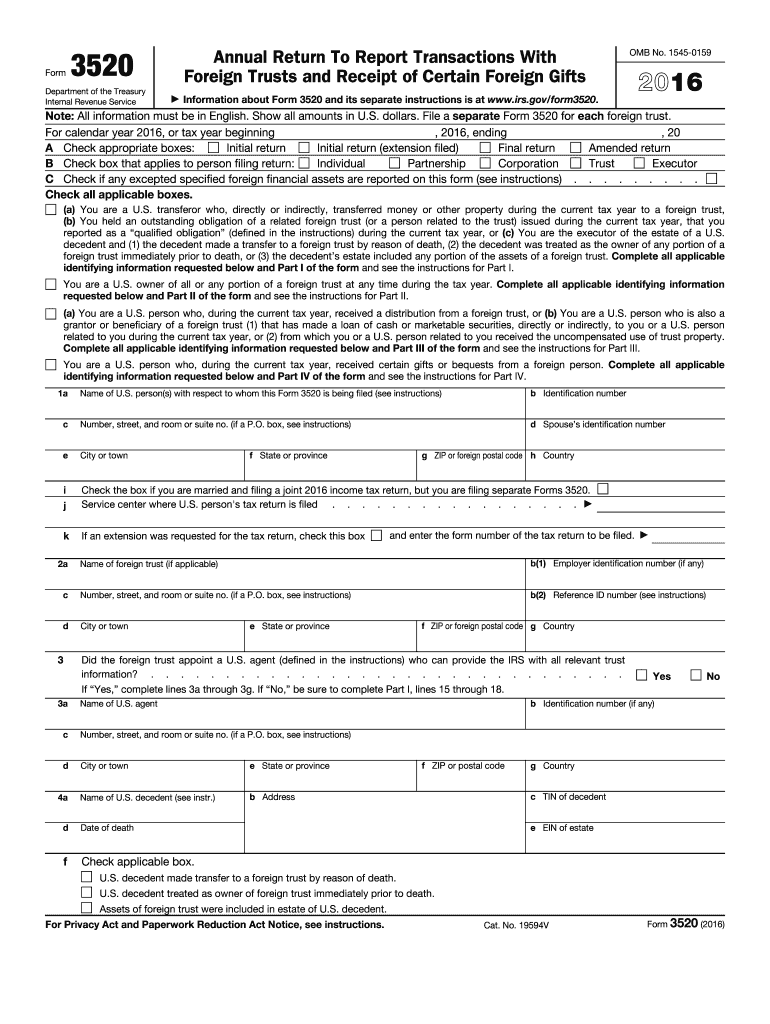

Definition and Meaning of Form 3

Form 3520 is an annual return required by the IRS for U.S. persons who engage in transactions with foreign trusts, or who receive certain foreign gifts. The 2016 version of this form ensures compliance with IRS regulations for that particular tax year. It records transfers to foreign trusts, distributions received, and gifts or bequests from foreign persons.

- Foreign Trust Transactions: U.S. persons must report any contributions to or receipts from foreign trusts.

- Foreign Gifts: Included are gifts or bequests from non-U.S. residents exceeding specific thresholds.

Understanding the purpose and use of Form 3520 helps ensure timely and accurate reporting, fulfilling obligations under U.S. tax law.

How to Obtain Form 3

To acquire Form 3520 for the year 2016, individuals have multiple options. The form is available directly from the IRS website, where it can be downloaded as a PDF. Alternatively, taxpayers can request a copy by calling the IRS or visiting an IRS office.

- Online Access: Via the IRS official site in the Forms and Publications section.

- Phone Requests: Contact the IRS helpline for assistance.

- Physical Copies: Obtainable through IRS taxpayer assistance centers.

Incorporating the right approach to obtain the form fits into the broader task of managing compliance with international transaction reporting.

Steps to Complete Form 3

Completing Form 3520 involves attention to detail and understanding specific IRS-related requirements. Here’s a general step-by-step process:

- Personal Information: Begin with your details including name, address, and taxpayer identification number.

- Transaction Details: Report all relevant transactions with foreign trusts or foreign gifts.

- Section Analysis: Fill out specific sections related to contributions to foreign trusts, distributions, and bequests.

- Currency Conversion: Ensure all amounts are shown in U.S. dollars.

- Review and Verification: Double-check entries to avoid errors, considering consulting with a tax professional.

These steps guide through the form, emphasizing correct entries and full disclosure.

Who Typically Uses Form 3

Form 3520 is predominantly utilized by U.S. persons involved in financial transactions with non-U.S. entities. This includes:

- Individuals: Those receiving substantial gifts or bequests from foreign persons.

- Beneficiaries: Individuals receiving distributions from foreign trusts.

- Grantors: U.S. persons establishing or transferring assets to foreign trusts.

Understanding the target users aids in recognizing one's obligations regarding foreign financial interactions.

Important Terms Related to Form 3

Familiarizing oneself with specific terms is essential:

- Foreign Trust: A trust established outside of the United States.

- Grantor: A person who creates a trust, contributing assets to it.

- Bequest: Property transferred after death via a will.

- UDS Conversion: Requirement to convert all reported amounts into U.S. dollars.

Grasping these terms aids in interpreting the form's language and requirements.

IRS Guidelines for Form 3

The IRS outlines specific guidelines to ensure compliance with reporting standards. Key points include:

- Filing Requirements: All U.S. persons must report according to IRS regulations.

- Supporting Documentation: Maintain records of all foreign transactions or gifts.

- Accuracy and Completeness: Strive to provide thorough and precise entries.

Adhering to these guidelines helps prevent compliance issues and potential penalties.

Filing Deadlines and Important Dates

Important dates include:

- Reporting Year: Form covers transactions within the 2016 calendar year.

- Deadline: Due concurrently with the taxpayer’s income tax return, typically on April 15, with possible extensions aligned with the tax return.

Timely filing eludes late penalties and interest.

Penalties for Non-Compliance

Failure to file Form 3520 can incur significant penalties:

- Financial Penalties: Typically a percentage of reported transaction amounts.

- Additional Fines: May apply for continued non-compliance.

- Mitigation Options: Accurate and timely requests for extensions or reasonable cause claims can mitigate penalties.

Understanding the ramifications of non-compliance underscores the importance of timely and accurate filing.