Definition & Meaning

The 2020 Form 1099-MISC is an IRS tax document used to report miscellaneous income. This form is primarily utilized by businesses and organizations to report payments made to individuals who are not employees, such as independent contractors or freelancers. The form helps the IRS track untaxed income, ensuring individuals and businesses pay the appropriate taxes.

Key Information Captured

- Non-employee Compensation: It's essential for reporting payments of $600 or more made to non-employees.

- Other Income Types: Includes rent, royalties, medical and healthcare payments, and more.

- Federal and State Tax Considerations: It provides necessary information for both federal and state tax returns, ensuring comprehensive income reporting.

How to Use the 2020 Form 1099-MISC

When using the 2020 Form 1099-MISC, it's crucial to understand its structure and fields:

Steps to Prepare the Form

- Gather Recipient Information: Collect accurate details of the recipient, including their name, address, and Social Security Number (SSN) or Employer Identification Number (EIN).

- Enter Income Details: Fill in precise amounts in relevant fields, such as Box 1 for rents and Box 3 for other income.

- Complete Payer Information: Ensure your business's identification and contact information are correctly entered.

Who Should Receive This Form?

- Independent Contractors: Those who received compensation of $600 or more.

- Rent recipients: If your business has paid rent, this amount must be reported.

- Healthcare Service Providers: Payments for medical and health care services are part of this reporting.

Steps to Complete the 2020 Form 1099-MISC

Completing the form involves several crucial steps:

Detailed Procedure

- Identify the Correct Copies: Copy A is for IRS submission, and Copy B should be provided to the income recipient.

- Accurate Data Entry: Ensure that all amounts and recipient information are accurate to prevent errors in filing.

- Verification and Compliance: Double-check all entries for compliance with IRS regulations.

Important Considerations

- Deadline Awareness: Keep track of IRS deadlines to avoid penalties.

- Retain Copies: Maintain a copy for your records and verify that all distributed copies are received by necessary parties.

Filing Deadlines / Important Dates

Adhering to IRS timelines is crucial for compliance:

Key Dates to Remember

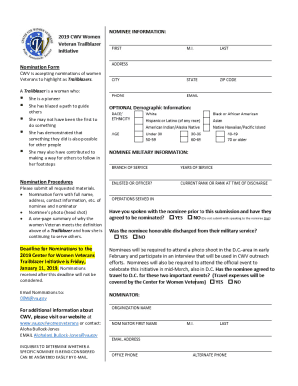

- Recipient Copy Deadline: January 31 of the following year is the deadline to deliver Copy B to recipients.

- IRS Submission: February 28, if filing on paper, and March 31 for electronic submissions.

Penalties for Late Filing

Failure to file on time can result in monetary penalties, escalating based on the lateness and the size of the business.

Penalties for Non-Compliance

Non-compliance with 1099-MISC filing requirements can have significant consequences:

Types of Penalties

- Late Filing Fees: Incremental penalties based on lateness and organizational size.

- Incorrect Information: Monetary fines if the forms contain errors.

Maximizing Compliance

- Audit Preparedness: Ensure all records are retrievable and accurate, should an IRS audit occur.

- Verification Protocols: Implement internal checks to verify the accuracy of information before submission.

Who Typically Uses the 2020 Form 1099-MISC

This form is primarily for businesses dealing with non-employees:

Typical Users

- Businesses and Corporations: Those who frequently hire independent contractors.

- Landlords and Real Estate Agents: Reporting rent income is essential.

- Healthcare Providers: For reporting payments made to medical practitioners.

Sector-Specific Usage

Businesses in sectors such as real estate, healthcare, and logistics frequently use this form to report diverse income types.

Software Compatibility (TurboTax, QuickBooks, etc.)

Many businesses utilize software to streamline 1099-MISC filings:

Compatible Software

- TurboTax and QuickBooks: Widely used for preparing and submitting forms electronically.

- Benefits: Automated calculations and error-checking capabilities ease the process.

Integration Tips

- Establish integration protocols with financial software to ensure data consistency and simplify year-end tax preparation.

State-Specific Rules for the 2020 Form 1099-MISC

State specifications can affect how the form is used:

State Variations

- Differing Requirements: States may have unique submission protocols or additional state-specific forms required with the 1099-MISC.

- State Tax Implications: Understanding how state taxes interplay with federal reporting is crucial for correct form usage.

Example States

- California: Often requires more stringent reporting due to its unique tax code.

- Texas: Follows federal requirements but may have specific guidelines for state business taxes.

By understanding the nuances of Form 1099-MISC, businesses can ensure compliance and avoid potential penalties.