Definition and Meaning of the K-1 Form

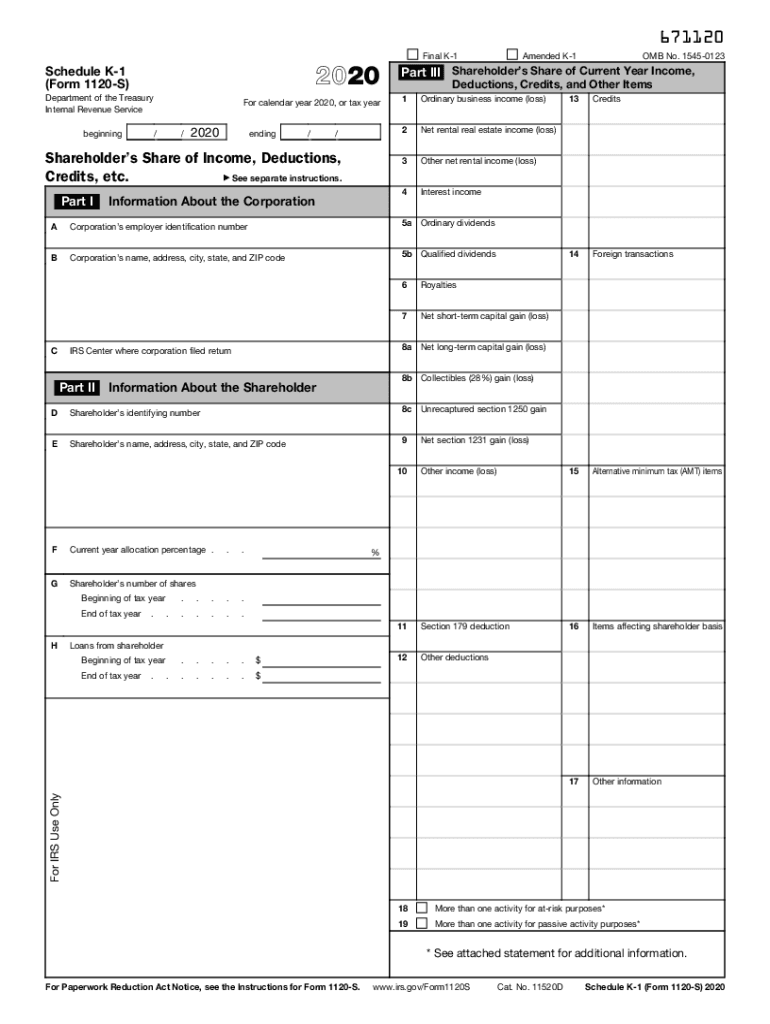

The K-1 form, specifically the Schedule K-1 (Form 1065), is a tax document used to report the income, deductions, and credits of a partnership, S corporation, or LLC. It details a taxpayer’s share of income, which must be reported on their individual tax return. This form is crucial for both the entity and the individual shareholders or partners, ensuring transparency and compliance with IRS regulations.

The K-1 is designed to provide detailed information about a partner's share of business income, losses, and other tax attributes. Taxpayers receive the K-1 from the partnership or S corporation, which must accurately reflect their share of the entity's earnings and cover a variety of financial items, including ordinary income, rental income, and capital gains. This form can often seem complicated, particularly for those unfamiliar with tax-related documents, necessitating careful review and understanding before filing individual returns.

Steps to Complete the K-1 Form

Completing the K-1 form involves several clear steps to ensure accurate reporting. It is essential to follow these steps diligently to avoid potential penalties for erroneous filings.

-

Gather Necessary Information:

- Collect details regarding the partnership or S corporation.

- Gather individual tax identification numbers (TINs) for all partners or shareholders.

- List the financial data from the entity that pertains to each partner’s share.

-

Identify the Types of Income and Deductions:

- Review the entity’s overall income, losses, and deductions. These may include ordinary business income, capital gains, and any dividends.

- Determine which of these items apply to each partner or shareholder.

-

Fill Out the Form:

- Input the entity's name, address, and tax identification number at the top of the form.

- Record each partner’s or shareholder’s name, address, and the amount of their share of income, losses, deductions, and credits in the appropriate sections.

- Make sure to include any specific contributions or withdrawals made by partners.

-

Provide Additional Information:

- Include details of any foreign transactions or partnerships if applicable.

- Attach any necessary schedules that support the reported figures on the K-1.

-

Distribute the K-1:

- Once completed, distribute the forms to each partner or shareholder. It must be sent out by the entity before the tax filing deadline to ensure that all individuals are equipped to file their taxes accurately.

Accurate completion of the K-1 form is fundamental, as any inaccuracies can lead to complications in individual tax filings, possibly resulting in audits or penalties.

Important Terms Related to the K-1 Form

Understanding key terminology associated with the K-1 form is vital for effective tax reporting. Here are several critical terms:

- Ordinary Business Income: This includes the revenue generated by the partnership’s core operational activities as reported on their financial statements.

- Passive Income: Income earned without active participation in the business, often pertaining to rental income or limited partnerships.

- Distributions: These are payments made by the partnership to its partners, which may affect the taxable amount reported on the K-1.

- Tax Basis: This refers to the amount of the partner's investment in the partnership, determining gain or loss when the partner disposes of their partnership interest.

- Losses and Deductions: These are reported on the K-1 and can offset other income on the partner’s tax return, ultimately reducing tax liability.

Understanding these terms helps mitigate confusion when reviewing the K-1 form, ensuring correct tax filings and compliance.

Filing Deadlines and Important Dates

Timely filing of the K-1 form is crucial to meet tax obligations. Key deadlines include:

-

Form Submission Deadline for Partnerships and S Corporations: Typically, this falls on the 15th day of the third month after the end of the entity's tax year. For entities that operate on a calendar year, this means March 15.

-

Distribution to Partners or Shareholders: K-1 forms must be provided to all partners and shareholders by the entity by the same due date as the entity's tax return. This allows sufficient time for individuals to prepare and file their returns accurately.

-

Individual Tax Return Filing Deadline: Partners must report the information from the K-1 on their personal tax returns. Individual returns are typically due on April 15, unless an extension is filed.

Awareness of these deadlines prevents unnecessary penalties and aids in maintaining compliance with tax regulations.

Who Typically Uses the K-1 Form?

The K-1 form is primarily utilized by individuals involved in certain business structures. Common users include:

-

Partners in a Partnership: Each partner receives a K-1, detailing their share of the partnership's income, deductions, and credits for reporting on their personal returns.

-

Shareholders of S Corporations: Shareholders also receive K-1 forms summarizing their share of the company's income and deductions, ensuring that all earnings are reported correctly for taxation.

-

Members of LLCs: If the LLC is treated as a partnership for tax purposes, members receive K-1 forms reflecting their earnings and losses from the LLC.

Understanding who receives K-1 forms is essential for individuals to ensure they are adequately tracking their income and fulfilling their tax responsibilities accurately.

Key Elements of the K-1 Form

The K-1 form comprises several essential sections that outline specifics about the allocated share of partnership income or loss.

-

Part I: Information about the Partnership or S Corporation

- This includes the entity's name, address, and tax identification number.

-

Part II: Information about the Partner or Shareholder

- Details include the partner's or shareholder's name, address, and taxpayer identification number.

-

Part III: Partner's or Shareholder's Share of Current Year Income, Deductions, Credits, and Other Items

- Specific line items report various financial figures, including ordinary business income, net rental real estate income, capital gains, and other deductions.

Each section is designed to provide a comprehensive overview of the financial progression and tax liabilities associated with the partnership or S corporation, ensuring accuracy when preparing individual tax returns.