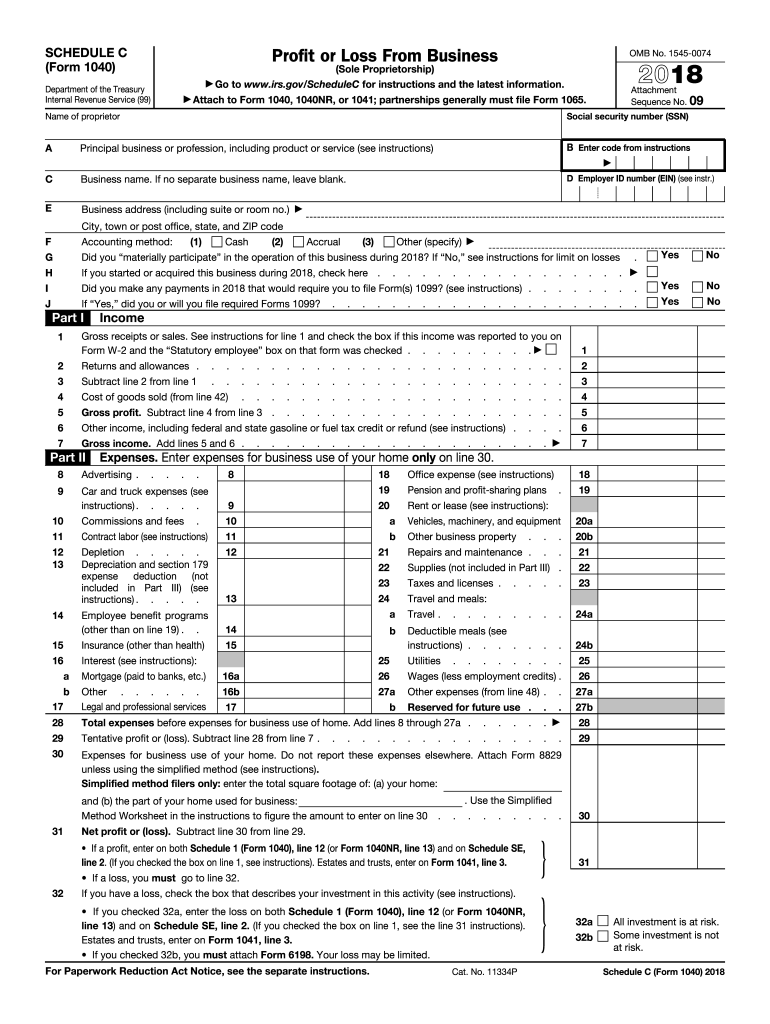

Definition and Purpose of Schedule C 2018

Schedule C (Form 1040) for the year 2018 is a critical tax document used by sole proprietors to report their business income and expenses. This form helps calculate the net profit or loss of a business, which subsequently affects the taxpayer's overall taxable income. As a comprehensive tool for recording financial activity, Schedule C covers categories such as income, deductions, and cost of goods sold, allowing for a detailed accounting of business operations. The form's relevance is heightened for small business owners and freelancers who operate without the formal structure of a corporation or partnership.

Steps to Complete Schedule C 2018

Completing Schedule C involves a structured approach, ensuring that each section is carefully filled with accurate data.

- Income: Record gross receipts or sales, returns, and allowances. This figure provides the basis for further calculations.

- Cost of Goods Sold: Detail the inventory at the beginning and end of the year, purchases, and costs associated with getting goods ready for sale.

- Expenses: Itemize deductible expenses such as advertising, office supplies, utilities, and more.

- Net Profit or Loss Calculation: Subtract total expenses from total income to determine the business's taxable income or deductible loss.

Accurate completion of each step ensures compliance and accurate reporting, critical for both financial and legal obligations.

Required Documents for Schedule C 2018

Gathering and organizing the necessary documents is a key prerequisite:

- Financial Records: Income and expense ledgers, receipts, invoices.

- Bank Statements: Reflecting business transactions.

- Mileage Logs: For vehicle expenses related to business use.

- Previous Tax Returns: Providing baseline comparisons.

Several of these documents are traditionally retained throughout the year, aiding in a smooth transition when tax season arrives.

Important Terms Related to Schedule C 2018

Understanding key terminology enhances comprehension and accurate form completion:

- Gross Receipts: Total income before deductions.

- Line 13: Depreciation: Reflects value reduction of assets over time.

- Net Profit: Income remaining after all business expenses are deducted.

These terms are integral not only to Schedule C but also enrich a taxpayer's overall financial literacy.

Who Typically Uses Schedule C 2018

Schedule C is predominantly utilized by sole proprietors and single-member LLCs. These business owners do not have the legal distinction of a corporation, meaning their business and personal finances are not separate for tax purposes. Freelancers, consultants, and independent contractors frequently rely on this form to comply with IRS requirements, recognizing their self-employed status.

IRS Guidelines for Schedule C 2018

The Internal Revenue Service (IRS) offers comprehensive guidelines to ensure accuracy and compliance:

- Deductions: Only genuine business expenses are deductible.

- Recordkeeping: Retain all supporting documentation for a minimum of three years.

- Filing Status: Must accurately reflect self-employment income and related taxes.

Consulting the IRS Publication 334, the guide for small businesses, provides additional support and clarification.

Filing Deadlines and Important Dates for Schedule C 2018

Timeliness is crucial for compliance and avoiding penalties:

- Annual Deadline: Typically April 15th, the same as Form 1040.

- Estimated Taxes: Due quarterly on April 15, June 15, September 15, and January 15 of the following year.

Missing filing deadlines can result in fines and interest on unpaid taxes, emphasizing the importance of staying informed and organized.

Examples of Using Schedule C 2018

Real-world scenarios illuminate the practical application of Schedule C:

- Case Study: Freelance Designer: Reports graphic design service fees as gross receipts and software subscriptions as business expenses.

- Scenario: Online Retailer: Includes inventory purchases under cost of goods sold and shipping expenses during fulfillment.

These examples are indicative of the broad applicability of Schedule C across varying business models.

Digital vs. Paper Versions of Schedule C 2018

Filing options offer flexibility to meet individual preferences:

- Digital Filing: Can be completed through IRS e-file systems or tax preparation software, offering error-checking capabilities and faster processing times.

- Paper Filing: Allows traditional submission via mail, suitable for those less comfortable with digital platforms.

Both methods require strict adherence to deadlines and accuracy standards, ensuring compliance regardless of the medium.