Definition and Purpose of Form 1040 (Schedule B)

Form 1040 (Schedule B) is a supplementary document used by U.S. taxpayers to report interest and ordinary dividend income on their individual income tax returns, specifically as part of Form 1040 or Form 1040-SR for the tax year 2022. This schedule plays a crucial role in providing the IRS with transparent details regarding a taxpayer's financial income sourced from banks, investments, and other accounts.

The form has distinct sections that taxpayers must complete to accurately reflect their interest income, ordinary dividends, and any foreign accounts they hold. Specifically, taxpayers must include:

- Interest income earned from various financial institutions, reflecting the cumulative amount received during the tax year.

- Ordinary dividends from stocks, mutual funds, or any other entities that distribute dividends.

- Information pertaining to foreign accounts, which often requires additional documentation if thresholds are exceeded.

Accurate completion of Schedule B is essential as it helps the IRS track sources of taxpayer income and ensure compliance with reporting requirements.

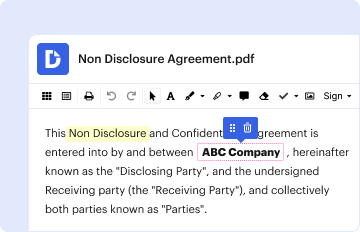

How to Complete Form 1040 (Schedule B)

Completing Form 1040 (Schedule B) involves a systematic approach to ensure all required information is accurately reported. Here’s a step-by-step breakdown:

- Gather Financial Documents: Collect statements from banks and investment accounts that detail interest and dividends earned during the tax year.

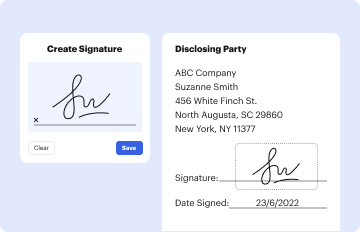

- Fill in Personal Information: Begin with your name and social security number at the top of the form, ensuring it aligns with your primary Form 1040.

- Report Interest Income: In Part I, list each source of interest income. Include the name of the payer, amount received, and checkboxes if applicable, indicating if the total from all sources exceeds $1,500.

- Example: If you received $300 in interest from Bank A and $700 from Bank B, these should be listed clearly, noting their sources.

- Declare Ordinary Dividends: In Part II, report ordinary dividends, similarly detailing each source and corresponding amounts.

- Example: Dividends from a stock could amount to $150, while mutual fund dividends could be $200, requiring separate line entries.

- Foreign Accounts Disclosure: Complete the appropriate section if you hold foreign accounts where the aggregate total exceeds $10,000 at any point during the year. This may require you to file additional forms.

- Review for Accuracy: Before submission, verify all calculations and details against your financial records to ensure completion accuracy.

The meticulous approach ensures compliance with IRS regulations and reduces the likelihood of audits or penalties.

Obtaining Form 1040 (Schedule B)

Acquiring Form 1040 (Schedule B) is straightforward:

- Download from IRS Website: The form is available for free on the official IRS website as a PDF file, enabling taxpayers to print it directly.

- Tax Software: Many tax preparation software programs include Schedule B as part of their package, automatically generating it based on inputted data.

- Order by Mail: Taxpayers can request a physical copy from the IRS by calling their customer service or by ordering it through the IRS forms and publications service.

Regardless of the method chosen, it is crucial to ensure that you are using the correct version for the applicable tax year.

Key Elements of Form 1040 (Schedule B)

Understanding the key elements of Form 1040 (Schedule B) is crucial for proper tax reporting. The primary components of the form include:

- Interest Income Reporting: Taxpayers must indicate the total interest received on their investments, including savings accounts, CDs, and government bonds.

- Dividend Reporting: Ordinary dividends must be disclosed, where any capital gain distributions received should be noted separately.

- Foreign Financial Accounts: Taxpayers must disclose foreign bank accounts or financial assets and comply with Foreign Bank Account Reporting (FBAR) regulations if total balances exceed specified thresholds.

- Questions on Ownership: The form includes questions to determine whether the taxpayer holds a financial interest in foreign accounts, which may result in additional filing requirements.

Detailed attention to these elements is necessary for ensuring compliance and avoiding potential penalties.

IRS Guidelines for Filing Form 1040 (Schedule B)

Adhering to IRS guidelines is essential when filing Form 1040 (Schedule B). Key guidelines include:

- Filing Timeline: Schedule B must be submitted along with your Form 1040 by the standard IRS filing deadline, typically April 15 for most taxpayers.

- Accuracy: The information provided must be precise and reflect your actual income to mitigate audit risks. Double-check all figures and sources before finalizing the submission.

- Record Keeping: Maintain thorough records of all income sources reported on Schedule B. The IRS recommends keeping financial records for at least three years after your tax return has been filed.

- Additional Forms for Complex Situations: If foreign accounts are involved, you may need to submit more detailed forms (like FinCEN Form 114) alongside your Schedule B.

- Amendments: If errors are discovered post-filing, taxpayers should file Form 1040-X to amend the original return, including any corrections related to Schedule B.

Understanding and applying these guidelines helps ensure a smoother filing experience and compliance with IRS regulations.

Common Scenarios for Using Form 1040 (Schedule B)

Various taxpayer scenarios illustrate the necessity of Form 1040 (Schedule B):

- Investment Earnings: A taxpayer who earns dividends from stock investments and interest from multiple savings accounts must report these earnings using Schedule B. Accurate reporting ensures proper tax calculation on these income sources.

- Foreign Account Holders: Individuals with foreign bank accounts that aggregate over $10,000 must file Schedule B. This requirement underscores the importance of transparency with the IRS regarding overseas investments.

- Taxpayers with Multiple Income Sources: Those receiving interest from bonds, stock dividends, and business income may need to detail all sources on Schedule B to comply with filing regulations.

Awareness of these scenarios is essential for any taxpayer aiming to navigate their tax responsibilities effectively.