Definition and Meaning of the 2012 Form 540

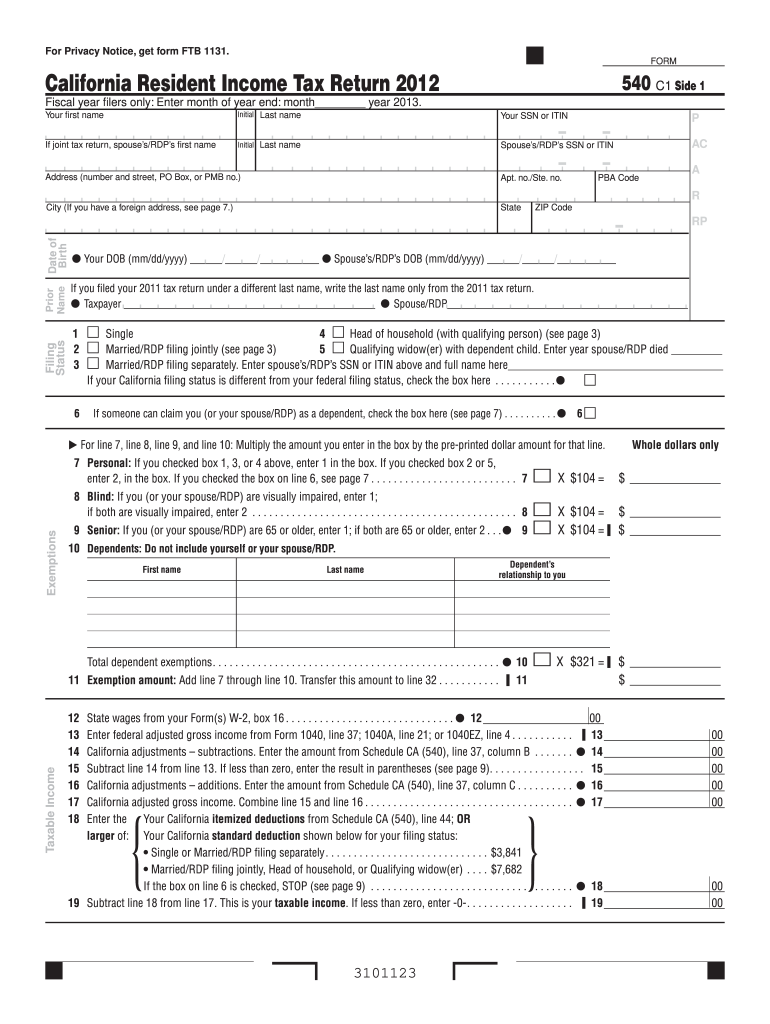

The 2012 Form 540 is California's primary income tax return form used by residents to report their individual income to the state's tax authority. It is specifically designed for California residents who are not married filing separately. The form captures essential personal and financial information needed by the California Franchise Tax Board (FTB) to assess tax liability. The 2012 iteration includes specific details regarding income, deductions, credits, and tax payments relevant to that tax year.

This form is essential for taxpayers to file their returns accurately, ensuring compliance with state tax laws. The 2012 Form 540 requires filers to provide their filing status, which directly affects tax rates and calculation of tax owed or refunds due. Common designations are Single, Married/RDP Filing Jointly, or Head of Household.

Key components of the form include:

- Personal Information: Name, address, and Social Security numbers.

- Income Reporting: Various income streams, including wages, interest, and dividends.

- Claiming Deductions: Standard and itemized deductions available in the tax year.

- Tax Credits: Possible credits that can lower the overall tax liability.

Steps to Complete the 2012 Form 540

Filing the 2012 Form 540 involves a series of systematic steps to ensure accuracy and compliance. Each section of the form must be completed thoroughly to avoid delays or penalties from the California Franchise Tax Board.

-

Gather Required Documentation: Before starting the form, it is crucial to gather all necessary documents, including W-2s, 1099s, and any relevant receipts for deductions and credits.

-

Fill out Personal Information: Start with Section A to provide your personal details. Ensure accuracy with names, addresses, and Social Security numbers.

-

Determine Filing Status: Select the correct filing status based on your tax situation. This affects your tax rates and the deductions you can claim.

-

Report Income: In Section B, report all sources of income. This may include wages, salaries, business income, and other taxable income.

-

Calculate Deductions and Credits: Move to Section C where you either select the standard deduction or itemize your deductions. Ensure that any applicable tax credits are included in this section, which directly impact your tax liability.

-

Compute Tax Liability: Utilize the tax tables provided by the FTB to calculate the amount of tax owed based on your taxable income.

-

Review and Verify: Double-check all entries for accuracy, ensuring that calculations are correct and all necessary schedules or forms are attached if applicable.

-

Submit the Form: Once completed, submit the 2012 Form 540 either electronically or via mail, ensuring it reaches the FTB by the filing deadline.

Important Terms Related to the 2012 Form 540

Understanding key terms associated with the 2012 Form 540 can greatly enhance clarity during the filing process. Here are some terms of importance:

-

Adjusted Gross Income (AGI): Your total income minus specific deductions. This figure is critical as it determines your eligibility for various credits and deductions.

-

Standard Deduction: A fixed deduction amount that taxpayers can use to reduce taxable income, which simplifies the filing process.

-

Itemized Deductions: Deductions based on actual expenses incurred throughout the tax year. Common examples include mortgage interest, state taxes paid, and certain healthcare expenses.

-

Tax Credits:

- Nonrefundable Credits: Credits that can reduce your tax liability to zero but will not provide a refund if the credit exceeds the tax owed.

- Refundable Credits: Credits that can be refunded to the taxpayer if they exceed the tax liability.

-

Filing Status: Determines your tax rate and eligibility for certain deductions and credits. It includes categories such as Single, Joint, and Head of Household.

How to Obtain the 2012 Form 540

Accessing the 2012 Form 540 is straightforward, and it can be obtained through several channels:

-

California Franchise Tax Board Website: The official website offers electronic copies of the form, which can be downloaded and printed.

-

Local Tax Offices: Tax preparation offices may provide physical copies of the form.

-

Libraries and Post Offices: Many public libraries and post offices stock necessary tax forms, making them accessible to the public.

-

Tax Preparation Software: Various software applications include the capability to prepare Form 540 directly, which often simplifies the filing process by automatically calculating figures.

It is essential to ensure that you are using the correct version of the form for the 2012 tax year, as prior or subsequent years have different tax rules and rates.

Filing Deadlines and Important Dates

Timely submission of the 2012 Form 540 is vital to avoid penalties. Important dates to remember include:

-

Filing Deadline: Typically, the deadline to file your 2012 Form 540 is on or before April 15, 2013. If this date falls on a weekend or holiday, the deadline may be adjusted.

-

Extensions: If additional time is needed, California residents could file for an extension, typically extending the deadline to October 15, 2013. However, any taxes owed must still be paid by the original deadline to avoid penalties.

-

Payment Deadlines: Tax payments, including estimates for future tax years, must also adhere to specified deadlines. Failure to adhere to these deadlines can result in penalties and interest charges.

Understanding these important dates ensures that taxpayers can manage their obligations effectively, potentially avoiding costly mistakes.