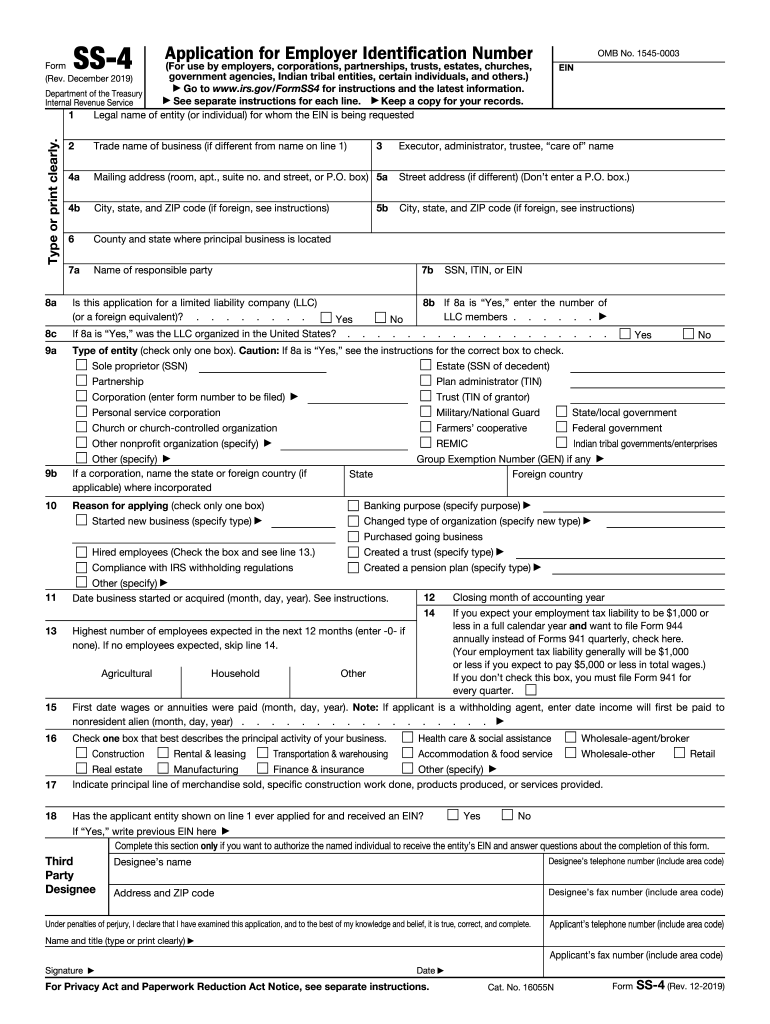

Definition and Purpose of the SS4 Form

The SS4 form, officially known as the Application for Employer Identification Number (EIN), is a document required by the Internal Revenue Service (IRS) for various entities seeking to obtain an EIN. This unique identifier is essential for tax reporting and is utilized by businesses, trusts, estates, and government agencies. An EIN is necessary for facilitating employee payroll, opening bank accounts, and filing tax returns, making it a critical component for entities engaged in any business activity.

The SS4 form collects fundamental information about the business entity, such as:

- The legal name of the entity

- Trade name, if applicable

- Entity address

- Type of business entity (e.g., corporation, partnership, sole proprietorship)

- Reason for applying for the EIN

Understanding the significance of the SS4 form simplifies the process of legal business operations, ensuring compliance with IRS regulations.

How to Use the SS4 Form

Utilizing the SS4 form involves a structured approach to ensure accurate completion and timely submission. Here are the steps for effective use:

- Determine Eligibility: Before initiating the application, confirm your eligibility. Most businesses will require an EIN unless they are sole proprietors without employees.

- Gather Required Information: Collect necessary documents, such as legal formation documents and personal identification numbers for the responsible party.

- Access the Form: The SS4 form can be obtained online as a PDF from the IRS website or through paper copies at IRS offices.

- Complete the Form: Fill out all required fields, ensuring accuracy to avoid delays. If you're unsure about certain sections, consult IRS guidelines or seek assistance.

- Submit the Form: Choose your submission method—online, by mail, or by fax. Ensure to keep a copy for your records.

Taking these steps will help streamline the application process for obtaining your EIN through the SS4 form.

Steps to Complete the SS4 Form

Completing the SS4 form requires attention to detail and adherence to specific guidelines. Here’s a breakdown of the process:

Step 1: Basic Information

- Enter the legal name and trade name of the business.

- Provide the primary address for the entity, as well as any additional address if necessary.

Step 2: Entity Type Selection

- Select the appropriate type of entity that applies (e.g., corporation, LLC, partnership).

- This selection influences the filing requirements and associated tax obligations.

Step 3: Responsible Party Information

- Identify the responsible party, typically an individual associated with the business.

- This person must have a valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

Step 4: Reason for Applying

- Specify why you are applying, such as starting a new business, hiring employees, or banking requirements.

Step 5: Signature and Date

- Ensure that the application is signed by the authorized person and dated accurately.

Completing these steps diligently reduces the risk of errors that could complicate the registration process with the IRS.

Important Terms Related to the SS4 Form

When working with the SS4 form, it's helpful to be familiar with essential terminology:

- Employer Identification Number (EIN): A nine-digit number assigned by the IRS for tax purposes.

- Responsible Party: The individual who exercises control over the funds or assets of the entity, typically required to provide their SSN.

- Tax Reporting: Refers to the necessary compliance of declaring income, expenses, and other financial information to the IRS.

These terms are integral to understanding the SS4 form, as they influence the processes surrounding the application and subsequent business operations.

Filing Deadlines and Important Dates for the SS4 Form

Awareness of deadlines is crucial for compliance when filing the SS4 form. While the form can be submitted at any time, there are specific considerations for different circumstances:

- New Business Formation: Submit your SS4 form before applying for an EIN to establish your business correctly.

- Hiring Employees: The form should be filed before your first employee’s start date to ensure timely payroll processing.

- Tax Filing Dates: Ensure that your EIN is acquired well in advance of annual tax filing deadlines to avoid complications.

Tracking these dates helps keep your business compliant and reduces the risk of issues arising from untimely submissions.

Form Submission Methods

The SS4 form can be submitted through several methods, each with its advantages. Understanding these can help streamline the application process:

- Online Submission: The quickest method is to apply directly through the IRS website. This option allows immediate EIN assignment upon completion.

- Mail Submission: If you prefer to fill out a paper version, send it to the appropriate IRS address based on your business location. This method typically requires several weeks for processing.

- Fax Submission: Providing the form via fax can result in quicker processing times than standard mail but is subject to an increased likelihood of rejections due to common errors.

Each submission method provides flexibility based on personal preferences and operational needs, allowing businesses to choose the best approach.