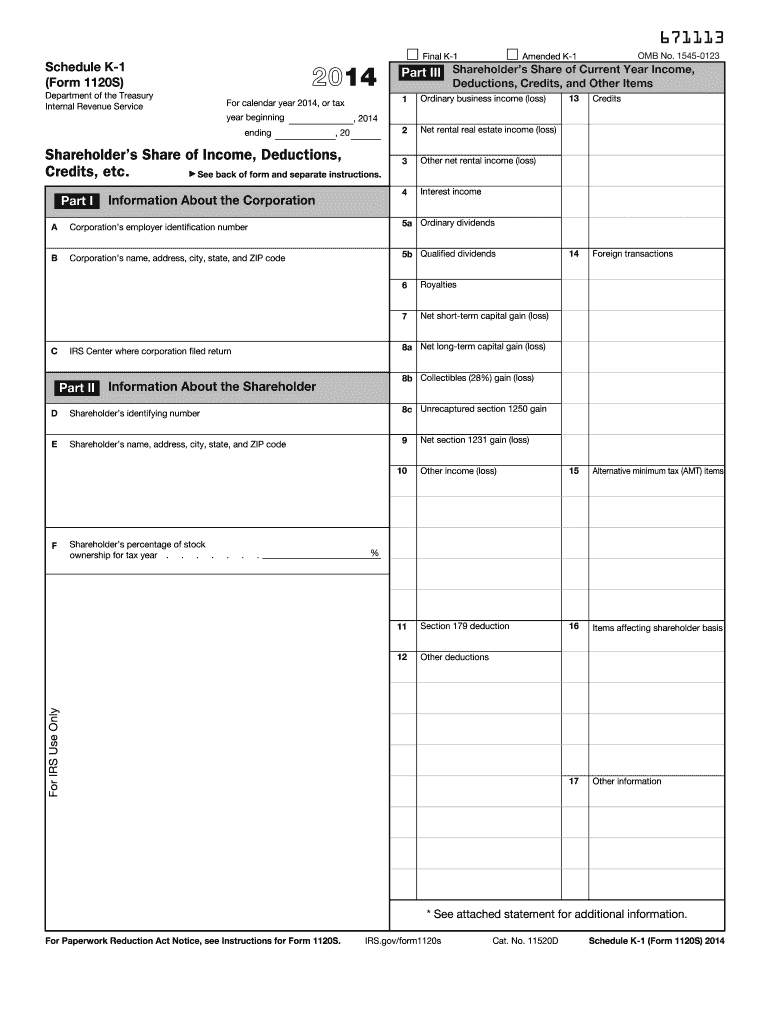

Definition and Meaning of the 2014 K Form

The 2014 K form refers to the Schedule K-1 (Form 1120S), which is used by S corporations to report a shareholder's share of income, deductions, credits, and other items pertinent to tax reporting. This form is critical for both the corporation and individual shareholders, as it helps ensure accurate reporting of tax liabilities. The K-1 typically includes information about ordinary business income, rental income, dividends, and various capital gains, along with deductions and credits that can be claimed by the shareholder.

Key Elements of the 2014 K Form

- Shareholder Information: The top section of the K-1 identifies the S corporation and the specific shareholder, including their identification numbers.

- Income Reporting: The K-1 details ordinary business income, allowing shareholders to report this income on their individual tax returns.

- Deductions and Credits: It includes any deductions and credits that apply to the shareholder, which are important for reducing taxable income.

- Capital Gains and Losses: Shareholders must report their respective shares of capital gains and losses derived from the corporation's investments.

Understanding these key elements is essential for both shareholders and tax professionals when completing tax returns.

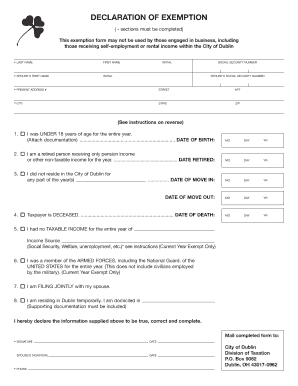

Steps to Complete the 2014 K Form

Completing the 2014 K form involves several methodical steps to ensure accurate reporting.

- Gather Required Information: Collect details about the S corporation, such as the EIN, the shareholders' identifying information, and financial data for the tax year.

- Fill in Shareholder Details: Enter the shareholder's name, address, and taxpayer identification number at the top of the form.

- Report Income: Input the ordinary business income, along with any other incomes such as rental income and dividends in the appropriate boxes.

- Enter Deductions: Record applicable deductions and credits that can be claimed by the shareholder.

- Capital Gains and Losses: Ensure you include all capital gains and losses from the corporation's activities in the designated sections.

After completing these steps, review the form to confirm all information is accurate before it is distributed to shareholders.

Important Terms Related to the 2014 K Form

Understanding the terminology associated with the 2014 K form is crucial for accurate completion and reporting. Key terms include:

- Distributive Share: This refers to the share of income or loss from the S corporation that is allocated to each shareholder.

- Ordinary Income: Income derived from common business activities, which is taxed at the shareholder's ordinary income tax rate.

- Adjustment to Income: Certain deductions that may be specifically designated, which affect the shareholder's overall taxable income.

Familiarizing oneself with these terms facilitates better comprehension and communication when preparing and filing taxes.

Filing Deadlines and Important Dates for the 2014 K Form

Adhering to specific deadlines is vital when dealing with tax documents like the 2014 K form. The key dates include:

- Due Date for Filing: The 2014 K-1 must be distributed to shareholders by March 15, 2015, the same day the S corporation's Form 1120S is due.

- Filing the Individual Tax Return: Shareholders must report the information received on their K-1 when filing their personal income tax returns, typically due by April 15.

Awareness of these dates allows both corporations and shareholders to ensure compliance and avoid penalties.

Who Typically Uses the 2014 K Form

The 2014 K form is primarily used by S corporations and their shareholders. Typical users include:

- S Corporations: Entities that opt for S corporation status to avoid double taxation, benefiting from tax treatment where income is passed through to shareholders.

- Individual Shareholders: Owners who report their share of income, deductions, and credits on their personal tax returns.

- Tax Professionals: Accountants and tax advisors who assist S corporations and shareholders in preparing and filing taxes accurately.

Understanding who utilizes the form helps in ensuring all interested parties meet their obligations efficiently.

Examples of Using the 2014 K Form

A practical understanding of how the 2014 K form operates can be illustrated through varied examples.

- Case of an S Corporation: An S corporation earns $100,000 in ordinary income, and three shareholders each own one third of the corporation. Each shareholder receives a K-1 reporting $33,333 as ordinary income to declare on their taxes.

- Utilizing Deductions: If the corporation incurs $10,000 in deductible expenses, this reduces the overall income reported. Each shareholder's K-1 would reflect the lower ordinary income, allowing for tax savings.

Such examples demonstrate the form's function in real-world contexts for taxation steps among shareholders.

Legal Use of the 2014 K Form

Utilizing the 2014 K form correctly is vital for legal compliance in the realm of tax reporting.

- Tax Reporting Requirements: The IRS mandates accurate completion and timely distribution of the K-1, which serves as critical documentation for shareholders' income tax filings.

- Legal Consequences of Non-Compliance: Failure to issue K-1s correctly can result in penalties for the S corporation, not to mention complications for shareholders when filing their individual taxes.

Being vigilant about legal use ensures that both corporations and shareholders fulfill their tax obligations effectively and avoid potential issues with IRS enforcement.