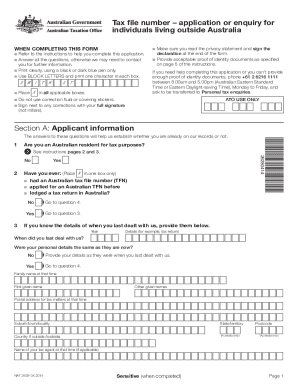

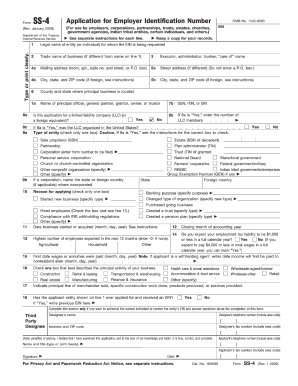

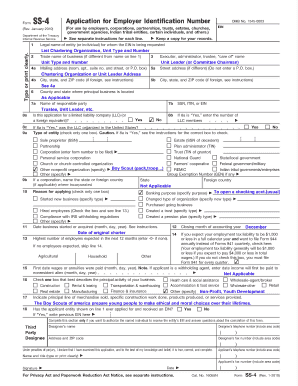

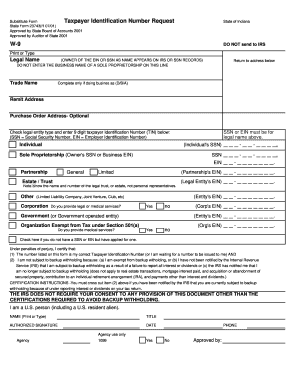

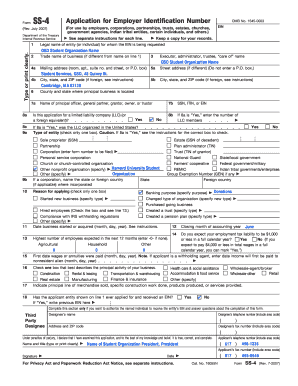

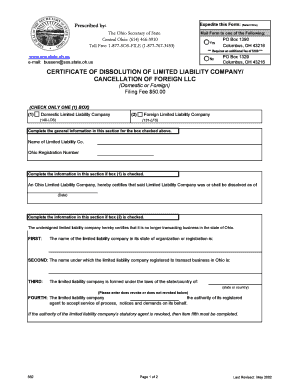

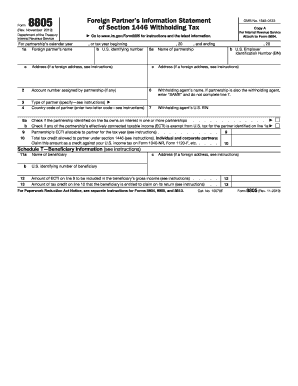

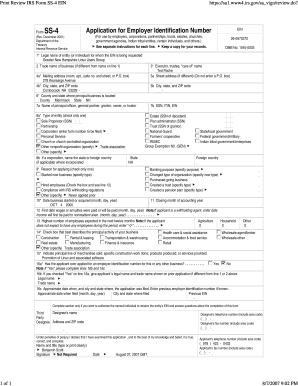

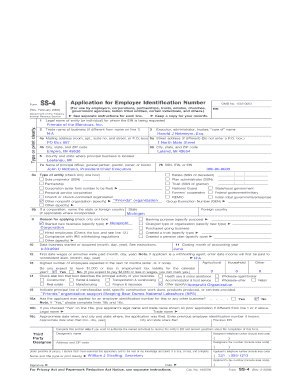

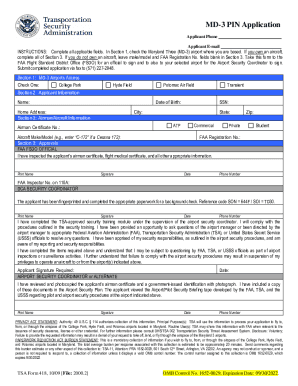

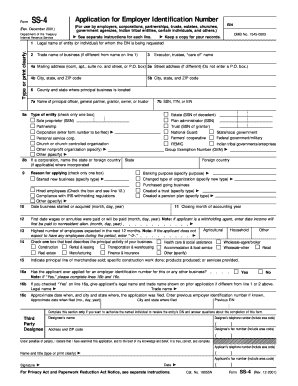

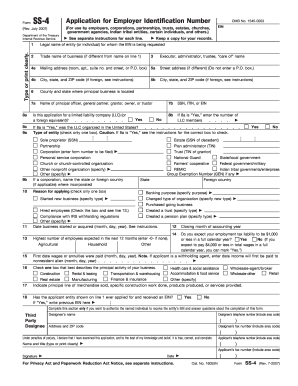

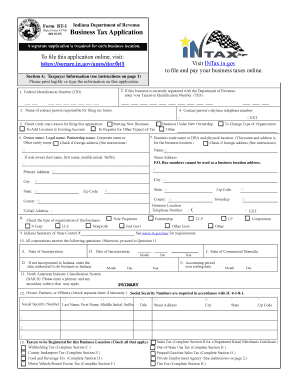

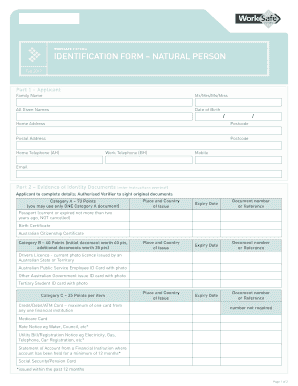

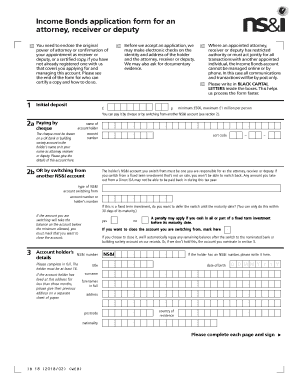

Boost your form preparation with Ein Application Forms. Select from dozens of documents for personal and business use and start modifying them immediately.

Your workflows always benefit when you can easily get all of the forms and documents you may need on hand. DocHub gives a wide array of document templates to relieve your day-to-day pains. Get a hold of Ein Application Forms category and quickly browse for your document.

Start working with Ein Application Forms in several clicks:

Enjoy smooth form managing with DocHub. Explore our Ein Application Forms online library and locate your form right now!