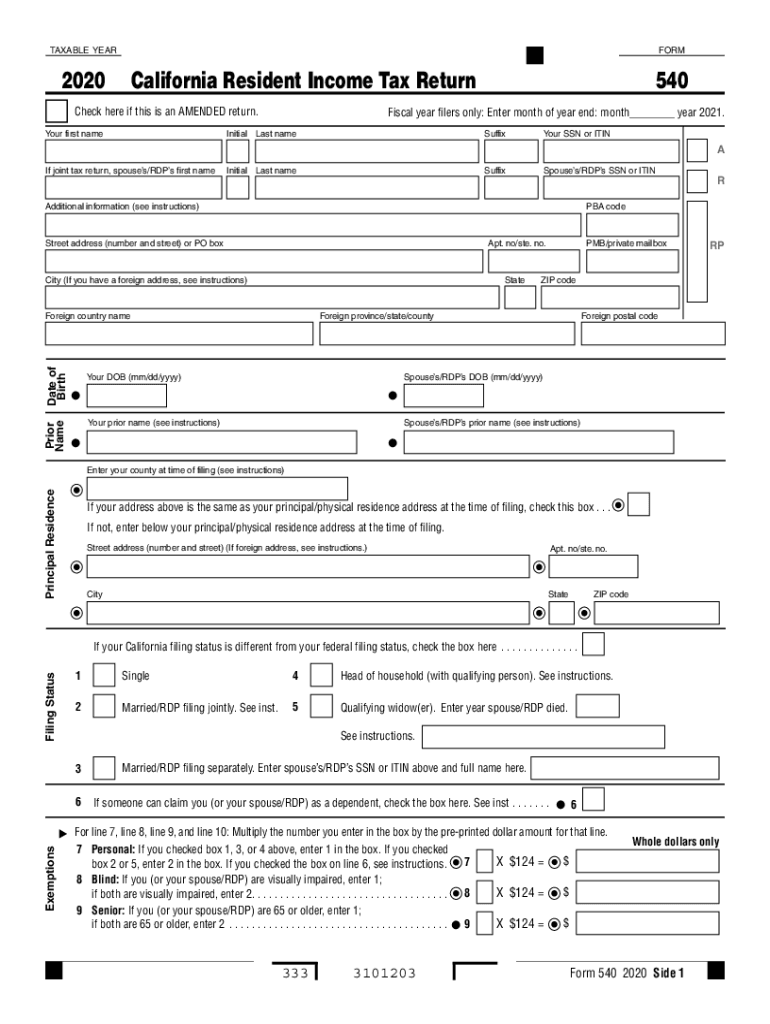

Definition & Meaning of the 2020 Form 540

The 2020 Form 540 is the California Resident Income Tax Return that taxpayers must complete to report income earned during the tax year of 2020. This official form provides a structured format for California residents to detail their income sources, claim deductions, and calculate tax liability. It is crucial for ensuring compliance with California tax laws.

The form incorporates various sections, including personal information, filing status, and income details. Taxpayers can also report deductions and credits applicable to their situation. For certain categories, such as those filing jointly or qualifying for specific tax credits, there are tailored instructions within the form that guide users in accurately completing their returns.

The 540 form includes multiple schedules, including Schedule CA (540), which allows taxpayers to adjust their federal income tax return toward California tax laws. Understanding how the 2020 form 540 functions is vital for effective tax management in compliance with state regulations.

Steps to Complete the 2020 Form 540

Completing the 2020 Form 540 involves several organized steps to ensure accuracy and compliance:

-

Gather Personal Information: Collect necessary detail such as Social Security numbers, income statements (W-2s, 1099s), and any previous tax returns that may be needed for reference.

-

Select Your Filing Status: Determine whether you are filing as single, married filing jointly, married filing separately, head of household, or qualifying widow(er). This choice significantly affects tax calculations and available credits.

-

Report Income: Enter all forms of income, including wages, interest, and dividends. Accurately tally all income sources as they will collectively impact your total taxable income.

-

Claim Deductions and Credits: Use the California standard deduction or itemize deductions if it yields a higher overall benefit. Additionally, review available tax credits that could reduce your overall tax liability.

-

Calculate Tax Liability: Compute tax owed or refund expected based on the income, deductions, and credits. This section may require referencing the tax tables to determine the correct amount.

-

Sign and Date the Form: All forms must be signed to validate the information provided. This includes a signature from both spouses if filing jointly.

-

Review and Submit the Form: Perform a final review to check for errors or omissions before submitting the completed form.

Following these steps can help taxpayers accurately file their California taxes, minimizing the risk of errors that could lead to penalties.

Important Terms Related to the 2020 Form 540

Understanding key terminology associated with the 2020 Form 540 is essential for a clear and accurate tax filing. Some important terms include:

-

Filing Status: Refers to the category under which a taxpayer files, impacting tax rates and deduction limits. Common statuses include single, married filing jointly, and head of household.

-

Deductions: Expenses that taxpayers can subtract from their total income, which may lower tax liability. California offers both standard and itemized deductions.

-

Tax Credits: Amounts that reduce tax liability dollar for dollar. Examples include the California Earned Income Tax Credit and various other state-specific credits.

-

Schedule CA (540): A supplementary form to the 540, which adjusts federal income to comply with California tax laws, crucial for reporting differences between federal and state tax codes.

-

Tax Liability: The total amount of tax owed by the taxpayer, calculated based on income and applicable rate schedules.

Familiarity with these terms provides a solid foundation for understanding and navigating tax preparation.

Required Documents for the 2020 Form 540

When preparing to complete the 2020 Form 540, taxpayers should ensure they have all necessary documents readily available. Key documents include:

- Identification Documents: Social Security numbers for the taxpayer and any dependents.

- Income Statements: W-2 forms from employers, 1099 forms for additional income sources, and any applicable business income documentation.

- Deduction Records: Receipts or statements that support itemized deductions, such as mortgage interest, medical expenses, and charitable contributions.

- Tax Credit Documentation: Records proving eligibility for credits, including childcare expenses or educational expenses.

- Previous Year’s Tax Return: Reference documents to streamline the entry process and provide comparative data.

Having these documents ensures efficient and accurate completion of the tax return.

Filing Deadlines / Important Dates for 2020 Form 540

Timeliness in filing the 2020 Form 540 is critical to avoid penalties and ensure compliance. The key deadlines are as follows:

-

Original Filing Deadline: The standard deadline for submitting the 2020 Form 540 for individual taxpayers is April 15, 2021. If this date falls on a weekend or holiday, the due date shifts to the next business day.

-

Extensions: Although an extension may be requested, it is essential to understand that this only extends the time to file, not the time to pay taxes owed. Extensions typically extend the filing deadline by six months but ensure payment is submitted by the original deadline to avoid interest and penalties.

-

Amendments: If amendments to the tax return are required, they must be completed using Form 540X and must generally be submitted within three years of the original filing date.

Understanding these critical dates assists taxpayers in planning their submission or extension requests appropriately, minimizing penalties.