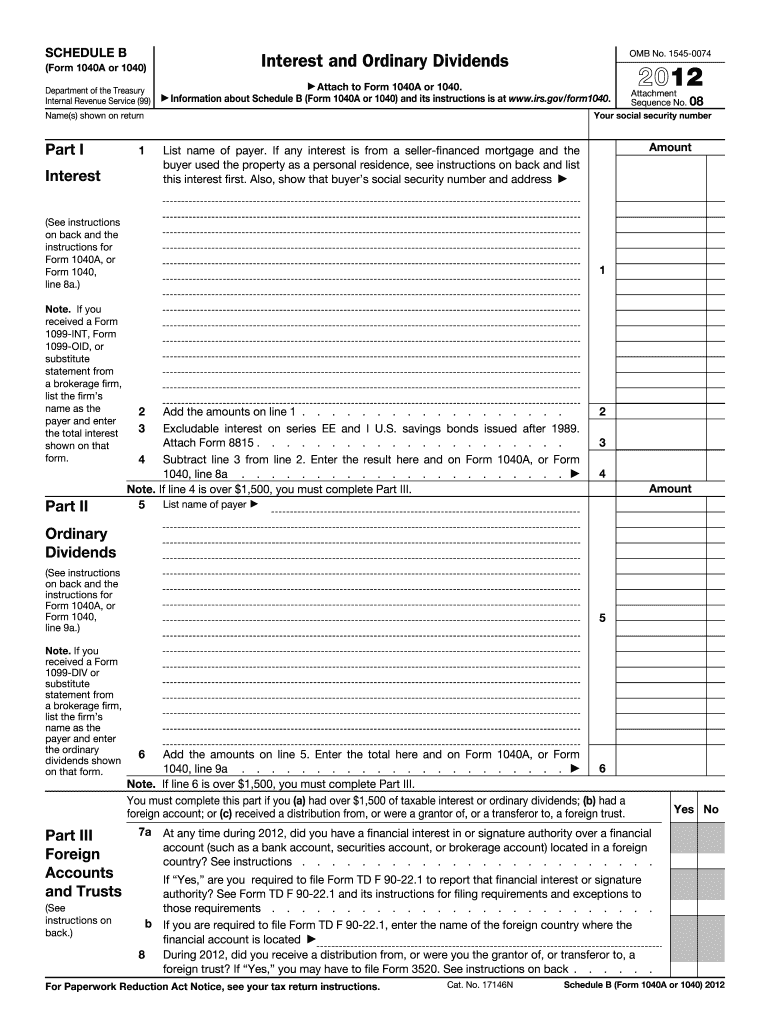

Definition and Meaning of the 2012 Schedule B Form

The 2012 Schedule B form is a component of the U.S. federal income tax return used to report different types of interest and ordinary dividend income received during the tax year. This form is typically required if you have more than $1,500 in taxable interest or ordinary dividends. Additionally, it captures information regarding foreign accounts and trusts, which includes an additional section to report specific details about such financial interests.

Key Sections of the Form

- Interest Income: This section records interest received from banks, savings and loan associations, credit unions, and other sources.

- Ordinary Dividends: Taxpayers report dividends from stocks or mutual funds.

- Foreign Accounts and Trusts: Includes questions about ownership or authority over foreign accounts and participation in foreign trusts.

How to Obtain the 2012 Schedule B Form

The 2012 Schedule B form can be acquired from various sources:

- IRS Website: Download the form directly from the Internal Revenue Service’s official website.

- Tax Preparation Software: Programs like TurboTax or H&R Block include this form as part of their digital filing process.

- Professional Tax Preparers: Accountants and tax advisors can provide and assist in completing the form.

Steps to Complete the 2012 Schedule B Form

Step 1: Gather Necessary Information

Collect forms like 1099-INT and 1099-DIV which report the interest and dividend income for the tax year.

Step 2: Fill Out Part I – Interest

- Include details from Form 1099-INT.

- Sum all interest incomes.

Step 3: Fill Out Part II – Dividends

- Report all ordinary dividends as documented on Form 1099-DIV.

- Calculate total ordinary dividends.

Step 4: Complete Part III – Foreign Accounts and Trusts

- Answer questions related to foreign accounts, providing specifics where necessary.

Who Typically Uses the 2012 Schedule B Form

Individuals, trusts, and small business owners who have received substantial interest and dividend incomes use the 2012 Schedule B form. It is particularly relevant for:

- Investors: Those with a diverse portfolio generating dividend income.

- Expats & Multinational Workers: If they have foreign bank accounts or trusts.

- Seniors: Retired individuals living on investment income.

Important Terms Related to the 2012 Schedule B Form

Key Definitions

- Taxable Interest: Interest that must be reported on the tax return.

- Ordinary Dividends: Standard dividends paid by a corporation to its shareholders.

- Foreign Financial Accounts: Includes a range of overseas financial assets.

Related Concepts

- Threshold Amounts: The $1,500 cap that prompts mandatory filing of Schedule B.

- Dividend Taxation: How ordinary dividends are taxed compared to qualified dividends.

Legal Use of the 2012 Schedule B Form

The accurate completion and submission of the 2012 Schedule B form is required to comply with U.S. tax regulations. Incorrect reporting may result in penalties or audits.

- Compliance: Filing ensures adherence to disclosure rules about U.S. and foreign financial interests.

- Documentation: Acts as a formal record of specific income categories, providing a clear financial picture to the IRS.

Key Elements of the 2012 Schedule B Form

Understand its critical components:

- Payer's Details: Names and addresses of entities from which interest and dividends were received.

- Amounts: Specific sums of interest and ordinary dividends.

- Certification: Verification of information accuracy regarding foreign accounts.

IRS Guidelines for the 2012 Schedule B Form

The IRS provides guidelines for completing the Schedule B form correctly:

- Documentation: Advice on maintaining records for all reported incomes.

- FAQs: Frequent questions answered on the official IRS website.

- Examples: Illustrative scenarios demonstrating how to report interest and dividends.

Filing Deadlines and Important Dates

The 2012 Schedule B form is due along with your federal income tax return, typically by April 15 of the following year. Extensions might be available, but require timely submission of an extension request. Familiarity with key filing deadlines is crucial to avoid penalties.

- Federal Deadline: April 15, 2013, for the 2012 tax year.

- Extensions: Options available upon request before the original deadline.