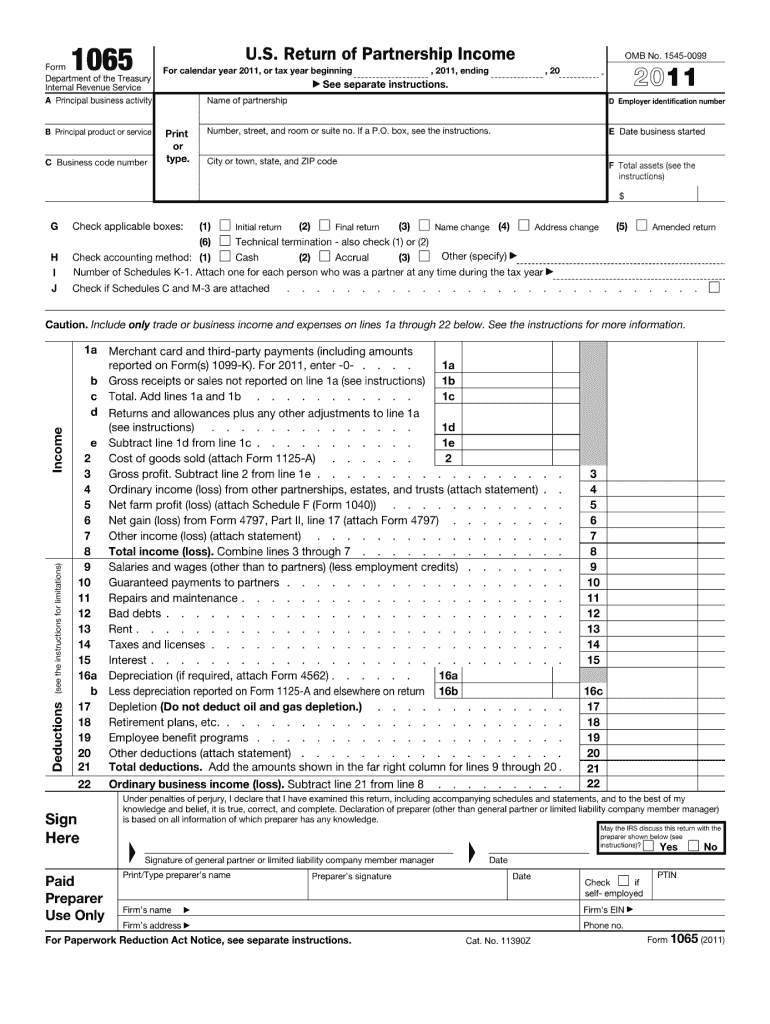

Definition and Meaning of IRS Form 1065

IRS Form 1065, also known as the U.S. Return of Partnership Income, is a critical document used by partnerships. This form is filed with the Internal Revenue Service (IRS) to report the income, deductions, gains, losses, and other financial details of a partnership. One of the unique aspects of partnerships is that they do not pay taxes directly. Instead, they pass income and expenses through to partners, who then include this data in their personal tax returns. The 2011 edition of Form 1065 continues this essential function, providing clarity and compliance with U.S. tax laws.

- Purpose: Provides the IRS with comprehensive data on partnership operations.

- Components: Includes sections detailing both passive and active income types, partner contributions, and withdrawal records.

How to Obtain IRS Form

Securing the 2011 version of Form 1065 can be done using several methods to cater to different preferences and requirements. This form is readily available through various sources, ensuring ease of access.

- IRS Website: The most reliable source is directly from the IRS website, where downloadable PDFs are maintained in their archives.

- Tax Software: Many tax preparation software platforms include past forms, allowing users to electronically fill and submit them.

- Tax Professionals: Consulting with a tax advisor or accountant, especially for complex scenarios, can help in obtaining and completing historical forms like the 2011 version.

Steps to Complete IRS Form

Filling out Form 1065 (2011) requires meticulous attention to detail to ensure accuracy and compliance with IRS expectations. The following sequence outlines the general steps:

- Gather Required Information: Collect comprehensive records of the partnership’s financial transactions, including all income, expenses, and distributions.

- Fill Out Form Sections: Address each part systematically, starting with basic details such as partnership name and employer identification number (EIN), proceeding to income, deductions, and the balance sheet.

- Attach Schedules: Supplement with Schedule K-1, detailing each partner’s share of income, deductions, and credits.

- Review and Validate: Double-check all entries for accuracy to avoid potential errors or omissions.

- Submit: Choose from paper filing or electronic submission methods, ensuring it aligns with IRS regulations.

Key Challenges Encountered

- Complex Financial Data: Partnerships with numerous revenue streams or deductions must carefully classify and enter data to reflect true financial activity.

- Collaborative Filling: Coordination among partners can be challenging, requiring specific contributions from all parties to complete accurately.

Key Elements of IRS Form

Understanding the essential sections of Form 1065 is crucial for accurate completion. The form comprises various elements that must be meticulously addressed:

- Partnership Details: Includes name, EIN, business address, and principal business activity.

- Income and Deductions: Revenue is reported alongside pertinent deductions, detailing financial conditions.

- Partner Distributions: Highlights each partner’s allocation of profits and responsibilities.

- Schedules: Schedule K-1 is particularly significant, as it relays individual partner financial data independently processed on personal tax returns.

These components ensure the IRS gains a thorough understanding of the partnership's fiscal interactions throughout the reporting period.

Important IRS Guidelines

The IRS provides specific guidelines to help navigate the complexities of Form 1065, ensuring that partnerships maintain compliance with federal tax laws.

- Documentation: Maintain complete and accurate records of all financial activities, as these are crucial for substantiating reported figures.

- Compliance: Adhere strictly to deadlines and required formats as outlined by the IRS to avoid penalties.

- Instructions: Utilize the IRS-provided instructions for Form 1065 for detailed explanations of each section, supporting accurate reporting.

Filing Deadlines and Important Dates

Adhering to filing deadlines is crucial for maintaining compliance and avoiding penalties. Partnerships must be aware of critical dates when submitting IRS Form 1065:

- Standard Deadline: March 15 of the year following the tax year. For 2011, this meant March 15, 2012.

- Extensions: Partnerships may file Form 7004 to request up to a six-month extension, pushing the deadline to September 15.

Understanding these dates helps prevent the negative consequences associated with late or incomplete submissions.

Software Compatibility for IRS Form

Leveraging technology is essential for efficiency in tax preparation. Several software solutions facilitate the accurate completion of Form 1065 (2011):

- Tax Software Solutions: Programs like TurboTax and QuickBooks offer tools and guidance tailored to partnership tax needs, helping streamline the completion and submission process.

- Integration Capabilities: Many platforms offer support for importing financial data from accounting systems, reducing manual data entry and errors.

These technological aids enhance accuracy and ease the burden of compliance for partnerships.

Business Types That Benefit Most from IRS Form

Specific business structures find IRS Form 1065 to be particularly beneficial in their tax reporting.

- LLCs: Limited Liability Companies that elect to be treated as partnerships.

- General Partnerships: Must report collective income and deductions but distribute tax liabilities to individuals.

- Limited Partnerships: Employ Form 1065 to delineate income per partner, reflective of their stake in business operations.

These structures utilize Form 1065 to meet regulatory requirements efficiently, ensuring transparency while conducting financial operations.

Penalties for Non-Compliance

Failure to comply with IRS Form 1065 submission requirements incurs penalties, emphasizing the importance of timely and accurate filing:

- Late Submission Penalty: Imposed per partner for every month the form remains unfiled past deadlines.

- Accuracy-Related Penalty: Incorrect filings can prompt financial penalties, affecting partnerships’ financial health.

Awareness and preemptive management of these risks are crucial for avoiding potential drawbacks resulting from non-compliance.