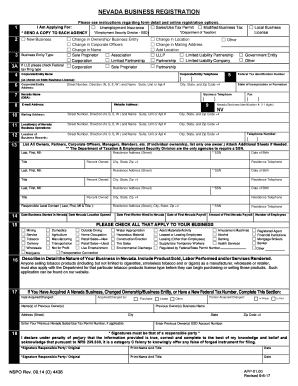

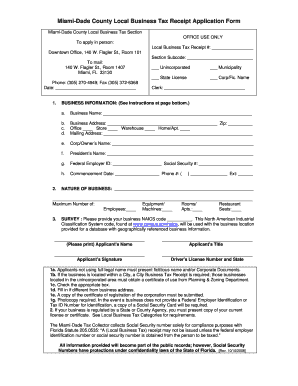

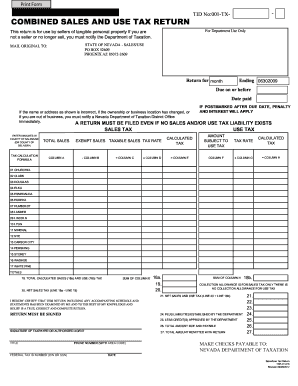

Choose State of nevada modified tax Business Forms relevant to your business and sector. Start modifying your business documents and securely complete them in your DocHub account.

Improve your form operations using our State of nevada modified tax Business Forms category with ready-made form templates that suit your requirements. Get the document, modify it, complete it, and share it with your contributors without breaking a sweat. Start working more efficiently with your forms.

How to use our State of nevada modified tax Business Forms:

Explore all of the opportunities for your online file administration with the State of nevada modified tax Business Forms. Get your free free DocHub account today!