Definition and Purpose of Form 1120-S (2013)

The 2013 Form 1120-S, also referred to as the U.S. Income Tax Return for an S Corporation, is utilized by S corporations to report their income, deductions, and credits to the Internal Revenue Service (IRS). S corporations are distinct entities that allow income to be passed through to shareholders without being taxed at the corporate level. This form plays a crucial role in ensuring that the tax responsibilities of shareholders are accurately reported based on the business's financial activities for the year.

Key Functions of Form 1120-S

- Pass-through Taxation: S corporations report their income directly on Form 1120-S, enabling income to be passed to shareholders who then report it on their individual tax returns.

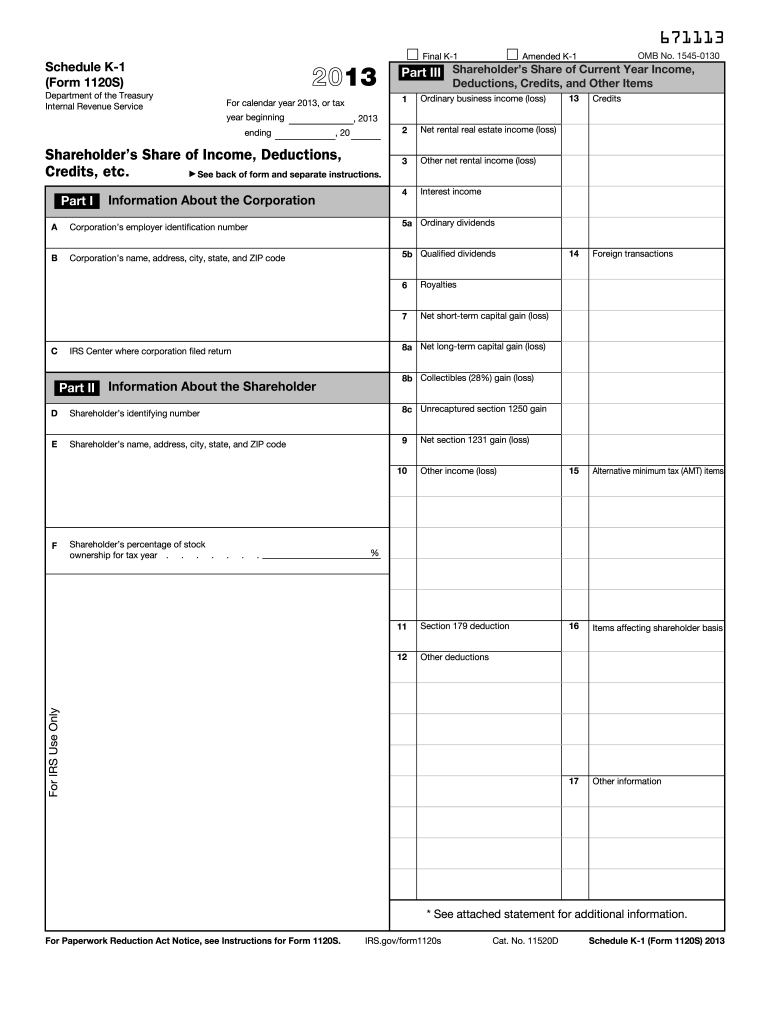

- Reporting Shareholder Income: The form includes detailed sections outlining each shareholder's share of income, deductions, credits, and other relevant items, typically reported on Schedule K-1 (Form 1120-S).

- Deductions and Credits: Form 1120-S allows S corporations to claim various deductions and credits available to them, which shareholders can use to reduce their overall tax liability.

How to Use the 2013 Form 1120-S Effectively

To effectively utilize the 2013 Form 1120-S, S corporations must first collect detailed financial information for the tax year. This includes income from sales, other business activities, and applicable deductions. Understanding how to complete each section is critical to ensuring compliance with IRS regulations.

Steps in Utilizing Form 1120-S

- Gather Financial Documents: Collect all income statements, expense records, and relevant tax documents necessary for filling out the form.

- Complete Section I: Report business income and expenses on the form. This includes calculating gross receipts, cost of goods sold, and deductions.

- Report Shareholder Information: Use Schedule K-1 to report each shareholder's income allocation accurately. Ensure that each section corresponds to the shareholder's percentage of ownership.

- Review and Submit: Before submitting the form, double-check calculations and ensure all necessary schedules are attached. The form can be filed electronically or via mail.

Obtaining the 2013 Form 1120-S

S corporations can access the 2013 Form 1120-S from several sources. It is essential to ensure that the correct version of the form is used to maintain compliance with tax laws.

Sources for the Form

- IRS Website: The official IRS website provides downloadable versions of all tax forms, including Form 1120-S for 2013.

- Tax Preparation Software: Many tax preparation programs include the form as part of their services, streamlining the filing process for users.

- Tax Professionals: Consulting a tax professional can provide access to the necessary forms and offer guidance in completing them.

Completing the 2013 Form 1120-S: Detailed Steps

Completing the 2013 Form 1120-S involves several key steps that must be followed thoroughly to ensure compliance.

Detailed Section Breakdown

-

Income Section:

- Report total gross receipts and sales.

- Determine and include any returns or allowances.

- Calculate the cost of goods sold (COGS) to derive gross income.

-

Deductions:

- Itemize deductible expenses, such as salaries, rent, and depreciation.

- Ensure each deduction aligns with substantiated business expenses to avoid discrepancies.

-

Shareholder Allocations:

- Complete Schedule K-1 for each shareholder, detailing their share of income, deductions, and any other tax attributes.

- Ensure that calculations align with the ownership percentages to maintain accuracy.

-

Attachments:

- Include any necessary supplemental schedules or forms as specified by the IRS.

- Ensure that all signatures and dates are completed to validate the return.

Key Elements of the 2013 Form 1120-S

The 2013 Form 1120-S comprises vital elements that guide the reporting process for S corporations and their shareholders.

Essential Components

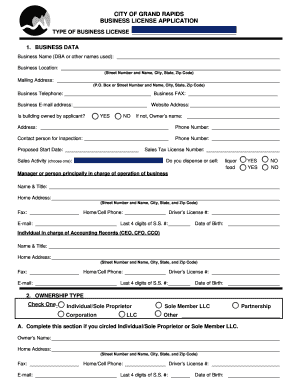

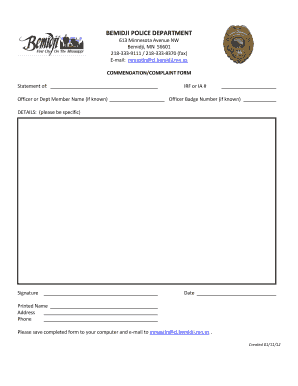

- Header Information: Identifying information about the S corporation, including name, address, and employer identification number (EIN).

- Income Reporting Lines: Specific lines allocated for reporting various forms of income, including business income, capital gains, and passive income.

- Deduction Categories: Clearly defined sections for reporting operational expenses, which are critical for reducing overall taxable income.

- Balance Sheet: A snapshot of the company's financial position, providing insight into assets, liabilities, and equity at year-end.

Important Dates and Filing Deadlines for the 2013 Form 1120-S

Understanding filing deadlines is crucial for compliance with the IRS. S corporations must adhere to specific due dates to avoid penalties.

Filing Timeline

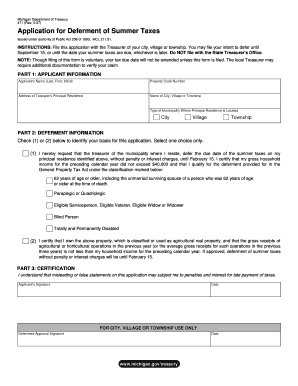

- Original Due Date: Form 1120-S is typically due on the 15th day of the third month following the end of the corporation’s tax year. For corporations with a calendar year ending December 31, the due date would be March 15, 2014.

- Extensions: S corporations can apply for a six-month extension using Form 7004, which extends the filing deadline but does not extend the time for tax payment.

Common Pitfalls and Penalties

Filing errors can lead to penalties and interest charges from the IRS. Awareness of common pitfalls can help S corporations avoid these issues.

Frequent Errors to Avoid

- Incorrect Filings: Misreporting income or misallocating expenses can trigger audits or require amended returns.

- Late Submissions: Failing to file on time can result in significant penalties, impacting the corporation’s financial standing.

- Neglecting Attachments: Omitting necessary schedules such as Schedule K-1 could lead to complications for shareholders during their personal tax filings.