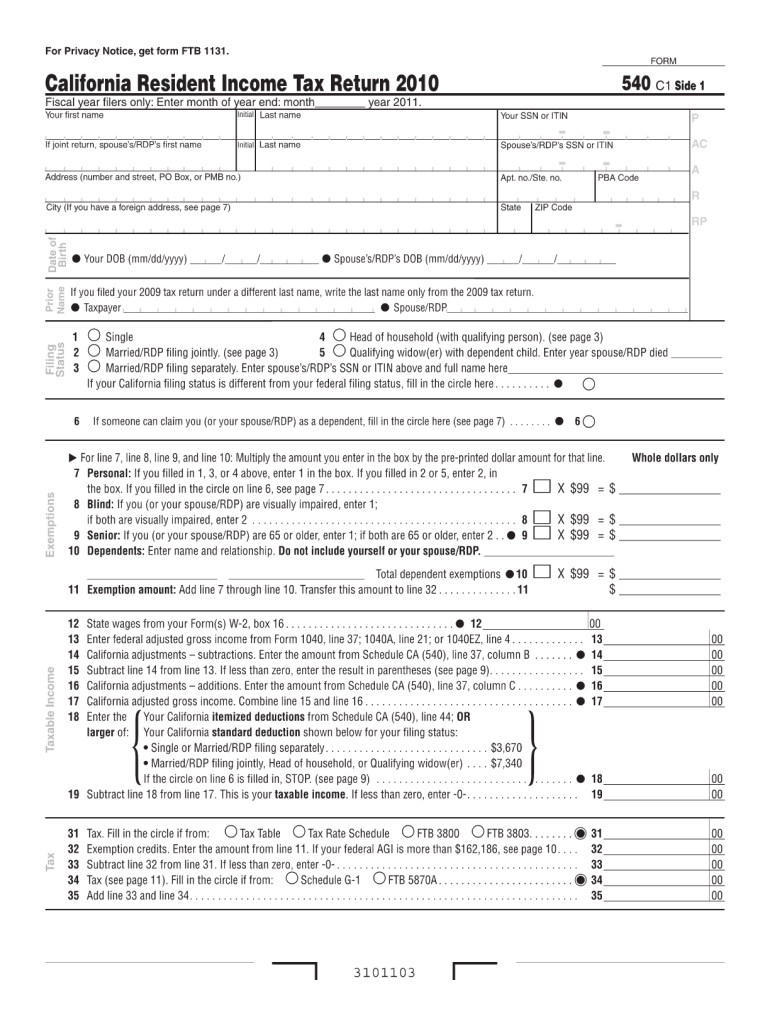

Definition and Meaning of the 540 Form 2010

The 540 form 2010 is the California Resident Income Tax Return specifically designed for taxpayers in California who are filing their income taxes for the year 2010. It is a crucial document used by individuals to report their income, claim deductions, and calculate the state income tax owed. This form is essential for maintaining compliance with state tax regulations, as it allows residents to accurately declare their financial activities within the tax year.

The 540 form 2010 includes personal information sections where taxpayers can provide details such as their name, address, and Social Security number. Additionally, it contains various sections designated for filing status, including single, married filing jointly, married filing separately, and head of household. Understanding the form's components is vital for navigating the complexities of tax obligations accurately.

Steps to Complete the 540 Form 2010

Completing the 540 form 2010 necessitates a systematic approach to ensure all information is correctly reported.

- Gather Personal Information: Collect necessary details such as Social Security numbers, income statements (W-2, 1099 forms), and records of deductions or credits.

- Determine Filing Status: Identify your filing status based on your marital situation and household setup, as this affects your tax rate and available deductions.

- Fill Out Income Sections: Report total income from various sources, including wages, interest, dividends, and any other relevant income documents.

- Claim Deductions: Utilize standard or itemized deductions where applicable. This may involve completing Schedule CA to adjust federal amounts to California's requirements.

- Calculate Tax: Use the tax tables provided with the 540 form to determine your state tax liability based on the calculated taxable income.

- Review and Submit: Double-check your completed form for accuracy, ensuring all sections are filled, and submit via mail or electronically through California's tax portal.

By adhering to these steps, you can confidently prepare your tax return while minimizing potential errors that may lead to compliance issues.

Important Terms Related to the 540 Form 2010

Understanding key terms related to the 540 form can greatly benefit taxpayers as they navigate the form and the filing process. Some of the most relevant terms include:

- Adjusted Gross Income (AGI): The total income calculated after subtracting specific deductions. AGI is important as it determines eligibility for various credits and deductions.

- Deductions: These are specific amounts that reduce the taxable income, which can either be standard deductions or itemized deductions based on individual financial situations.

- Tax Credits: Direct reductions to the tax owed, which can significantly affect the overall tax liability. Examples include credits for education expenses and childcare.

- Filing Status: Categories defined by the IRS and state authorities that determine tax rates and available standard deductions. This includes categories such as "Single," "Married Filing Jointly," and "Head of Household."

These terms not only help in filling out the 540 form 2010 accurately but also provide clarity on tax obligations and strategies for minimizing tax liability.

Filing Deadlines and Important Dates for the 540 Form 2010

Adhering to filing deadlines is critical for compliance with California tax regulations. For the 540 form 2010, the key dates include:

- Filing Deadline: Typically, the filing deadline for state income tax returns in California is April 15 of the year following the tax year. For 2010, this means returns must be submitted by April 15, 2011.

- Extension Requests: Taxpayers who need additional time can request an extension, which generally allows filing by October 15, 2011, but any taxes owed must still be paid by the original deadline to avoid penalties.

- Amendment Deadlines: If a taxpayer discovers an error after filing, California allows amendments to be submitted within four years from the date the original return was filed.

It is prudent to mark these dates on a calendar to avoid late submissions and potential penalties.

Examples of Using the 540 Form 2010

The 540 form 2010 serves various purposes for different taxpayer scenarios:

- Self-Employed Individuals: A freelancer in California must report all income earned through their work on the 540 form 2010, taking special note to declare any business-related expenses to reduce their taxable income.

- Students: A college student who earns income from part-time work will also use the 540 form 2010 to report earnings while potentially qualifying for education tax credits.

- Retired Individuals: Seniors receiving retirement benefits must report these as income on the 540 form 2010, while considering potential deductions available to them such as medical expenses.

These examples illustrate how diverse the application of the 540 form can be, catering to various financial situations and lifestyles.

Required Documents for the 540 Form 2010

To successfully complete the 540 form 2010, taxpayers should gather the following essential documents:

- Income Statements (W-2, 1099): These forms report wages, salaries, and other sources of income necessary for accurate reporting.

- Previous Year’s Tax Return: Reference the prior year’s return for consistency and to ensure all carryover items (like credits or deductions) are included.

- Documentation for Deductions: Gather receipts, statements, and other proofs for expenses such as mortgage interest, property tax, and charitable contributions.

- Health Coverage Verification: If applicable, documents proving compliance with health coverage requirements must be included.

Having these documents on hand will facilitate a smoother and more precise completion of the tax return process.