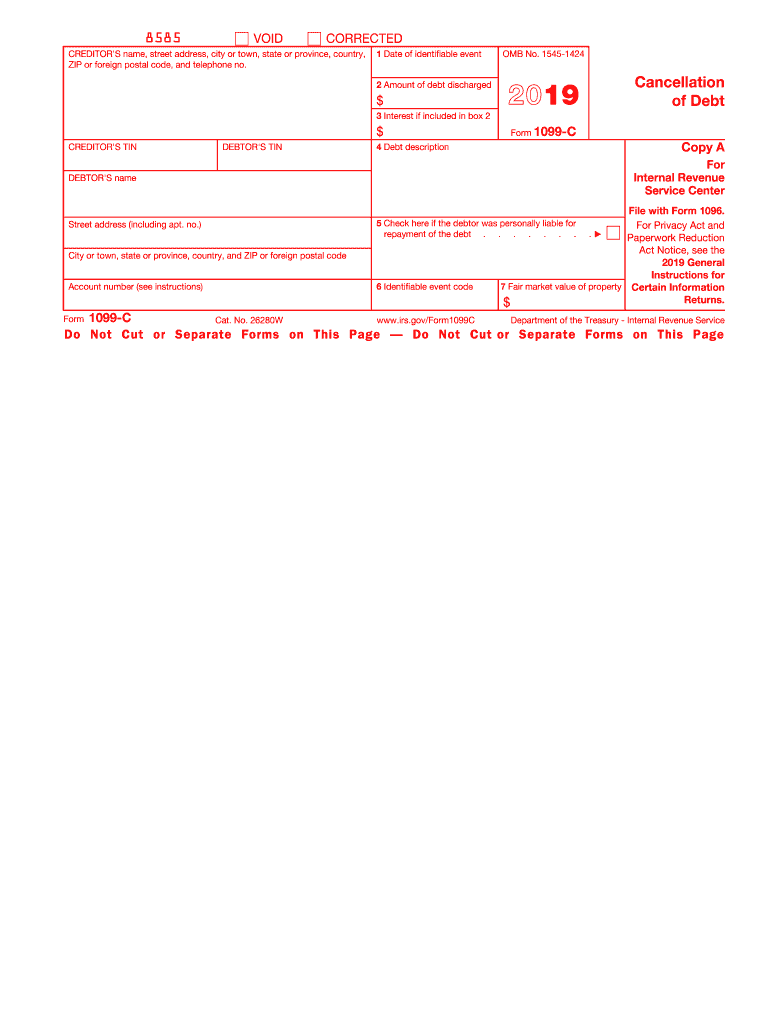

Definition and Meaning of Form 1099-C

Form 1099-C, Cancellation of Debt, is an IRS form used by creditors to report canceled debt of $600 or more to the IRS. This form is typically used when a lender forgives or cancels a debt owed by an individual or entity. When debt is canceled, forgiven, or discharged for less than the amount you owe, the amount of the canceled debt is treated as income to you and may be taxable.

Context and Purpose

- Creditors' Role: Creditors, such as banks or credit card companies, must issue Form 1099-C to debtors and the IRS when they cancel a debt of $600 or more.

- Debtors' Obligation: Debtors are required to include the canceled amount as income when filing their tax returns unless a specific exclusion applies.

- Income Reporting: Canceled debt is considered income because the debtor retains the money that was initially borrowed despite not fully repaying it.

How to Obtain Form 1099-C for 2020

Form 1099-C can be obtained directly through the creditor who canceled the debt. Creditors are obligated to send the completed form to debtors after the cancellation occurs.

Obtaining from Creditors

- Timing: Debtors should expect to receive the form by January 31 following the year in which the debt was canceled.

- Contacting Creditors: If you have not received your form, contact your creditor to verify your mailing address and request a re-send.

Online Access

- IRS Website: You can view the form as a reference on the IRS website, but it must be issued by a creditor to be valid for tax reporting purposes.

- Account Portals: Some creditors may offer online portals where you can download tax documents, including the 1099-C.

Key Elements of Form 1099-C

Understanding the key elements of Form 1099-C is essential for accurate tax reporting.

Sections of the Form

- Creditor's Details: Includes the creditor's name, address, and TIN (tax identification number).

- Debtor's Information: Contains the debtor's name, address, and TIN.

- Amount of Debt Canceled: Specifies the total amount of the debt that was canceled.

- Date of Cancellation: Indicates the specific date when the debt cancellation occurred.

Additional Information

- Identifiable Event Code: Provides a code that explains the reason for debt cancellation, such as bankruptcy or agreement between debtor and creditor.

- Fair Market Value: May include information on the fair market value of any property that secured the debt.

Steps to Complete the 1099-C for 2020

If you are the entity required to complete Form 1099-C, certain steps must be followed to ensure compliance.

- Gather Information: Collect all relevant debtor information, including contact and identifying financial details.

- Calculate Canceled Debt: Determine the exact amount of debt forgiven and the applicable date.

- Complete the Form: Fill in all required entries, including creditor and debtor details, amount, and identifiable event code.

- Submit the Form: Send Form 1099-C to both the IRS and the debtor. The IRS copy goes with Form 1096, Annual Summary and Transmittal of U.S. Information Returns.

Important Considerations

- Accuracy: Ensure accuracy in calculation and reporting to avoid penalties.

- Deadlines: Provide copies to the debtor by January 31 and to the IRS by February 28 (or March 31 if filing electronically).

Legal Use and Implications of Form 1099-C

Form 1099-C serves crucial legal and regulatory functions in tax reporting for both creditors and debtors.

Implications for Creditors

- Creditors use the form to maintain compliance with IRS debt reporting requirements and avoid penalties associated with non-reporting or misreporting.

Implications for Debtors

- Income Recognition: Debtors must recognize the canceled debt as income on federal tax returns, potentially increasing taxable income.

- Exclusions: Certain exclusions may apply, such as debt discharged through bankruptcy or insolvency.

IRS Guidelines for Form 1099-C

The IRS provides comprehensive guidelines to ensure the proper use and reporting of Form 1099-C.

Guidelines Overview

- Reporting Requirements: Detailed in IRS Publication 4681, which covers canceled debts, foreclosures, and repossessions.

- Exclusions and Exceptions: Provides criteria for when canceled debt does not need to be reported, such as under insolvency exclusions.

Filing Deadlines and Important Dates for Form 1099-C

Deadlines for Filing

- To the Debtor: January 31 following the tax year of debt cancellation.

- To the IRS: February 28 via mail or March 31 for electronic submissions.

Compliance and Penalties

Failure to file by these dates can result in penalties imposed on the creditor. Debtors should report the 1099-C information on their tax return for the year received.

Penalties for Non-Compliance

Failure to file Form 1099-C correctly and timely can result in significant penalties.

Penalty Details

- Late Filing: Varies depending on delay duration and if the IRS considers the failure intentional.

- Incorrect Filing: Penalties can be applied for providing erroneous information.

Understanding these penalties stresses the importance of accuracy and timeliness in completing and submitting Form 1099-C.