Definition & Meaning

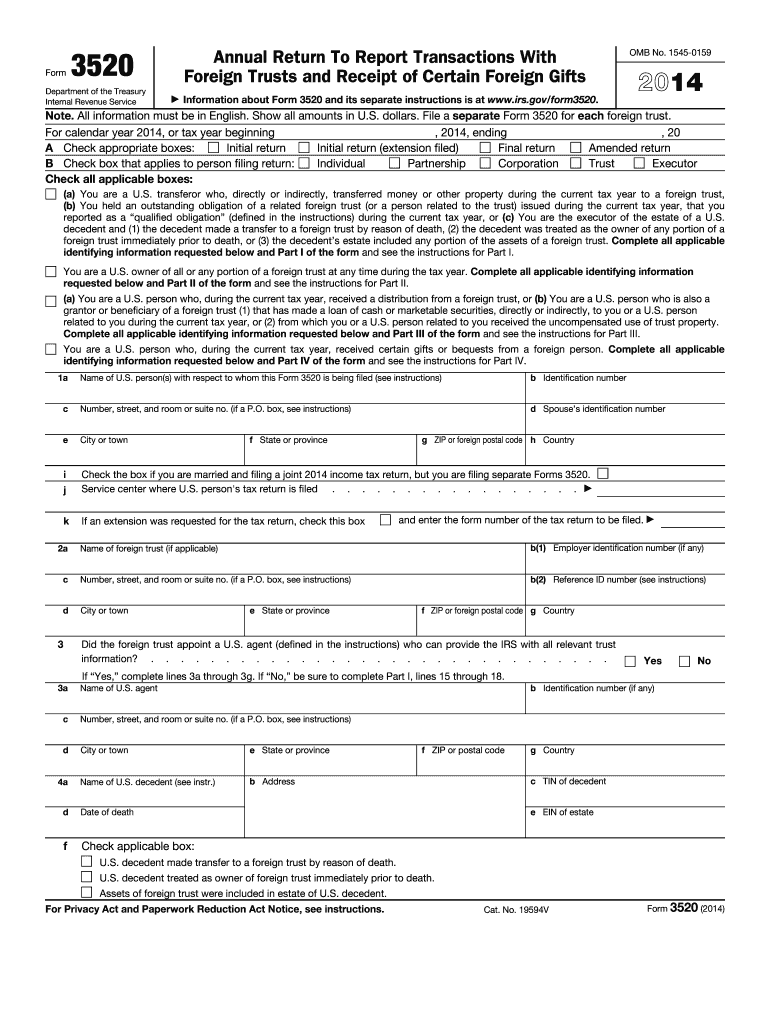

Form 3520 is a report required by the IRS for U.S. persons who engage in certain financial transactions with foreign entities. Specifically, the form is used to report transactions with foreign trusts, including transfers to and distributions from these trusts, as well as the receipt of large gifts or bequests from foreign persons. Understanding its purpose is essential for U.S. taxpayers who have foreign financial interests to ensure proper compliance with IRS regulations.

Importance of Reporting

- Foreign Trust Transactions: It's crucial for maintaining transparency in foreign trust dealings.

- Gifts and Bequests: Requires reporting of any substantial foreign gifts to avoid penalties.

- Financial Transparency: Supports broader efforts to prevent tax evasion and increase fiscal transparency.

Reporting Requirements

When filing Form 3520, all sections must be completed accurately, showcasing transactions in U.S. currency. Even minor misreporting can lead to significant consequences, making thorough understanding indispensable.

How to Use the 2014 Form 3520

Key Components

Form 3520 consists of several parts designed for reporting different types of transactions:

- Part I: Identification Information

- Part II: Information on Foreign Trust Creators

- Part III: Receivers of Distributions from Foreign Trusts

- Part IV: Receipt of Foreign Gifts and Bequests

Practical Use Cases

- U.S. Resident with Foreign Gift: Must report all substantial monetary gifts received from foreign entities.

- Settlor of a Foreign Trust: If you’ve established a foreign trust, reporting details about this setup is mandatory.

Steps to Complete the 2014 Form 3520

- Collect Necessary Documentation: Gather financial statements and details of any foreign transactions.

- Translate Amounts: Convert all foreign currency transactions to U.S. dollars using the IRS-approved exchange rate.

- Complete All Relevant Parts: Ensure each section of the form relevant to your situation is filled out.

- Review for Accuracy: Double-check all entries to prevent errors, which could lead to penalties.

- Retain Copies for Your Records: Keep a copy of the completed form and all supporting documentation.

Error Avoidance Tips

- Cross-Check Entries: Validate all numerical values and personal information.

- Understand All Instructions: Follow IRS guidelines closely and seek help if necessary.

Filing Deadlines / Important Dates

Key Deadlines

Form 3520 should generally be filed by the 15th day of the fourth month following the end of the U.S. person's tax year, typically April 15 for individuals. Extensions align with tax return extensions, but this must be requested explicitly.

Late Filing Consequences

- Monetary Penalties: Failing to file on time can result in penalties up to 35% of the transaction involved.

- Increased Scrutiny: Late submissions might lead to further investigation by the IRS.

IRS Guidelines

Standard Procedures

- Filing Requirements: Explicit details on what constitutes possession of a foreign trust or receipt of foreign gifts.

- Additional Support: IRS provides resources for those seeking clarification on complex sections of the form.

Common Errors and Misunderstandings

- Misclassification: Incorrectly categorizing a foreign entity might cause issues.

- Incomplete Submissions: All sections relevant to the filer’s situation need completion.

Penalties for Non-Compliance

Understanding the Consequences

Failing to comply with Form 3520 requirements carries strict penalties. The following are key repercussions:

- Significant Fines: Monetary penalties can accrue quickly, based on a percentage of the trust’s or gift's value.

- Legal Action: Severe cases of non-compliance could escalate into legal proceedings.

Avoiding Penalties

- Timely Filing: Always file by the deadline.

- Accurate Information: Providing verified data reduces the chance of errors.

How to Obtain the 2014 Form 3520

Methods of Acquisition

- Download Directly from IRS Website: Electronic versions can be obtained with ease.

- Request by Mail: For those preferring physical copies, forms can be mailed upon request.

Accessibility Considerations

Ensure digital accessibility if downloading online, ensuring that all needed software to open PDF documents, like Adobe Reader, is available.

Disclosure Requirements

Detailed Reporting

Complete disclosure is required on the form, with emphasis on:

- Foreign Trust Names: Name and address of each beneficiary or trustee connected to reported entities.

- Transactional Clarity: Clear reporting of all received or transferred trust income.

Confidentiality Measures

All submitted information is safeguarded by IRS confidentiality rules, ensuring disclosed data is only used for tax compliance and legal purposes.