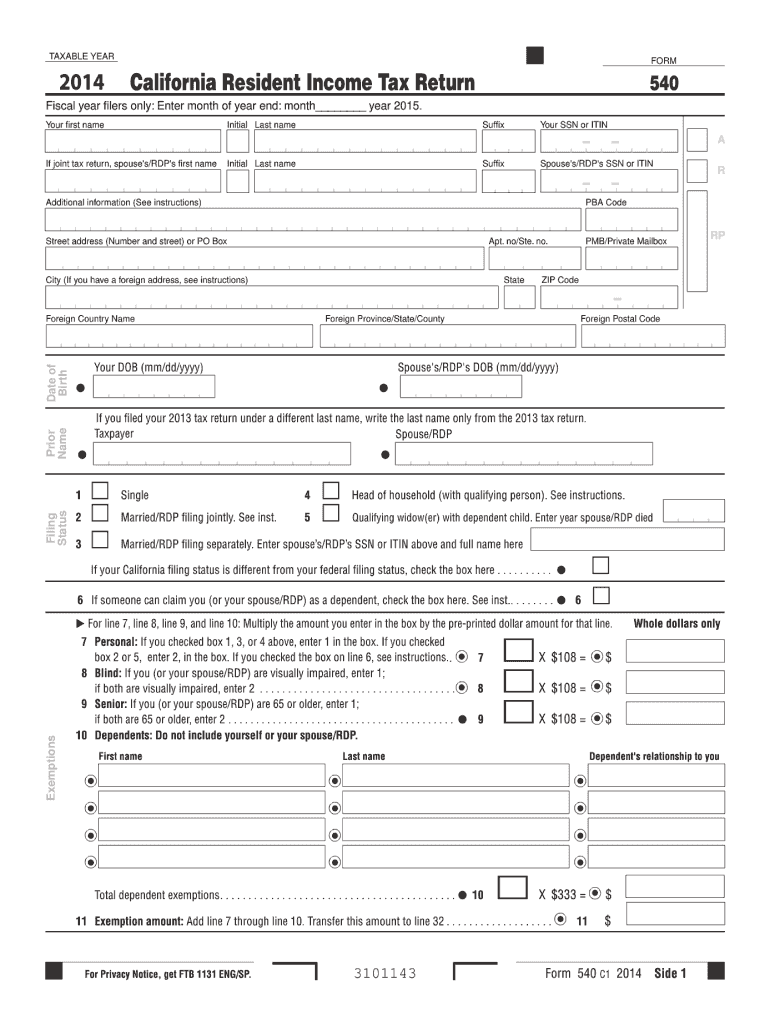

Definition & Meaning of the 2014 540 Form

The 2014 540 form is the California Resident Income Tax Return for the tax year 2014. This form is used by residents to report their income and calculate their state income tax obligations. It serves as a declaration of total income, allowable deductions, and credits, ultimately determining the amount owed to the state or the refund due to the taxpayer. A clear understanding of this form is essential for compliance with California state tax laws, ensuring that residents properly adhere to tax regulations while maximizing applicable deductions and credits.

Key Components of the 2014 540 Form

- Personal Information: The form requires detailed personal information for each taxpayer, including name, address, Social Security number, and filing status (e.g., single, married).

- Income Reporting: Taxpayers must report all sources of income, including wages, self-employment income, dividends, and interest.

- Deductions and Credits: The form allows for various deductions, such as those for mortgage interest, property taxes, and certain expenditures. Credits can also be claimed based on qualifications, helping to reduce the overall tax liability.

- Tax Calculation: The taxable income is calculated based on reported income minus eligible deductions, which ultimately leads to determining the tax due or the refund amount.

Understanding the structure and purpose of the form is crucial for accurate filing and compliance.

How to Use the 2014 540 Form Effectively

Using the 2014 540 form effectively involves a systematic approach to ensure all necessary information is accurately reported.

- Gather Required Documentation: Collect all relevant financial documents, including W-2s, 1099s, and any paperwork related to deductions or credits.

- Complete the Personal Information Section: Fill out your personal details, ensuring that your Social Security number and filing status are correctly entered.

- Report Income: List all income sources, ensuring that the amounts are accurate and reflect your financial situation for the year. This includes wages, investment income, and any other earnings.

- Claim Deductions and Credits: Carefully review allowable deductions and credits applicable to your situation. Ensure that you have the necessary documentation to support these claims.

Paying close attention to detail and following these steps will facilitate a smoother filing process and help minimize errors.

Steps to Complete the 2014 540 Form

Completing the 2014 540 form requires careful attention to detail. Follow these steps for a thorough completion process:

-

Personal Information Entry: Start by entering your full name, address, and Social Security number. Select your filing status based on your marital situation on December 31, 2014.

-

Income Section: Add all income sources using W-2s and relevant documentation. Ensure that your total income reflects all earnings accurately for an honest tax statement.

-

Adjustments to Income: Include any adjustments necessary, such as educator expenses or moving expenses for qualified active duty members.

-

Deductions: Determine whether to itemize deductions or take the standard deduction. If itemizing, provide detailed information on each deduction claimed.

-

Tax Computation: Compute your total tax liability based on your taxable income. Reference the tax tables included in the form instructions for accurate tax rates.

-

Refund or Amount Due: Finally, calculate whether you will receive a refund or if you owe additional taxes. Make sure to sign and date the form where indicated.

Following these steps will enhance accuracy and help avoid common mistakes during the tax filing process.

Important Terms Related to the 2014 540 Form

Familiarizing yourself with important terms associated with the 2014 540 form can help in understanding your tax filing better. Some key terms include:

- Taxable Income: The amount of income subject to tax after deductions and exemptions.

- Standard Deduction: A fixed dollar amount that reduces the income on which you are taxed, varying based on filing status.

- Itemized Deductions: Deductions that can be claimed for eligible expenses incurred, which must be documented and exceed the standard deduction amount.

- Tax Credits: Amounts that can directly reduce your total tax due, often based on specific expenses or activities.

- Filing Status: Classification of your tax situation based on marital status, which affects tax rates and eligibility for deductions.

Understanding these terms ensures clarity in your tax responsibilities and enhances the effectiveness of your filing strategy.

Filing Deadlines for the 2014 540 Form

Awareness of filing deadlines is essential to avoid penalties and ensure timely submission of the 2014 540 form.

- Original Due Date: The standard due date for the 2014 California Resident Income Tax Return was April 15, 2015.

- Extension Deadlines: Taxpayers who applied for an extension had until October 15, 2015, to file their returns. This extension does not apply to any taxes owed, which were still due by April 15.

- Penalties for Late Filing: Filing after the deadline could lead to penalties, including fines that accrue over time, particularly if taxes owed were not paid when due.

Being aware of and adhering to these deadlines is imperative to avoid unnecessary financial repercussions.

Who Typically Uses the 2014 540 Form

The 2014 540 form is primarily utilized by:

- California Residents: Individuals residing in California who earn income within the state must complete this form annually.

- Part-Year Residents: Those who moved into or out of California during the year and had income from California sources are also required to use this form to accurately report their tax obligations.

- Married Couples: Couples filing jointly or separately may utilize the form, choosing the method that best suits their tax situation.

- Self-Employed Individuals: Business owners and self-employed persons use this form to report income, deductions, and calculate taxes owed as part of individual taxation.

Understanding who needs to use the form helps ensure compliance and accurate tax reporting for diverse taxpayers.

Examples of Using the 2014 540 Form

Real-world scenarios can illustrate how the 2014 540 form is used by various individuals:

-

A Full-Time Employee: An individual working full-time in California reports their annual salary and claims standard deductions. They gather W-2 forms for tax reporting, ultimately submitting a straightforward 2014 540 form.

-

A Self-Employed Contractor: This user has multiple income streams, including freelance work and a part-time job. They need to track all sources of income precisely, including potential business deductions. Their 2014 540 form will require documenting these income sources in detail to comply with tax laws.

-

Part-Year Resident: Someone who moved to California mid-year must report income earned in and outside the state. They can allocate income accordingly on their 2014 540 form while still ensuring compliance with California tax regulations.

These examples highlight the form's applicability across various situations, showcasing its role in state tax adherence and planning.