Definition & Meaning

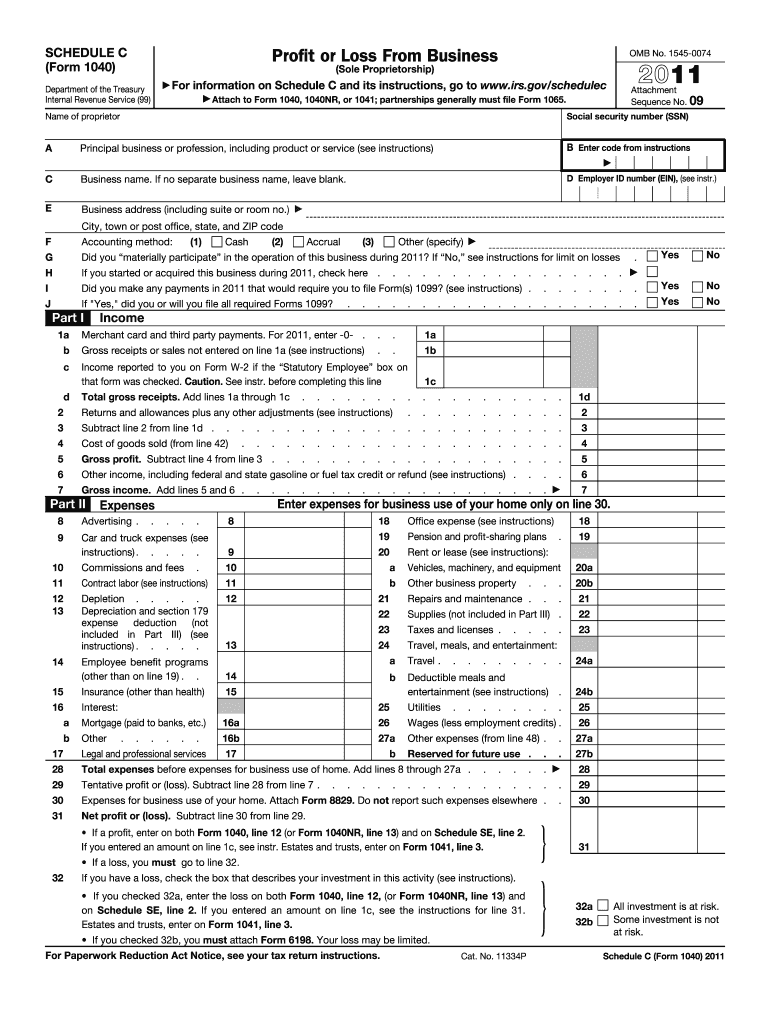

The 2011 Schedule C Form, officially known as Schedule C (Form 1040), is used by sole proprietors to report their business income and expenses to the Internal Revenue Service (IRS). This form is vital for calculating the net profit or loss of a business, which in turn affects the amount of tax owed. Typically, this form is attached to the individual’s Form 1040 during tax filing. Sole proprietors—including freelancers and contractors—rely on this document to accurately reflect their business activities for the 2011 tax year.

Important Terms Related to the 2011 Schedule C Form

Understanding specific terms is essential when completing the 2011 Schedule C Form. Key terms include:

- Gross Receipts: Total income before expenses are deducted.

- Cost of Goods Sold (COGS): Direct costs related to producing goods sold by a company.

- Net Profit/Loss: The remaining amount after all business expenses are subtracted from gross income.

- Direct Expenses: Costs that can be directly linked to the production of goods or services, such as materials and labor.

- Indirect Expenses: Overhead costs not directly tied to production, including utilities and rent.

These terms create a foundation for accurately completing and understanding the form's requirements.

Steps to Complete the 2011 Schedule C Form

Filling out the 2011 Schedule C Form involves several steps:

- Personal Information: Start by entering your name and Social Security Number.

- Business Information: Fill in details about your business, including the name, address, EIN if applicable, and type of business.

- Income Section: Report all income, including gross receipts and sales.

- Expenses Section: Deduct permissible business expenses divided into specific categories.

- Calculate Net Profit or Loss: Subtract total expenses from total income to determine your business's financial outcome.

- Final Review: Ensure accuracy and completeness before attaching it to Form 1040.

Who Typically Uses the 2011 Schedule C Form

The primary users of the 2011 Schedule C Form are:

- Sole Proprietors: Individuals who own and run an unincorporated business.

- Freelancers and Independent Contractors: Those earning income outside of traditional employment.

- Self-Employed Individuals: Whether part-time or full-time, those earning directly from business activities.

- Small Business Owners: Operating as sole proprietors without forming a partnership or corporation.

Filing Deadlines / Important Dates

Timely filing is crucial for avoiding penalties. Key dates include:

- April 15, 2012: Due date for filing the 2011 Schedule C along with Form 1040.

- October 15, 2012: Extension deadline, if a timely request was filed by April 15.

Submitting on time ensures compliance and avoids additional costs.

Required Documents

Gathering the correct documents assists in accurate completion:

- Income Records: Invoices, receipts, and bank statements showing received income.

- Expense Receipts: Proof of all deductible business expenses, such as receipts or bank statements.

- Inventory Records: Documentation relating to the valuation and cost of goods sold.

- Mileage Logs: If claiming vehicle-related expenses.

Having thorough documentation supports the figures reported on the form.

IRS Guidelines

Compliance with IRS guidelines is essential:

- Accuracy and Honesty: Ensure that all reported information is true and accurate.

- Record Keeping: Maintain complete and accurate records for at least three years.

- Form Updates: Check for any updates or changes specific to the 2011 tax year, including adjustment figures essential for calculations.

Adhering to these guidelines prevents complications and potential audits.

Penalties for Non-Compliance

Failing to comply with filing requirements can result in penalties:

- Late Filing Penalty: Typically five percent of the unpaid taxes for each month or part of a month that a tax return is late.

- Accuracy-Related Penalty: Imposed if the underpayment is due to negligence or disregard of rules or regulations.

Understanding these penalties underscores the importance of timely and accurate filing.

Form Submission Methods (Online / Mail / In-Person)

Submitting the 2011 Schedule C Form can be done through:

- Online Filing: Using software compliant with IRS e-file.

- Mail: Sending completed forms to the designated IRS address for your region.

- In-Person: Delivering directly to an IRS office, if required.

Each method has specific advantages, and selecting the right one hinges on individual needs and preferences.