Definition & Meaning

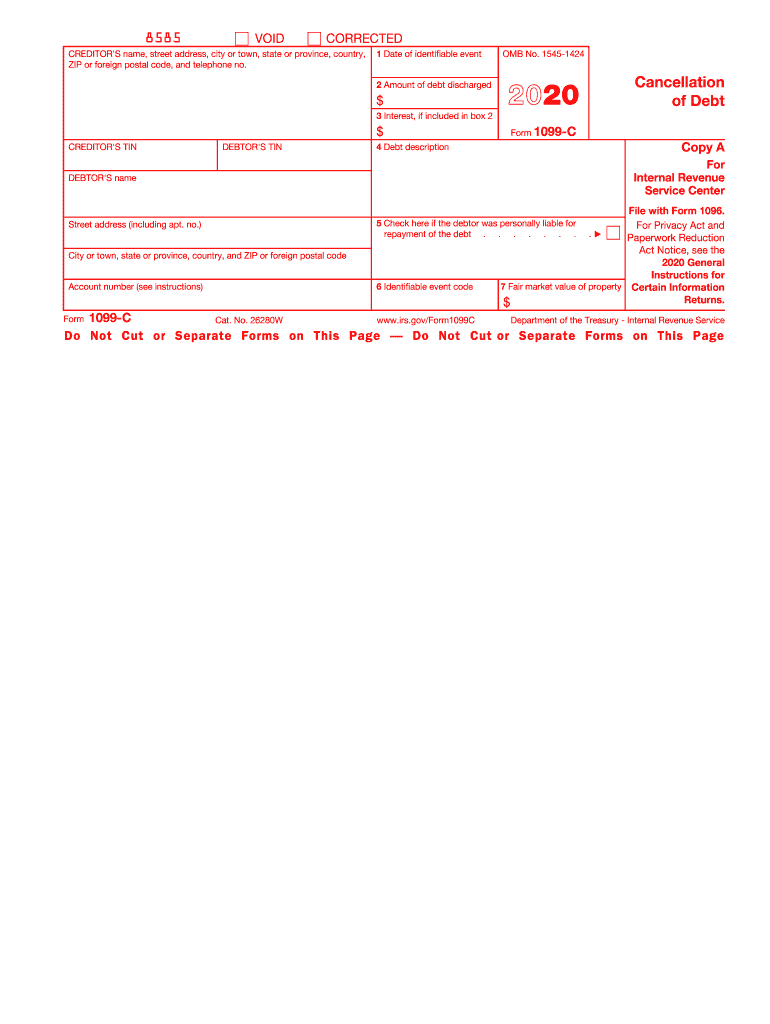

The Form 1099-C is an IRS tax document utilized by creditors to report the cancellation or discharge of debt. When a financial institution forgives or cancels a debt of $600 or more, it must issue a 1099-C form to the debtor and the IRS. This form helps track taxable income, as canceled debt is typically considered taxable. It provides essential information, including creditor and debtor details, the amount of debt discharged, and any interest included in the forgiven amount.

How to Use the 1099-C Form

The primary purpose of the 1099-C form is to notify debtors and the IRS about canceled debts that may be taxable. Recipients must include this information when filing their income taxes. If one receives a 1099-C form, it is crucial to verify the accuracy of the details and seek clarification from the issuing creditor if discrepancies arise. Debtors may need to report the canceled debt as income unless exceptions apply, such as bankruptcy or insolvency.

How to Obtain the 1099-C Form

Typically, the 1099-C form is provided by the creditor that forgave or canceled a qualifying debt. Debtors don't usually request this form themselves; they automatically receive it if their debt cancellation meets the reporting criteria. For taxpayers concerned about receiving a 1099-C form, it is advisable to contact the creditor involved for confirmation or expected timelines.

Key Elements of the 1099-C Form

The form includes critical data such as:

- Creditor's Information: Name and contact details of the creditor issuing the form.

- Debtor's Information: Name, address, and taxpayer identification number of the debtor.

- Debt Details: Total amount of debt discharged, with any interest included.

- Identifiable Event Code: Specific circumstances for the debt cancellation (e.g., bankruptcy).

- Interest and Penalties: Whether forgiven interest is included in the amounts discharged.

Reviewing these elements ensures the information provided aligns with the debtor's records.

Steps to Complete the 1099-C Form

Filling out a 1099-C form accurately is crucial. Here’s a generalized step-by-step approach:

- Gather Required Information: Ensure that all relevant financial documents are at hand.

- Enter Creditor Details: Fill in the sections with the creditor's name, address, and tax identification number.

- Input Debtor Information: Similar details for the debtor, ensuring absolute accuracy.

- Complete Debt Information: Specify the total discharged amount and related details in the relevant boxes.

- Specify Event Codes: Use the correct event code to identify the nature of the debt cancellation.

- Finalize and Submit: Ensure all information is correct before submitting copies to the IRS and the debtor.

Important Terms Related to 1099-C Form

Understanding the terminology on a 1099-C form ensures proper handling. Key terms include:

- Cancellation of Debt Income: The amount of debt considered taxable income upon cancellation.

- Identifiable Event: Particular circumstances leading to debt cancellation (e.g., lender decision).

- Insolvency: A legal state where liabilities exceed assets, potentially exempting the debt from being taxed.

Familiarity with these terms aids in understanding the form and potential tax implications.

IRS Guidelines

The IRS provides explicit instructions concerning the 1099-C form. Creditors must issue the form when debt of $600 or more is canceled, while recipients should understand it may impact taxable income. Exceptions may apply to the debtor, such as bankruptcy or insolvency, which exempt the income from taxes. Taxpayers are advised to follow IRS guidelines closely and consult a tax professional if questions arise.

Filing Deadlines / Important Dates

Compliance with filing deadlines is essential to avoid penalties. Creditors must typically send the 1099-C form to debtors by January 31st of the year following the debt cancellation. Additionally, the form must be filed with the IRS by the institution's relevant due date, generally aligning with other tax filing deadlines. It’s crucial for both creditors and debtors to adhere to these time frames to ensure compliance.

Legal Use of the 1099-C Form

The 1099-C form is a legally mandated document in reporting canceled debt. Its use is governed by IRS regulations, ensuring transparency and accuracy in financial reporting. Incorrect or fraudulent information on the form can lead to legal consequences. For debtors, understanding how this form impacts their tax return is vital, and seeking professional advice may be necessary if complexities arise.

State-Specific Rules for the 1099-C Form

While the 1099-C is a federal form, individual states may have additional regulations surrounding its use. Variations in state tax laws mean that debt cancellation can have different implications dependent on geographic location. Debtors should consult state tax authorities or professionals familiar with local regulations to understand any unique state stipulations that might affect their financial situation.