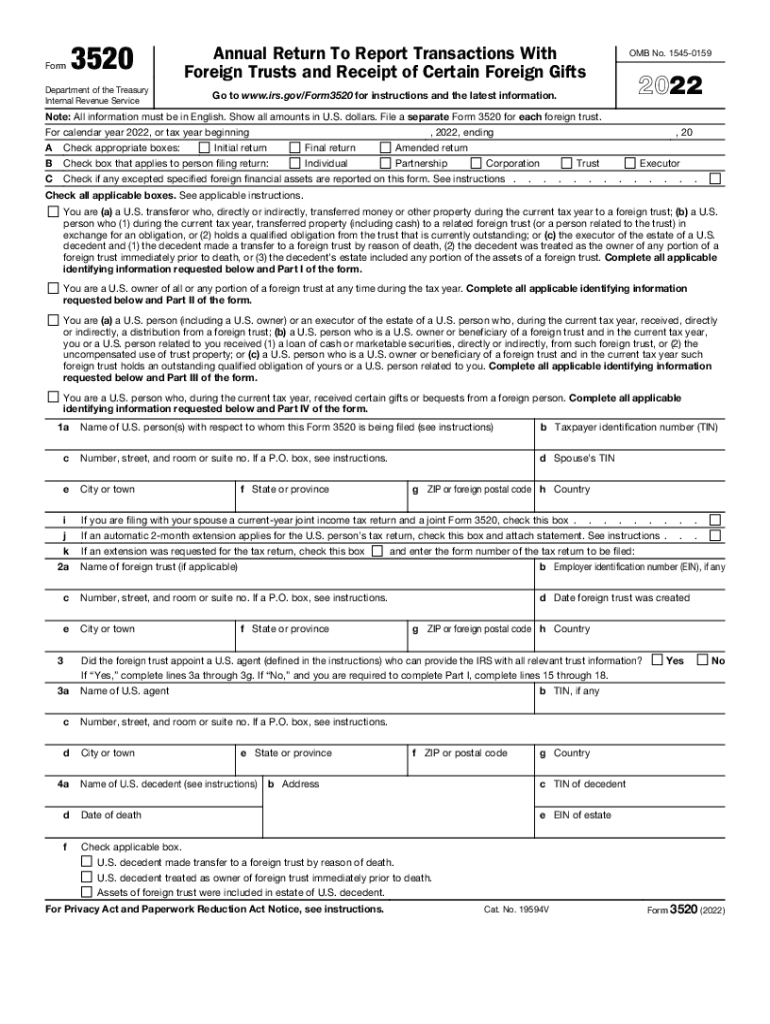

Definition and Purpose of Form 3520

Form 3520, officially known as the Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts, is a critical document required by the U.S. Internal Revenue Service (IRS). U.S. persons who have engaged in transactions involving foreign trusts or received substantial gifts or bequests from foreign individuals or entities are obligated to file this form. The goal is to ensure transparency and compliance with U.S. tax regulations regarding foreign income and assets.

Why File Form 3520

Filing Form 3520 is essential to comply with federal tax laws that monitor international financial activities. It helps the IRS track the transfer of assets and funds from foreign connections, ensuring that U.S. taxpayers report foreign income and pay applicable taxes. Non-compliance can lead to significant penalties, emphasizing the importance of timely and accurate filing.

Steps to Complete Form 3520

Completing Form 3520 involves several key steps designed to capture comprehensive information about the filer’s involvement with foreign trusts or monetary gifts:

- Identify the Filer: Provide detailed personal information including name, address, and taxpayer identification number.

- Report Foreign Trust Transactions: Disclose any transfers to or distributions from foreign trusts. Include the date and nature of each transaction.

- Detail Gift Recipients: If applicable, list all significant gifts received from foreign sources. Indicate the value and identity of the donor.

- Submit Supporting Documentation: Attach necessary documents that substantiate the values and entities involved in the transactions.

- ** Review and Finalize**: Ensure all sections are completed thoroughly before submission to avoid errors or omissions.

Required Documentation

Supporting documents may include:

- Trust agreements detailing the terms and parties involved.

- Appraisal reports or valuation letters for gifts.

- Proof of transfers or distributions, such as bank statements or transaction records.

Filing Deadlines and Submission Methods

Important Dates

The deadline for filing Form 3520 typically aligns with the U.S. tax return deadline, which is April 15. Extensions may be filed, but this does not affect any penalties associated with late filing of the form itself.

Submission Methods

Form 3520 can be submitted:

- Online: Though comprehensive online submission services aren't always available for this form, consulting with electronic filing services or tax software is recommended.

- Mail: Physical forms can be mailed directly to the IRS using the address provided for international forms.

Penalties for Non-Compliance

Failure to file Form 3520 on time or inaccurately can result in heavy penalties. The IRS imposes severe fines, which can be calculated as a percentage of the non-reported amount:

- 35% of the gross reportable amount for foreign trust transactions.

- Up to $10,000 for failure to report specific foreign gifts.

In cases of fraudulence or willful neglect, additional legal actions may be pursued by the IRS.

IRS Guidelines and Disclosure Requirements

Key IRS Guidelines

The IRS has established comprehensive guidelines to facilitate accurate reporting on Form 3520. These guidelines outline the necessity to disclose:

- Trust formations and dissolutions.

- Significant alterations to the trust agreement.

- Receipt of unusually large monetary gifts or bequests.

Disclosure Mandates

Full disclosure is mandated to prevent underreporting of foreign transactions. Taxpayers are urged to accurately present all applicable data as provided in the IRS instructions for Form 3520, ensuring responsible reporting.

Eligibility and Common Use Cases

Eligibility Criteria

Form 3520 must be filed by:

- U.S. persons involved in transactions with foreign trusts.

- Individuals receiving gifts exceeding $100,000 from a non-U.S. individual.

- Entities that distribute large foreign gifts or have an interest in foreign trusts.

Example Scenarios

Common scenarios requiring Form 3520 filing include:

- A U.S. citizen setting up a foreign family trust.

- Receipt of a large inheritance from an overseas relative.

- Participation in foreign corporations as a trustee or beneficiary.

Software Compatibility and Integration

Tax software like TurboTax and QuickBooks offers limited direct support for Form 3520 due to its complexity, but they provide resources for integrating data with broader tax filings. Consulting tax professionals or dedicated international tax software is often recommended for complex filings.

Digital Versus Paper Version

While the form can be completed digitally for ease of use, it often needs to be printed and mailed due to specific IRS requirements. Maintaining digital records for personal verification is advisable.

By understanding the intricacies of Form 3520, individuals can ensure compliance with international tax regulations, minimize penalties, and efficiently manage their international financial interactions.