Definition and Purpose of Form 3520

Form 3520 is an essential IRS document required for U.S. persons who engage in transactions with foreign trusts or receive certain foreign gifts. This form is primarily used to report transfers to and distributions from foreign trusts and to document extensive details about gifts or bequests received from non-U.S. persons. The information provided helps the IRS monitor these transactions and ensure compliance with tax obligations associated with foreign assets, fostering transparency and aiding in the prevention of tax evasion.

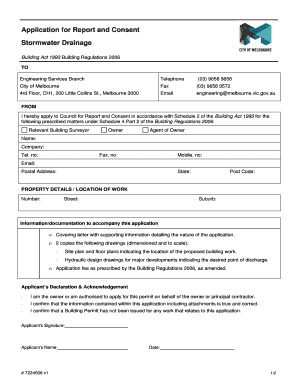

Steps to Complete the 2013 Form 3520

- Identify Reporting Requirements: Determine if you need to report contributions to a foreign trust, distributions received, or foreign gifts.

- Gather Necessary Information: Collect details about the foreign trust, including its name, address, and type. Also, maintain records of any transactions or gifts that will be reported.

- Complete the Required Sections: Fill out Part I for gifts or bequests, Part II for ownership of a foreign trust, and Part III for distributions received. Each section requires distinct data, such as transaction amounts, in U.S. dollars.

- Attach Additional Documentation: Include any additional statements or documentation required by specific sections, like relevant trust documents or transaction details.

- Review for Accuracy: Double-check all entries for completion and correctness. Ensuring accuracy is crucial to avoid penalties.

- File the Form: Submit the completed form to the IRS by the deadline, either electronically or via mail, along with any required payments.

Required Documents and Information

- Information about the Foreign Trust: Name, address, and identifying number of the trust.

- Transaction Details: Nature and amount of transactions or gifts.

- Recipient and Donor Details: Names, addresses, and taxpayer identification numbers.

- Supporting Statements: Additional documentation, such as copies of relevant agreements or statements from foreign entities.

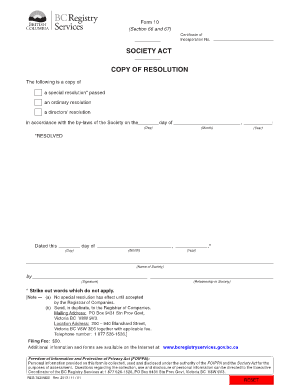

IRS Filing Deadlines and Important Dates

Filing Form 3520 coincides with your federal tax return deadline, typically April 15 for most filers. If residing outside the United States, an automatic two-month extension may apply, pushing the deadline to June 15. Filing an extension for your federal return also extends the Form 3520 deadline. Be mindful of these dates to avoid penalties.

Penalties for Non-Compliance

Failure to file Form 3520 or providing inaccurate information can result in severe financial penalties. The IRS may impose fines amounting to 35% of the transfer or distribution amount not adequately reported. Additional penalties may apply for continued non-compliance, emphasizing the importance of accurate and timely submissions.

Examples of Using the 2013 Form 3520

- Example 1: John, a U.S. citizen, contributed property valued at $100,000 to a Canadian trust. John must report this contribution on Form 3520 Part II, showing the property's fair market value and the trust's details.

- Example 2: Sarah received a $50,000 cash gift from a non-family member residing overseas. She needs to complete Part III to disclose the gift details and report any applicable tax obligations.

Legal Implications and Compliance

Form 3520 plays a critical role in maintaining compliance with U.S. tax laws related to foreign financial activities. Accurate reporting supports lawful participation in global transactions while adhering to the Internal Revenue Code provisions. Consulting a tax advisor or legal expert may be beneficial in navigating complex filings.

Who Typically Uses the 2013 Form 3520

This form is primarily utilized by U.S. persons, including citizens, resident aliens, and domestic entities like corporations, who interact financially with foreign trusts or receive significant foreign gifts. These individuals and entities are legally obligated to report such international financial activities to the IRS for transparency and tax compliance.

Digital vs. Paper Version Accessibility

Form 3520 is available in both digital and paper formats, allowing filers flexibility. Electronic filing is particularly convenient, offering speed and efficiency in submission. However, those preferring traditional methods can complete and mail a physical copy. Ensure security measures are adhered to, especially with electronic submissions, to guard sensitive information.