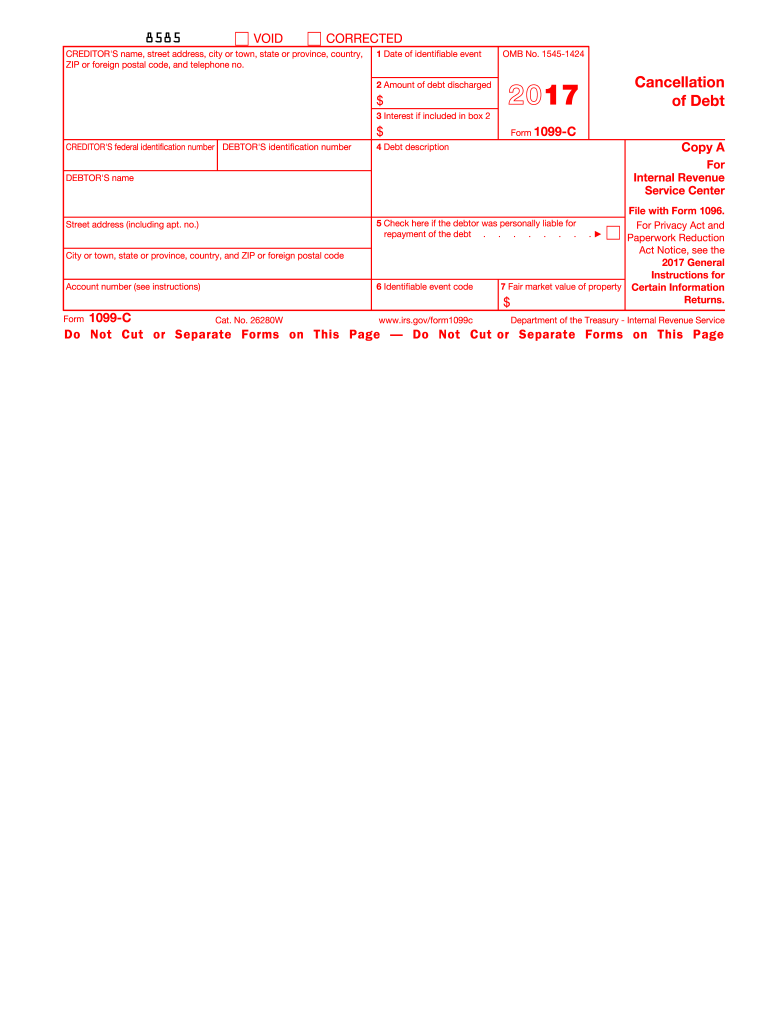

Definition and Meaning of the 1099-C Form

The Form 1099-C, Cancellation of Debt, is an Internal Revenue Service (IRS) tax form used to report the cancellation of debt to the debtor and the IRS. It is essential in documenting forgiven or canceled debt of $600 or more as potentially taxable income to the debtor. Debt can be canceled in various scenarios, including foreclosures, the renegotiation of debt terms, or as a result of the debtor's bankruptcy proceedings. Understanding this form's implications is crucial for both debtors and creditors, since failure to report such debt can result in significant IRS penalties.

How to Obtain the 1099-C Form

You can obtain a 1099-C form from several sources. Creditors, including banks, financial institutions, and credit card companies, typically issue this form when they forgive a debtor's outstanding balance. You can expect to receive the form at the end of the tax year. If you don't receive it, you can visit the IRS website to download a copy. Keep in mind that Copy A is not printable from the IRS site due to scannability issues and should only be filed electronically or requested through official IRS channels.

Steps to Complete the 1099-C Form

- Information Gathering: Gather all necessary details about the debt, including the date of cancellation, the amount canceled, and the creditor's information.

- Filling Out the Required Sections: Enter the debtor’s and creditor’s information accurately, including names, addresses, and identification numbers.

- Debt Details: Provide specifics about the canceled debt, including the date the debt was forgiven, and whether it involved personal or business obligations.

- Marking Exemptions: Identify any applicable exceptions under IRS guidelines where canceled debt would not be included as taxable income.

- Verification and Submission: Review all entered details for accuracy before submitting the form to the IRS and sending copies to the debtor.

IRS Guidelines on the 1099-C Form

The IRS outlines specific guidelines for handling canceled debt. Creditors are required to issue a 1099-C form to debtors and the IRS for amounts over $600. The IRS considers canceled debt income unless the debtor qualifies for an exemption. Debtors must calculate this income when filing annual taxes, except for exemptions such as bankruptcy or documented insolvency cases. The guidelines also specify handling unique situations, like joint liabilities or multiple creditors.

Legal Use of the 1099-C Form

The 1099-C form holds legal significance as it directly affects taxable income reporting. Proper acknowledgment of canceled debt prevents misreporting income, which could lead to IRS audits or penalties. Legal stipulations dictate that debtors must include any amounts reported on a 1099-C as part of their gross income unless they meet IRS exemption conditions. It's advisable to consult with a tax professional if there are complexities regarding canceled debt circumstances or exemptions.

Important Terms Related to the 1099-C Form

- Debtor: The individual or entity whose debt has been canceled.

- Creditor: The entity or person forgiving the debt, responsible for issuing the 1099-C form.

- Insolvency: A condition where a debtor's total liabilities exceed total assets, potentially exempting them from reporting canceled debt.

- Scannability: Refers to how the IRS processes forms; Copy A should be submitted electronically to avoid issues in reading the form.

Penalties for Non-Compliance

Failing to report canceled debt as income can result in significant IRS penalties, which range from monetary fines to criminal liability in cases of intentional tax evasion. Creditors may also face penalties if they fail to issue the form correctly or on time. Taxpayers should ensure that all relevant debts are accurately reported and seek professional guidance if uncertainties arise about potential exemptions or about calculating owed amounts.

Software Compatibility for Filing 1099-C

Various tax filing software like TurboTax and QuickBooks offer modules to handle 1099-C forms. These programs help ensure accurate report generation by importing data and offering step-by-step instructions. They typically allow for electronic submission to comply with IRS filing requirements and provide additional features for tracking form status and managing related tax documents efficiently. Ensure that the version of the software being used is up-to-date to support the latest regulations and file formats.