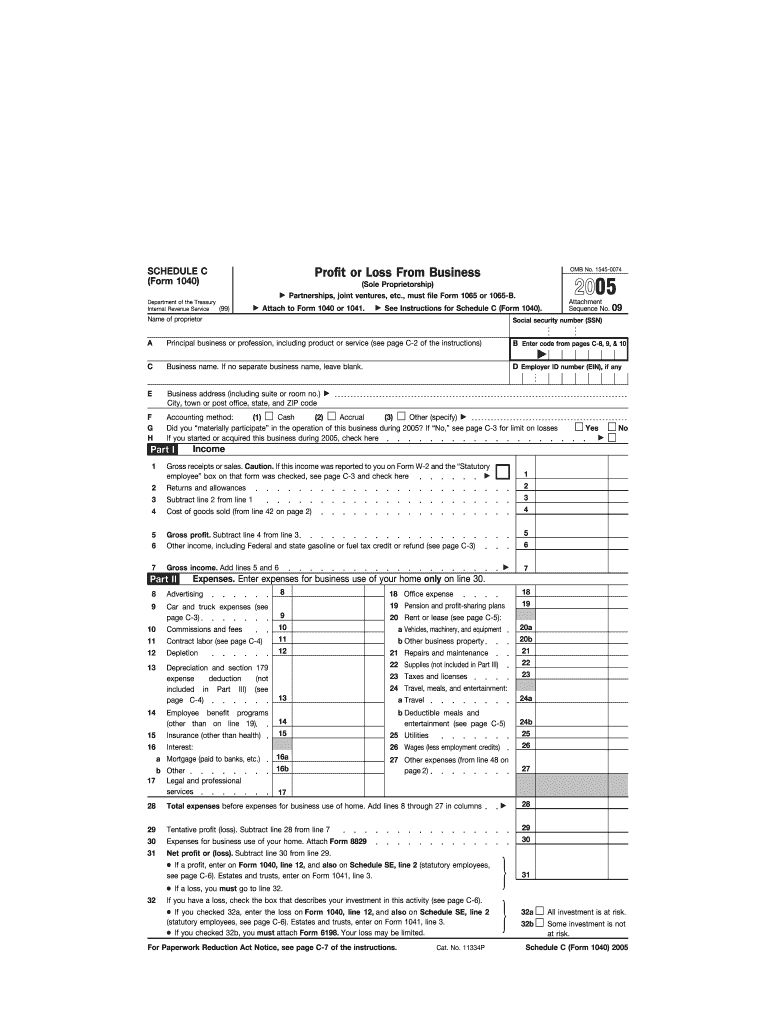

Definition and Purpose of the 2005 Form 1040

The 2005 Form 1040, often referred to simply as Form 1040, is a United States federal tax document used by individuals to file their annual income tax returns. This form captures a comprehensive picture of your financial activities for the year, including wages, interests, dividends, and other sources of income. It enables taxpayers to calculate their final tax liability or refund.

Key Features and Sections

- Income Reporting: The form requires detailed reporting of different income types, including wages, salaries, tips, and capital gains.

- Deductions and Credits: Taxpayers can claim various deductions and tax credits, ultimately reducing their taxable income.

- Taxes Paid: This section details any withholding from salaries or estimated tax payments made throughout the year.

- Refund or Amount Owed: The conclusion of this form determines whether the taxpayer is due for a refund or owes additional taxes.

Steps to Complete the 2005 Form 1040

Filing your taxes accurately requires attention to detail. Here’s a step-by-step outline to guide you through the process of completing the 2005 Form 1040.

-

Gather Necessary Documents:

- Collect W-2s showing wages and withholdings.

- Obtain Form 1099s for additional income like dividends and unemployment wages.

-

Report Income:

- Accurately fill in all sources of income reported on your documents.

- Ensure all income types, such as self-employed earnings, are included.

-

Claim Deductions & Credits:

- Identify eligible deductions such as retirement contributions or mortgage interest.

- Explore available credits, for example, the Child Tax Credit or Education Credits.

-

Calculate Taxable Income:

- Subtract applicable deductions from the gross income to compute taxable income.

- Use tax tables or software to determine preliminary tax liability based on this value.

-

Finalize Tax Liability:

- Deduct tax credits from the calculated tax liability to find the exact amount owed.

- Compare taxes paid through withholding or estimated payments against liability.

-

Determine Refund or Payment:

- If withholdings and credits exceed liability, calculate the refund.

- Otherwise, prepare to submit any balance due to the U.S. Treasury.

Who Should Use the 2005 Form 1040

Form 1040 is versatile, suiting a broad spectrum of taxpayers.

Typical Users Include:

- Employees: Individuals earning salaries and wages with potential income from other sources.

- Self-Employed Individuals: Those needing to report profits or losses from a business or freelance work.

- Investors: Taxpayers with capital gains or losses and dividend income.

- Retired Persons: Individuals receiving pensions or annuities, and may have taxable retirement fund withdrawals.

- Students: If earning above a specific income threshold, even students are required to file utilizing Form 1040.

Legal Obligations and Compliance

Use of the 2005 Form 1040 requires adherence to specific legal protocols and is governed by the IRS guidelines.

Compliance Tips

- Accurate Reporting: Always present exact figures to avoid penalties for underreporting or fraudulent claims.

- Timely Filing: Submit your form by the official deadline to avoid late fees. Remember, the standard deadline is typically April 15.

- Record Keeping: Maintain copies of your filed forms and supporting documents for at least three years in case of audits or discrepancies.

Examples of Using the 2005 Form 1040

Scenario 1: Self-employed Artist

A freelance artist must report all sales, minus allowable business expenses, to determine net earnings. They might include a Schedule C alongside Form 1040 to itemize these details.

Scenario 2: Dual Income Family

A family with two working adults must combine incomes and deductions possible for each. They need to pay special attention to joint filing benefits and consequences.

IRS Guidelines for the 2005 Form 1040

The Internal Revenue Service (IRS) is responsible for the issuance and regulation of Form 1040. The IRS provides publications and instructions to aid taxpayers in accurately completing their forms according to the law.

Key Considerations

- Follow the IRS instructions meticulously to maximize benefits and ensure accurate filings.

- Utilize IRS helplines or tax preparers when complexities arise.

Importance of Filing the 2005 Form 1040

Filing the 2005 Form 1040 is essential for meeting legal tax obligations. It ensures proper documentation of income, allowing the IRS to assess the fairness and correctness of the taxes collected, and facilitates returns and refunds where applicable. Non-compliance can result in audits, penalties, or legal consequences.