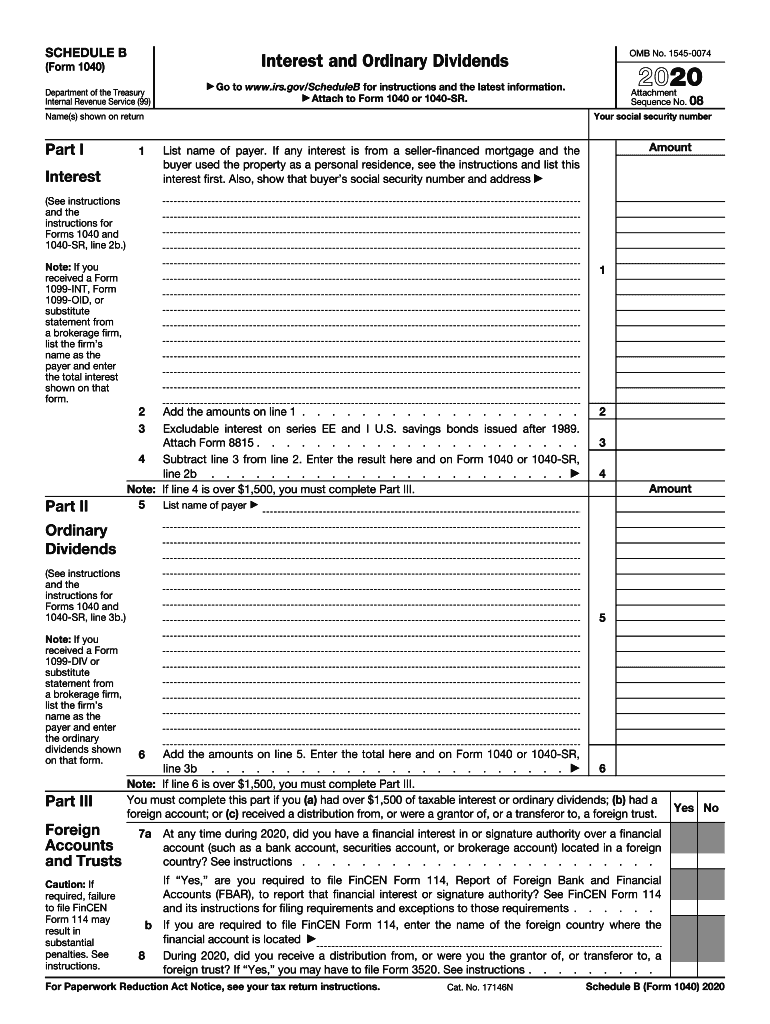

Definition and Overview of Schedule B

Schedule B is a supplementary form required by the Internal Revenue Service (IRS) for taxpayers who report interest and ordinary dividends as part of their annual income tax returns. Specifically, it is used in conjunction with Form 1040 or Form 1040-SR. Taxpayers must complete this form to declare earnings from various sources, including bank interest accounts, dividends from stocks, and other financial investments. Determining when to file this additional form is crucial, as it aids in accurately reporting income to comply with federal tax obligations.

Purpose of Schedule B

The primary purpose of Schedule B is to provide transparency and detail regarding a taxpayer's interest and dividend income. Failing to report this information can lead to penalties or further scrutiny from the IRS. It includes sections where taxpayers list each payer of interest and dividends, calculate total amounts received, and disclose any foreign accounts and trusts. This form plays a vital role in ensuring taxpayers comply with tax laws concerning income reporting.

Who Needs to File Schedule B

Taxpayers who receive more than one thousand five hundred dollars in taxable interest or dividends, or who have a foreign bank account, must use Schedule B. Specific categories of taxpayers who typically need to file include:

- Individual taxpayers with multiple sources of interest income.

- Investors receiving dividends from shares in corporations.

- Taxpayers holding accounts in foreign banks or participating in foreign financial institutions.

Understanding the requirements for filing can help mitigate issues during tax preparation.

How to Obtain Schedule B

Obtaining Schedule B is a straightforward process for taxpayers. The form is readily available through several methods:

- IRS Website: Taxpayers can download the Schedule B form directly from the IRS website, where the most current version for the tax year, such as the 2024 Schedule B, is provided.

- Tax Preparation Software: Many tax software programs, like TurboTax and QuickBooks, automatically include Schedule B in the filing process when you input relevant financial data. These programs often simplify the process by ensuring that necessary forms are filled out appropriately based on your entries.

- Tax Professionals: Individuals can also get assistance from tax professionals or accountants, who can provide the form as part of their services.

Acquiring the form through these sources ensures taxpayers have the most current version with any updates in regulations or instructions.

Steps to Complete Schedule B

Completing Schedule B involves several detailed steps to ensure proper reporting of interest and dividend income. The following are essential guidelines:

-

Gather Documentation:

- Collect all Form 1099s and statements from banks and investment firms detailing interest and dividends received.

- Ensure you have complete records for each income source to support the entries on Schedule B.

-

Fill Out Personal Information:

- Enter your name, Social Security number, and any other requested information at the top of Page 1.

-

Input Interest Income:

- On Part I of Schedule B, report each payer's name and the total amount of interest earned. If you have many payers, attach additional sheets as necessary.

-

Report Dividend Income:

- Move to Part II to detail dividend income. Similar to the interest section, provide necessary details for each payer and total dividends received.

-

Foreign Accounts and Trusts:

- If applicable, complete the section concerning foreign accounts or trusts. You'll need to indicate whether you have an interest in any financial accounts located outside the United States and provide additional information as required.

-

Finalize and Review:

- Review the completed form for accuracy and completeness before attaching it to your main tax return. Ensure all figures match up with your supporting documentation.

Taking the time to follow these steps ensures accurate filing and compliance with IRS guidelines.

Important Terms Related to Schedule B

Familiarity with specific terminology related to Schedule B can aid taxpayers in better understanding their obligations when filing. Key terms include:

- Taxable Interest: Interest income that must be reported to the IRS, usually shown on Form 1099-INT.

- Ordinary Dividends: Payments received from shares of stock, not qualified dividends, reported on Form 1099-DIV.

- Foreign Accounts: Financial accounts held in non-U.S. institutions, often subject to additional reporting requirements through forms like the FBAR.

- Payer: The entity from which the taxpayer receives interest or dividends.

Understanding these terms helps navigate the reporting process effectively.

Filing Deadlines and Important Dates

Filing Schedule B has specific deadlines that taxpayers should be mindful of to avoid penalties. Generally, the deadline to file individual tax returns, including any additional schedules like Schedule B, is April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally:

-

Extensions: Taxpayers can request extensions for filing their taxes, typically offering an additional six months. However, this does not extend the time for paying any taxes owed.

-

Amendments: If errors are discovered after the original filing, taxpayers can amend their returns using Form 1040-X. Any necessary revisions to Schedule B should be included in this amendment.

Being aware of these deadlines ensures compliance and allows taxpayers to prepare their returns accurately and in a timely manner.