Definition and Purpose of the 2S Form

The 2S form is the U.S. tax return specifically designed for S corporations. An S corporation, under Internal Revenue Code Subchapter S, allows income, deductions, and credits to be passed through to shareholders for federal tax purposes. This form is essential for reporting the corporation's income, gains, losses, deductions, and credits, as well as for the shareholders’ individual tax obligations. Each shareholder must report their share of the corporation’s income when filing their personal tax returns, thus avoiding double taxation at the corporate level.

The 2S form must be completed accurately to ensure compliance with federal tax regulations. A corporation electing to become an S corporation must file this form to maintain its status, wherein the corporate income is not taxed at the entity level but rather at the shareholder level.

Key Features of the 2S Form

- Pass-Through Entity: Allows income to be taxed at the shareholder level instead of the corporate level.

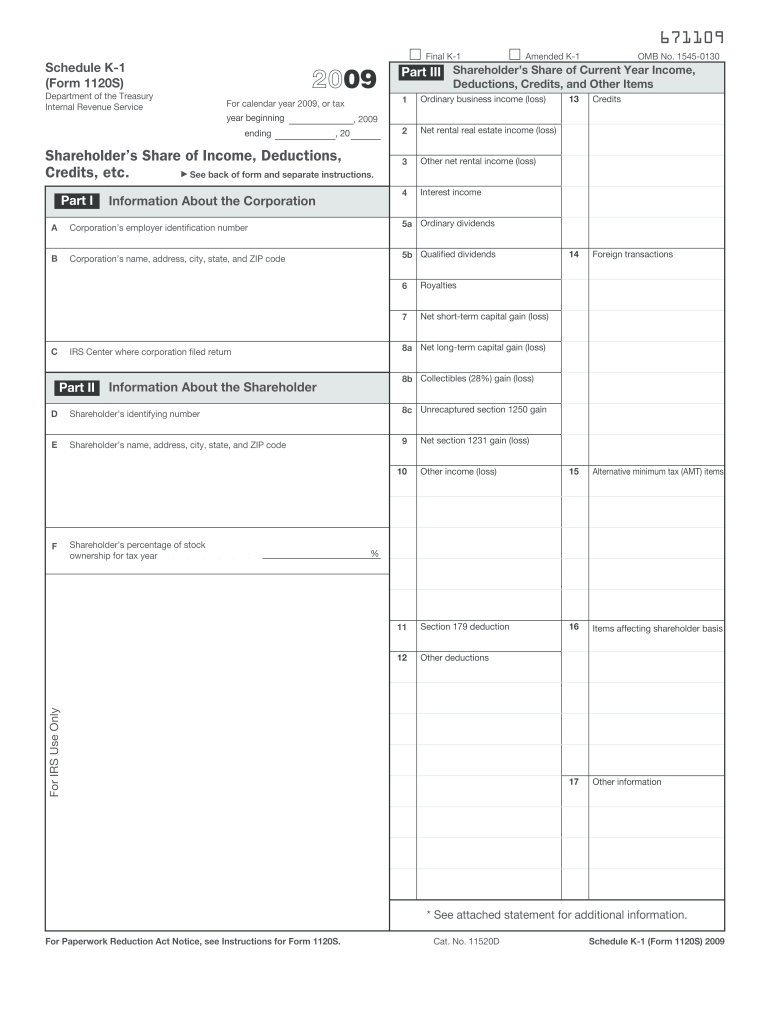

- Shareholder Reporting: Each shareholder receives a Schedule K-1, summarizing their share of the corporation's income and deductions.

- IRS Compliance: Necessary for S corporations to fulfill IRS requirements, maintaining legal status.

How to Use the 2S Form Effectively

Proper utilization of the 2S form begins with gathering the required financial information and understanding the form's sections. Each section of the form requires specific data about the S corporation's financial activities throughout the tax year.

Steps to Follow

- Gather Financial Statements: Collect all relevant financial data, including income statements and balance sheets.

- Complete General Information: Input the corporation’s name, address, and Employer Identification Number (EIN).

- Report Income: Fill out the income section accurately, detailing all income generated from business operations.

- Deductions and Credits: Itemize deductions and any applicable tax credits to ensure the tax liability is calculated correctly.

- Provide Shareholder Information: Prepare to issue Schedule K-1 forms to each shareholder, detailing their share of the income and deductions.

- Review and Submit: Ensure that the form is free from errors, sign, and either mail or electronically file the form with the IRS.

Best Practices

- Accurate Record Keeping: Maintain detailed records throughout the year to streamline the completion process.

- Consult a Tax Professional: Seek advice if uncertain about any aspect of the form or calculations.

- Use Tax Software: Consider utilizing software designed for tax preparation to minimize errors and save time.

Key Elements of the 2S Form

Understanding the elements within the 2S form is essential for ensuring accurate reporting.

Major Components

-

Income Section: This section captures the total income generated by the S corporation, including sales revenue, interest income, and other forms of income.

- Examples of income types include ordinary business income, capital gains, rental income, and dividends.

-

Deductions: Expenses related to operating the business that can be deducted from total income. Common deductions include salaries, rent, and utilities.

-

Tax Credits: Any tax credits the corporation qualifies for must be reported, as these can significantly reduce tax liability.

-

Schedule K-1: Each shareholder receives this form, detailing their share of the income and deductions. It is crucial for their individual tax filings.

Filing Deadlines and Important Dates for the 2S Form

Awareness of filing deadlines is critical for compliance and avoiding penalties. For S corporations using the 2S form, the filing deadline is typically the 15th day of the third month after the end of the corporation's tax year.

Important Dates

- March 15, 2010: Filing deadline for calendar year corporations and for extensions.

- Extension Information: If additional time is needed, corporations can request an automatic six-month extension using Form 7004, requiring submission before the original deadline.

Consequences of Late Filing

- Penalties: Failure to file on time can result in penalties for both the corporation and its shareholders. Late fees can accumulate daily until the form is submitted.

- Interest Accumulation: Any taxes owed that are not paid by the deadline accrue interest, increasing the total amount due.

Legal Usage of the 2S Form

Using the 2S form within the legal parameters set by the IRS is crucial for maintaining the benefits associated with S corporation status.

Compliance Requirements

- S Corporation Status: Corporations must meet specific eligibility criteria, such as having no more than 100 shareholders and being a domestic entity.

- Filing Obligations: Annual filing of the 1120S form is mandatory to keep the S corporation status intact.

Legal Implications

- Tax Liabilities: Shareholders must ensure that their personal tax filings accurately reflect the information provided on Schedule K-1 to comply with tax regulations.

- Audit Risks: Non-compliance or inaccuracies on the form can trigger audits by the IRS, leading to potential legal challenges and financial penalties.

Important Terms Related to the 2S Form

Familiarity with key terminology enhances understanding and accurate completion of the 2S form.

Terminology Overview

- S Corporation: A tax designation that allows income to pass through to shareholders for taxation.

- Shareholder: An individual or entity that owns shares in the S corporation and is entitled to its income and losses.

- Schedule K-1: A document issued to shareholders that details their respective shares of income, deductions, and credits from the corporation.

- Pass-Through Taxation: A tax structure where the income is taxed at individual shareholder levels rather than the corporate level.

Each of these terms plays a critical role in understanding the responsibilities and impacts of using the 2S form.