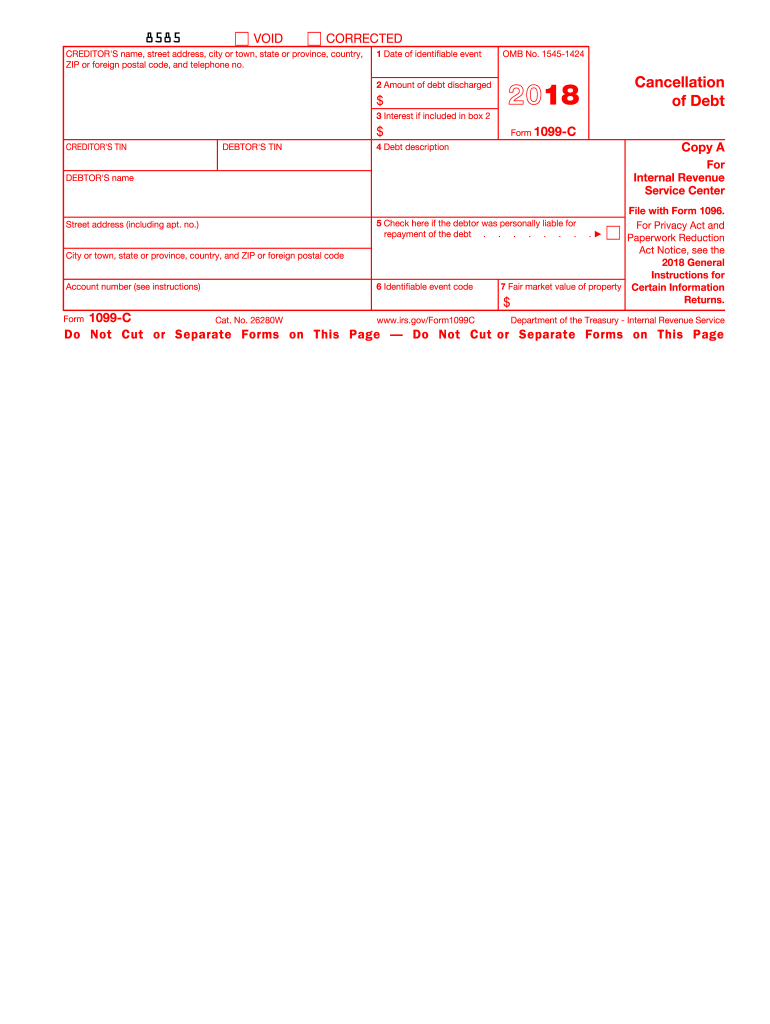

Understanding Form 1099-C: Cancellation of Debt

Form 1099-C, known as the Cancellation of Debt form, is essential for reporting debt forgiveness in tax filings. When a debt is forgiven, canceled, or discharged, it is considered taxable income by the IRS. Lenders who forgive $600 or more of debt must issue this form to the debtor and the IRS.

Application and Process for Form 1099-C

-

Obtain the Form: The official Form 1099-C can be obtained through the IRS or financial institutions. It's important to use the correct version, such as the 2015 edition, for specifying the relevant tax year.

-

Complete the Form: Debtors must fill out parts of the form to ensure the lender and IRS receive accurate information. This involves personal details and the nature of the forgiven debt.

-

Submit the Form: Lenders submit the completed form to the IRS and the debtor by January 31 of the following tax year. Debtors should then include the information in their federal tax return.

Usage and Importance of Form 1099-C

Form 1099-C is crucial in tax reporting because it ensures income transparency for debt cancellation, which the IRS regards as taxable. Proper reporting can prevent legal issues or fines associated with tax evasion.

Key Elements of Form 1099-C

Form 1099-C features specific components that parties must understand:

- Creditor and Debtor Information: Includes names, addresses, and Tax Identification Numbers (TIN) of both debt cancellation parties.

- Debt Description: Specifies the cause for forgiveness and details about the original debt agreement, including dates and terms.

- Amount of Discharged Debt: The total debt that was canceled is listed here, determining the taxable amount.

- Event Codes: Explains the reason for debt discharge, marked by specific codes, which detail bankruptcy, agreement alteration, or direct forgiveness.

IRS Guidelines for Form 1099-C

The IRS provides directives for form accuracy:

- Issuance: Financial institutions must ensure issuance to both debtors and the IRS.

- Recording: Debtors should maintain records in case of audits or inquiries.

- Special Cases: Situations like insolvency and debts discharged through bankruptcy have separate considerations, affecting the taxability of forgiven debt.

Filing Deadlines and Important Dates

- Issuance Date: Creditors need to issue Form 1099-C by January 31 post the debt discharge year.

- Tax Filing Deadline: Debtors must include this form in their tax filings by April 15, aligning with regular IRS deadlines.

Legal Use and Compliance

Noncompliance with Form 1099-C can lead to penalties:

- Lenders Penalties: Fines for failing to provide timely or accurate forms.

- Debtors Consequences: Tax penalties due to underreporting income can add liabilities.

Scenarios and Real-World Examples

Debtor Scenarios

- Self-Employed: If a self-employed individual’s business debt is forgiven, it directly impacts their taxable income.

- Students: Student loan discharges also require documentation via Form 1099-C, affecting post-education taxes.

Examples in Practice

For instance, when a bank writes off a portion of a loan due to the debtor's financial hardship, this forgiven amount is reported as taxable income. The specific entry of this cancellation must reflect in the annual tax return.

Conclusion

Understanding and correctly utilizing Form 1099-C is vital to adhering to IRS tax requirements. By ensuring accurate completion and timely submission, both creditors and debtors can avoid potential legal troubles and maintain financial transparency.