to the SSA by the last day of February 2013 for paper filers, or by March 31, 2013, for electronic filers. Staying aware of these deadlines helps avoid penalties and ensures compliance.

Form Submission Methods

- Online Submission: File electronically through the SSA's Business Services Online (BSO) portal for efficiency and quick processing.

- Paper Submission: Mail official paper versions to the SSA at the designated address for those without electronic filing capabilities. If opting for paper, ensure all copies are appropriately aligned.

IRS Guidelines for Form W-3 2012

The IRS provides detailed instructions for completing and filing Form W-3, emphasizing accuracy in the reflection of W-2 information and adherence to submission deadlines. These guidelines are key to ensuring compliance and facilitating smooth processing of employment tax information.