Definition & Meaning

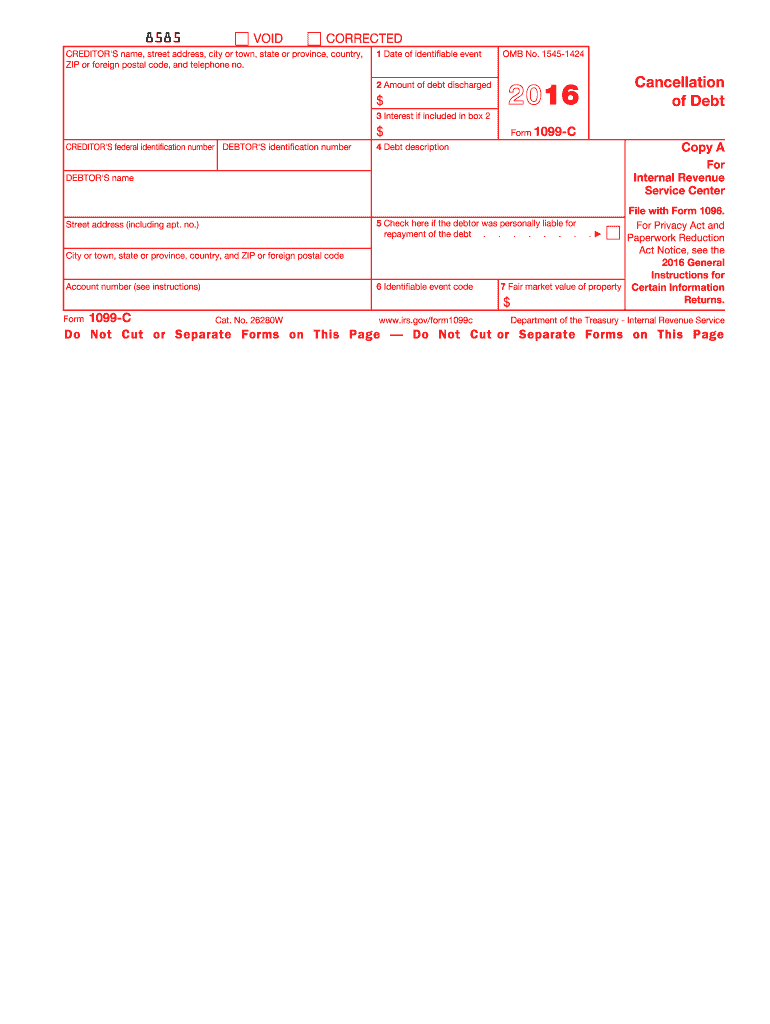

Form 1099-C, Cancellation of Debt, is a tax document used by lenders to report the cancellation of $600 or more of a borrower's debt. When a debt is canceled, forgiven, or discharged, the IRS treats this amount as taxable income, which is why such transactions must be documented using this form. Entities that typically use Form 1099-C include credit card companies, financial institutions, and the government.

Key Components

- Debtor's Information: Includes the borrower's name, address, and taxpayer identification number.

- Creditor's Information: Lists the lender's name, address, and federal identification number.

- Debt Details: Incorporates the amount of debt forgiven and the date of the cancellation.

- Box References: Each section within the form is assigned a specific box number that corresponds to particular information areas.

How to Use the 1099-C 2016 Form

Entities utilizing the Form 1099-C must understand its purpose and follow detailed steps to correctly use it for reporting debt cancellation. It is fundamental for both creditors, who are responsible for issuing the form, and for debtors, who need to report the canceled debt on their tax returns.

Step-by-Step Guide

- Gather Information: Creditor gathers details about the cancellation event, including borrower information and the specifics of the debt.

- Complete the Form: Fill out the 1099-C form by entering all necessary data in the correct fields.

- Distribute Copies: Provide a copy to both the debtor and IRS; the debtor's copy can be used for tax filing purposes.

How to Obtain the 1099-C 2016 Form

Securing Form 1099-C for reporting cancellation of debt transactions is essential for compliance. There are several avenues to obtain this IRS form.

Acquisition Methods

- IRS Website: Downloads and instructions are available on the IRS official portal.

- Tax Software: Many tax preparation platforms provide access to form templates.

- Professional Accountants: Tax professionals often maintain copies of necessary forms, including the 1099-C.

Steps to Complete the 1099-C 2016 Form

Filling out the 1099-C form accurately ensures transparency and compliance with IRS regulations. Here's a detailed guide on completing this document.

Detailed Instructions

- Input Personal Details: Enter debtor and creditor information in the respective sections.

- Report Debt Cancellation Details: Clearly document the canceled amount, the debt type, and the cancellation date.

- Review for Errors: Verify all entered data for accuracy and completeness before submission.

Common Errors to Avoid

- Confusing debtor with creditor details

- Incorrect total of canceled debt

- Wrong tax identification numbers

Legal Use of the 1099-C 2016 Form

Form 1099-C serves as a legal document to communicate debt cancellation to the IRS. Proper use is crucial for both compliance and tax accuracy.

Legal Considerations

- Regulatory Requirement: Mandatory for creditors to issue for any $600 or more cancellations.

- Tax Implications: Debtors must reflect this as income, potentially affecting tax liability.

Important Terms Related to 1099-C 2016 Form

Understanding specific terms linked to Form 1099-C is crucial to grasp its full implications.

Glossary of Terms

- Cancellation of Debt (COD): The forgiveness or discharge of a borrower's obligation to repay, considered taxable.

- Taxable Income: Debt cancellations added to a debtor's earnings for IRS reporting.

- Tax Year 2016: Specific year for which this form must be applied regarding any cancellations within that timeframe.

IRS Guidelines

Adhering to IRS guidelines for Form 1099-C ensures compliance and avoids penalties.

Compliance Requirements

- Filing and Submission: Ensure forms are filed with the IRS and a copy given to the debtor.

- Accuracy: All details must be precise to prevent audits or fines.

Filing Deadlines / Important Dates

Staying informed on filing deadlines is vital for avoiding delays and penalties.

Key Deadlines

- January 31: Date by which debtors should receive their copy of the 1099-C.

- February 28/April 1: Paper vs. electronic filing deadline with the IRS.

Penalties for Missed Deadlines

- Fines dependent on the duration of delay and whether the error was intentional.

This comprehensive breakdown serves as an influential guide for understanding, completing, and correctly filing Form 1099-C for the year 2016, ensuring both compliance and financial clarity.