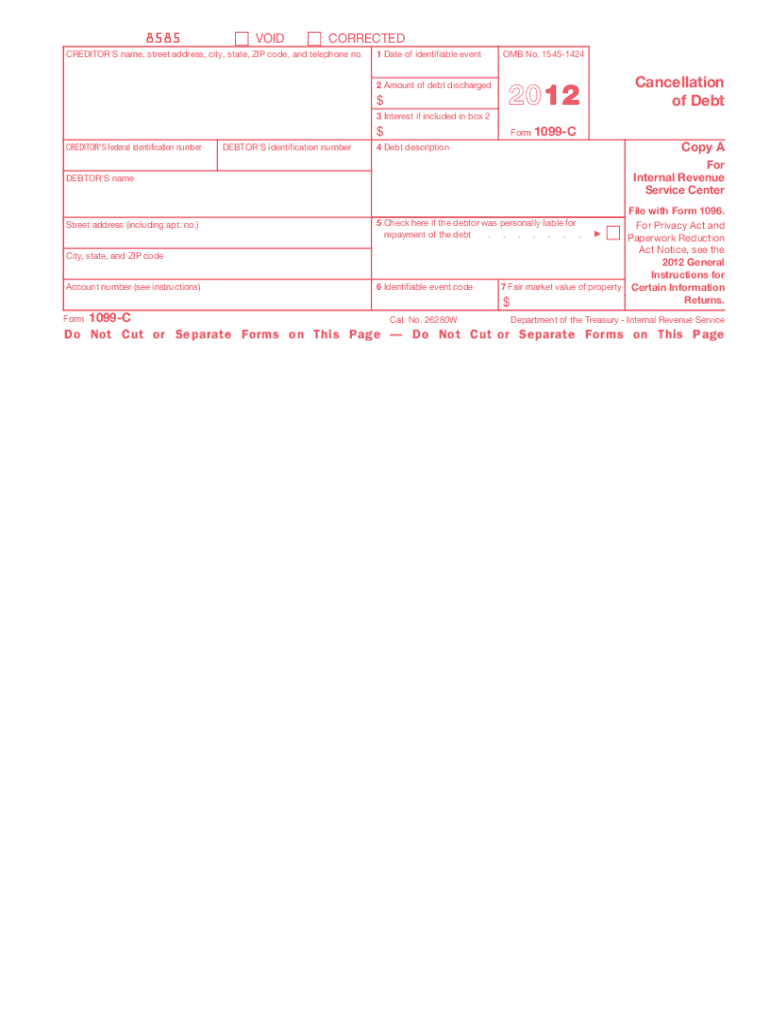

Definition & Meaning

The 2-C form is a critical document used by creditors to report the cancellation of a debt. It is essential for both creditors and debtors to understand this form as it has significant tax implications. The form indicates that a debt, typically over $600, has been forgiven, which can be considered taxable income under IRS regulations. This document helps ensure that individuals properly report any discharged debts on their tax returns, aligning with federal guidelines.

How to Use the 2-C Form

Individuals receiving a 2-C form should use it to report the cancellation of debt as part of their taxable income for that year. The information from the form should be accurately entered on the individual's tax return. For debtors, it's crucial to determine whether the cancellation leads to an increase in taxable income or if they qualify for any exceptions or exclusions. For example, insolvency at the time of debt cancellation could mean the debt is not entirely taxable.

How to Obtain the 2-C Form

To obtain a 2-C form, debtors typically receive it directly from the creditor or lender who canceled the debt. Creditors are required by law to send this form by January 31 of the year following the debt cancellation. If the form is not received, it's important for individuals to contact their creditor directly to request a copy and ensure all information is correctly reported on their tax return.

Steps to Complete the 2-C Form

- Review the Form: Ensure all personal information is correct, including name, address, and taxpayer identification number.

- Verify Debt Information: Confirm that the amount of canceled debt is accurate. This will be listed in Box 2.

- Check Identifiable Event Code: Review Box 6 for the code that explains the reason for debt cancellation.

- Identify Exceptions or Exclusions: Determine if you qualify for any exceptions; circumstances such as insolvency may apply.

- Consult the IRS Guidelines: Use the IRS instructions to correctly report the canceled debt on your tax return.

- Seek Professional Advice: Consider consulting a tax professional if the form involves complex financial situations or large amounts.

Key Elements of the 2-C Form

- Date of Identifiable Event: Indicates when the debt was considered canceled. Important for tax reporting purposes.

- Amount of Debt Canceled: Detailed in Box 2, this figure is crucial as it impacts your taxable income.

- Interest Included: Box 3 shows any interest included in the reported amount which may already be reported as income.

- Debt Description: Information regarding the type of debt canceled, aiding in accurate reporting.

Penalties for Non-Compliance

Failing to report the information on the 2-C form when required can lead to significant penalties. These penalties may include fines or additional taxes owed, as the IRS may consider unreported canceled debt as income. Additionally, providing incorrect information on the form can result in further legal complications and financial repercussions, emphasizing the need for accuracy.

Legal Use of the 2-C Form

The legal use of the 2-C form includes the accurate reporting of discharged debt for tax purposes. Creditors must issue this form to report canceled debts over $600, while debtors must include this information when filing their taxes. Misreporting or failure to report can lead to legal consequences, underlining the importance of adhering to IRS guidelines.

IRS Guidelines

The IRS provides specific guidelines on how the 2-C form should be completed and filed. The IRS publications clarify the conditions under which canceled debt must be reported, how to calculate debt for tax purposes, and when exceptions apply. By following these guidelines, taxpayers ensure compliance and avoid potential penalties or audits.

Filing Deadlines / Important Dates

The deadline for creditors to issue the 2-C form is January 31 of the year following the debt cancellation. Debtors must include the canceled debt in their income when filing their tax returns, which has a typical deadline of April 15. Meeting these deadlines is critical to avoid penalties and ensure all tax obligations are fulfilled promptly.