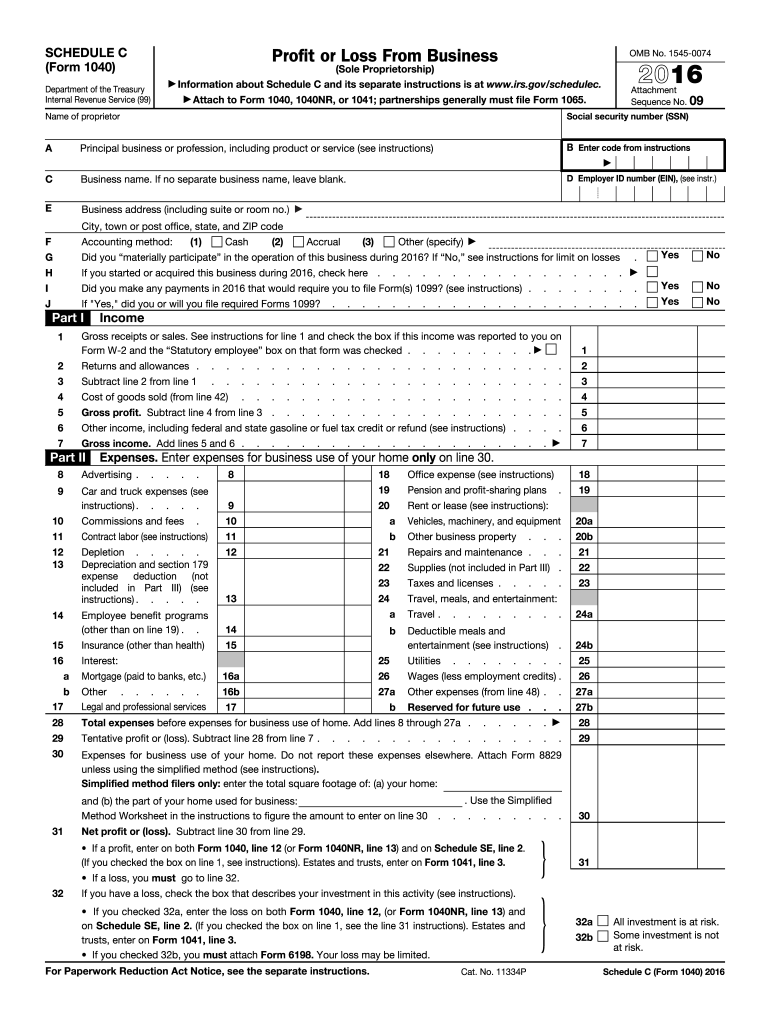

Definition and Purpose of Schedule C Form 2016

The Schedule C Form 2016, officially known as "Profit or Loss from Business," is a critical document used by sole proprietors to report their business income and expenses to the IRS. This form plays a pivotal role for U.S.-based small business owners who operate as sole proprietors, freelancers, or independent contractors. The primary purpose of Schedule C is to calculate the net profit or loss from a business which is then transferred to the individual's Form 1040. This calculation impacts the overall tax payable or the refund due. Ensuring accurate and thorough completion of the Schedule C is essential for both compliance and optimizing tax obligations.

How to Use the Schedule C Form 2016

To effectively utilize the Schedule C Form 2016, business owners should gather relevant financial records to ensure accurate reporting. The form requires detailed documentation of both gross income and business expenses. Key steps include:

- Determine Gross Receipts: Collect all income earned from business operations, including sales receipts and payment confirmations.

- Account for Returns and Allowances: Document any returns, allowances, or discounts provided during the year.

- Deduct Business Expenses: List deductible expenses incurred while operating the business. This includes costs such as advertising, legal services, supplies, and travel.

- Calculate Cost of Goods Sold (COGS): For businesses that sell products, determine the total cost of producing or purchasing items sold within the taxable year.

- Report Vehicle Information: If vehicles are used for business purposes, document mileage, maintenance, and operational costs.

Steps to Complete the Schedule C Form 2016

Completing the Schedule C Form 2016 involves several methodical steps to ensure correctness and compliance:

- Complete Part I - Income: Enter gross receipts or sales and subtract returns/allowances to determine gross income.

- Complete Part II - Expenses: Detail business expenses into the provided categories and sum them for total deductions.

- Complete Part III - Cost of Goods Sold: If applicable, calculate and enter COGS. This requires beginning inventory, purchases, and ending inventory.

- Complete Part IV - Information on Your Vehicle: For businesses using vehicles, include beginning mileage, total miles driven, and percentage of business use.

- Complete Part V - Other Expenses: List any additional business expenses not categorized above and provide descriptions.

Key Elements of the Schedule C Form 2016

The Schedule C Form 2016 is composed of several critical sections:

- Gross Receipts/Sales: Total income before expenses.

- Returns and Allowances: Analysis and deductions related to customer returns and discounts.

- Business Expenses: Includes ordinary and necessary costs like rent, payroll, supplies, and utilities.

- Cost of Goods Sold: Calculation critical for businesses involved in the production or merchandising of goods.

- Vehicle Information: Documentation of business mileage for personal vehicles used in the business.

Required Documents for Schedule C Form 2016

Preparation for filing the Schedule C Form necessitates gathering several documents to ensure comprehensive reporting:

- Income Records: Includes invoices, bank statements, and accounting records reflecting gross receipts.

- Expense Receipts: Documentation for all business costs, including utility bills, lease agreements, and employee wages.

- Inventory Records: Necessary for calculating the cost of goods sold.

- Mileage Logs: Records detailing business use of vehicles.

- Previous Tax Returns: Useful for referencing past data and ensuring consistency in reporting.

IRS Guidelines for Schedule C Form 2016

The IRS provides specific guidelines for completing the Schedule C Form 2016, which include:

- Documentation: Maintain adequate and accurate records throughout the year.

- Deductible Expenses: Ensure all reported expenses meet the criteria of being both ordinary (common in your trade) and necessary (helpful and appropriate).

- Deadlines: File the Schedule C by the tax deadline or request an extension using Form 4868.

- Audit Preparedness: Be prepared to substantiate every entry with documentation, as inadequate records can lead to auditing issues and penalties.

Penalties for Non-Compliance with Schedule C Form 2016

Failure to accurately complete and file the Schedule C Form 2016 can result in several penalties:

- Late Filing Fee: Accrues if the form is not submitted by the deadline unless an extension has been granted.

- Accuracy-Related Penalties: Imposed if a significant understatement of income is identified.

- Failure to Furnish Information: Penalties apply if inadequate information is provided, particularly regarding income items.

- Fraudulent Reporting: Severe fines and legal consequences for intentional misrepresentation of financial information on the form.

Important Terms Related to Schedule C Form 2016

Understanding key terms associated with the Schedule C Form 2016 provides clarity and aids accurate completion:

- Gross Receipts: Total business income before any deductions.

- Ordinary Expenses: Standard costs typical in a business sector.

- Necessary Expenses: Essential costs for business operation.

- Cost of Goods Sold: Direct costs associated with production or purchasing items for sale.

- Self-Employment Tax: This additional tax covers Social Security and Medicare taxes for individuals who work for themselves.