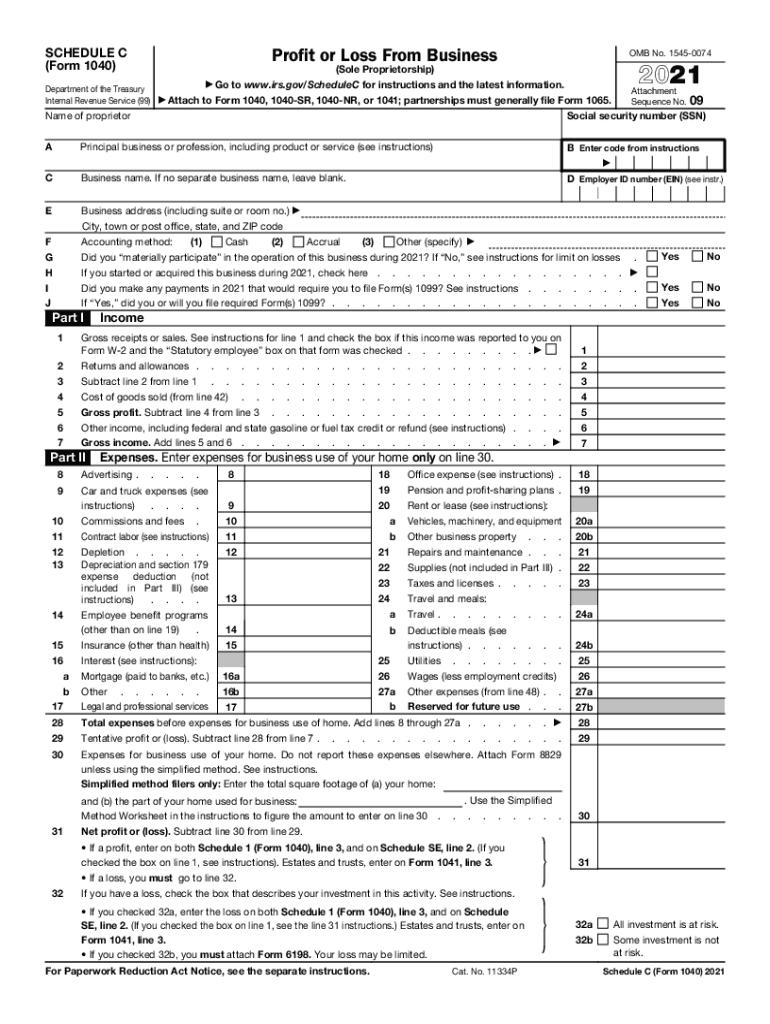

Definition and Meaning of Schedule C

Schedule C (Form 1040) is a critical document used by sole proprietors in the United States to report profit or loss from their business. This IRS form helps individuals detail their income streams, expenses, and cost of goods sold, providing insight into the financial health and operations of the business over a fiscal year. Understanding the exact purpose of Schedule C is vital for accurate tax reporting, reducing the risk of errors or audits.

Schedule C allows business owners to deduct legitimate expenses such as office supplies, travel, and advertising, helping to minimize taxable income. Properly completing it can significantly impact a sole proprietor's tax liability, making it crucial to grasp the intricacies of its various sections.

How to Obtain the Schedule C

Acquiring Schedule C is straightforward. Forms can be downloaded directly from the IRS website, ensuring easy access to the most current version. Physical copies are often available at local libraries or IRS offices. Many tax software programs also include Schedule C, streamlining the process for users who file electronically.

Key online resources:

- IRS official website for downloadable forms

- Tax preparation software such as TurboTax or H&R Block

- Local IRS offices and libraries for physical copies

Steps to Complete the Schedule C

Completing Schedule C requires careful attention to detail. Here’s a step-by-step guide:

- Business Information: Provide basic details such as your business name, address, and the type of business entity.

- Income: Report gross receipts or sales. Include any returns and allowances, and subtract the cost of goods sold.

- Expenses: Deduct allowable business expenses ranging from rent and utilities to education and wages.

- Net Profit or Loss: Calculate the difference between total income and expenses to determine the net profit or loss.

- Supplementary Information: Answer specific questions about your accounting methods and material participation in the business.

- Review and Submit: Double-check your entries for accuracy before attaching the form to your Form 1040.

Accountants or tax preparation services can assist with complex situations, ensuring compliance with IRS standards.

Key Elements of the Schedule C

Schedule C comprises several key sections, each vital for comprehensive tax reporting:

- Part I: Income: Details gross income, sales, and cost of goods sold.

- Part II: Expenses: Lists deductible business expenses, including operational costs.

- Part III: Cost of Goods Sold: Requires calculation if involved in manufacturing or selling products.

- Part IV: Information on Your Vehicle: For claiming vehicle expenses.

- Part V: Other Expenses: Allows additional expense reporting not included in Part II.

Each section requires detailed reporting to ensure all business activities and financial dealings are accurately reflected.

Important Terms Related to Schedule C

Understanding specific terms is crucial for effectively managing your Schedule C:

- Gross Receipts: Total revenue from business activities.

- Deductions: Expenses that can be subtracted from income.

- Net Profit: The business's revenue after subtracting all expenses.

- Depreciation: The reduction in value of business assets over time.

- Material Participation: Involvement in the operations of the business.

Familiarity with these terms enables proper form completion and compliance with tax obligations.

IRS Guidelines for Schedule C

The IRS outlines specific guidelines for completing Schedule C to enhance compliance and accuracy:

- Follow the instructions provided with the form meticulously.

- Use precise documentation to validate income and expense claims.

- Ensure all required signatures and details are included.

- Retain supporting documents, such as receipts and invoices, for at least three years.

The IRS provides additional resources, including publications and FAQs, to assist taxpayers in completing their Schedule C accurately.

Penalties for Non-Compliance

Non-compliance with Schedule C requirements can lead to significant penalties:

- Underpayment Penalties: Failing to report accurate income may result in penalties and interest.

- Audit Risks: Inaccuracies can trigger audits, which may increase scrutiny on all financial activities.

- Fines: Providing false information or omitting crucial details may result in financial penalties.

Adhering to regulations and maintaining accurate records are paramount to avoiding such repercussions.

Software Compatibility with Schedule C

Numerous software platforms facilitate the preparation of Schedule C:

- TurboTax: Offers guided assistance through each section.

- QuickBooks: Integrates business financial management with tax reporting.

- H&R Block: Provides streamlined solutions for filing Schedule C electronically.

These platforms often include checks and balances to minimize errors and ensure completeness in reporting.

Who Typically Uses the Schedule C

Schedule C is primarily utilized by:

- Sole Proprietors: Individuals operating unincorporated businesses.

- Single-member LLCs: Limited liability companies with a single owner.

- Freelancers and Gig Workers: Those with diverse income sources and expense tracking needs.

By understanding who must file this form, business owners can ensure they meet their tax filing obligations correctly.