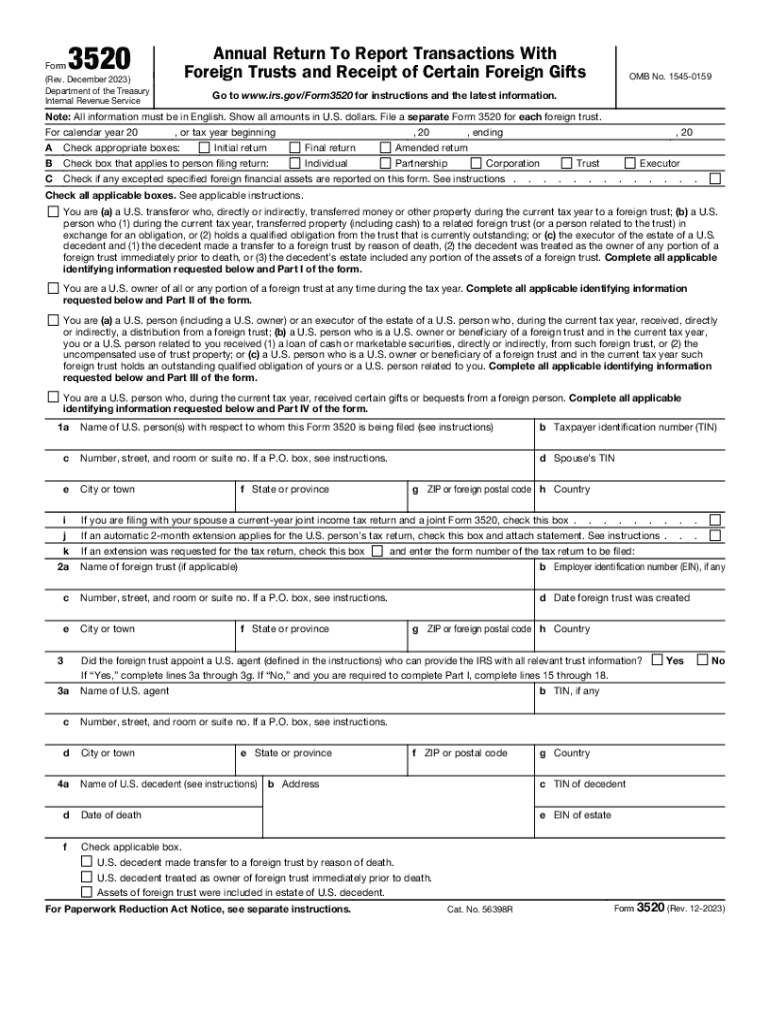

Definition and Meaning

Form 3520, officially known as the "Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts," is a critical document mandated by the IRS for U.S. persons involved with foreign trusts or receiving substantial foreign gifts. This form allows the IRS to track and regulate financial transactions involving foreign entities, ensuring compliance with U.S. tax laws and helping prevent tax evasion. It includes sections for reporting various interactions, such as transfers to foreign trusts, ownership interests in foreign trusts, and details of foreign gifts.

How to Use Form 3520

Using Form 3520 involves accurately reporting financial interactions with foreign entities to the IRS. It's crucial for individuals to determine their specific situation—whether they're reporting a trust transaction, a received foreign gift, or both. The form includes multiple sections requiring detailed information about the trust entity or the gift received, including values, dates, and other pertinent details. Understanding the full scope of your obligations when interacting with this form is essential to avoid penalties.

Key Uses of the Form

- Reporting distributions received from foreign trusts.

- Informing the IRS about gifts or bequests from non-U.S. individuals.

- Documenting transactions involving foreign trust ownership.

Steps to Complete Form 3520

Completing Form 3520 requires careful attention to detail and thorough documentation. The process includes:

- Gathering Required Information: Collect detailed data about the foreign trust or gifts, including identification numbers, dates, values, and any relevant documents.

- Filling Out Sections: Start with personal information, followed by specific sections detailing transactions or ownership interests.

- Reviewing IRS Instructions: Because the form is complex, reviewing official IRS instructions can clarify doubts and ensure accuracy.

- Proofreading Entries: Double-check all entries for errors or omissions that could lead to processing delays or penalties.

Common Mistakes to Avoid

- Failing to sign the form.

- Omitting required supplemental information.

- Incorrectly reporting transaction amounts.

Who Typically Uses Form 3520

Form 3520 is primarily used by U.S. citizens and residents who have dealings with foreign trusts or receive certain foreign gifts. This may include:

- International business owners.

- U.S. expatriates with foreign assets.

- Individuals with substantial foreign inheritances.

Scenarios for Usage

- A U.S. investor receiving dividends from a foreign trust.

- An individual inheriting property from a relative abroad.

- A U.S.-based corporation engaging foreign trustees for fiduciary purposes.

IRS Guidelines and Compliance

Under IRS guidelines, any U.S. person involved with foreign trusts or receiving gifts above a specific threshold must file Form 3520. Compliance is crucial, as non-compliance leads to severe penalties. The IRS offers detailed instructions to assist filers in accurately completing the form and ensuring that they meet all related obligations.

Essential IRS Requirements

- Timely filing along with the U.S. federal income tax return.

- Providing honest and complete information about foreign financial transactions.

Filing Deadlines and Key Dates

The filing deadline for Form 3520 generally coincides with the deadline for the individual’s U.S. federal tax return. For most calendar-year taxpayers, this date falls on April 15. However, extensions are available, moving the deadline to October 15 if properly requested.

- April 15: Standard filing deadline.

- October 15: Extended deadline with an approved extension request.

Penalties for Non-Compliance

Penalties for failing to file Form 3520 can be severe. The IRS imposes penalties starting at $10,000 for failing to file or for filing incorrect information. Additional penalties can accrue for continued non-compliance, including a percentage of the foreign trust amount or foreign gift if not reported.

Avoiding Penalties

- Ensure timely submission by the due date.

- Verify accuracy and completeness of all information provided.

- Regularly consult IRS updates regarding foreign asset reporting.

Required Documents

Filing Form 3520 necessitates various documents to verify the details of transactions or gifts reported. Required documents may include:

- Identification documents for involved entities.

- Transaction statements or gift deeds.

- Trust agreements outlining the terms of foreign trusts.

Developing a systematic approach to managing these documents throughout the year can aid in efficient filing and minimize the risk of errors.