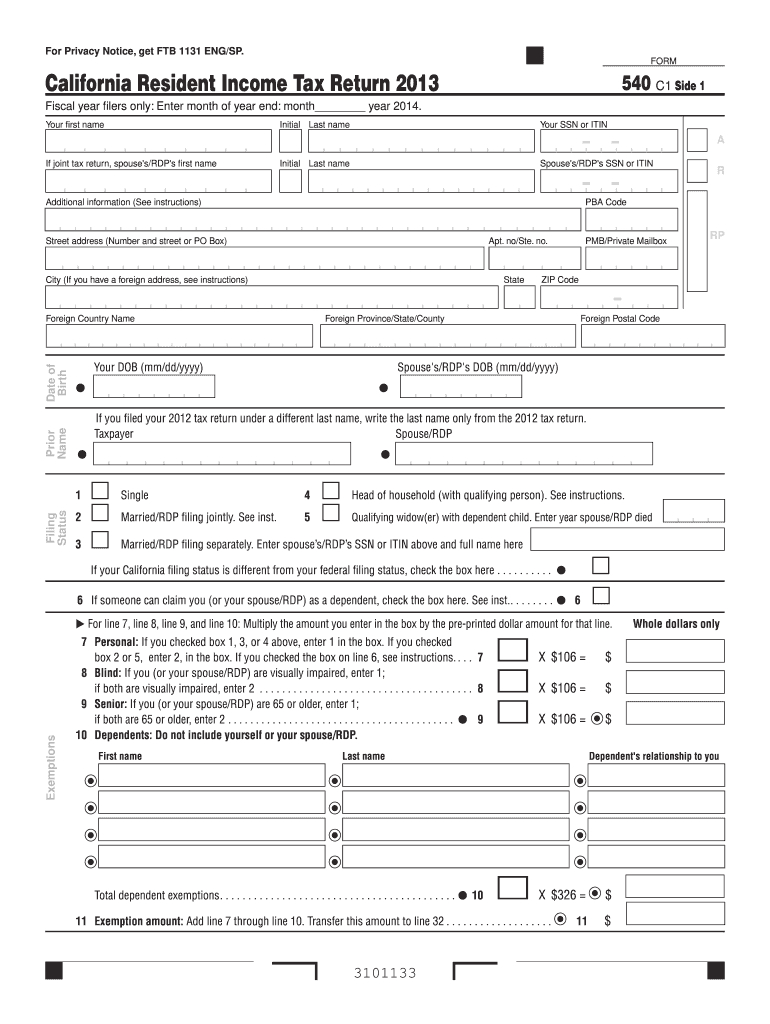

Definition and Purpose of the 2013 Form 540

The 2013 Form 540 is the California Resident Income Tax Return required for residents to report their income and calculate their state tax obligations. Individuals who lived in California for more than half of the tax year must use this form to file their state income tax. It helps establish the amount of income subject to state tax, allows taxpayers to claim permissible deductions and credits, and enables the calculation of the total tax owed or refund due.

The form includes sections to provide personal information such as name, address, and Social Security number, as well as details about filing status (single, married, or head of household). In addition, it requires taxpayers to disclose their total income, including wages, interest, and other sources, which is vital for accurate tax calculation. Completing this form accurately is essential for compliance with California tax law.

Steps to Complete the 2013 Form 540

Completing the 2013 Form 540 involves several steps to ensure accuracy and compliance with state requirements.

-

Gather Required Information

- Collect all income statements (W-2s, 1099s).

- Include documentation for deductions (mortgage interest, property taxes).

-

Personal Information

- Fill out your name, Social Security number, and residency information. Ensure that the information matches your IRS records.

-

Determine Filing Status

- Choose your filing status based on your situation. This could be single, married filing jointly, married filing separately, or head of household.

-

Report Your Income

- Input all sources of income, including wages, dividends, and rental income. Use Schedule CA (540) if you have income adjustments.

-

Calculate Deductions and Credits

- Decide between the standard deduction or itemizing your deductions, and claim any credits available to you.

-

Calculate Taxable Income and Tax Due

- Follow the instructions to determine your taxable income, then apply California tax rates to calculate your tax owed.

-

Review and Sign

- Double-check all entries for accuracy, ensure all necessary forms are attached, and sign the document before submission.

-

File the Form

- Submit your completed Form 540 by the established deadline through mail, or electronically if preferred.

Each step should be approached methodically to minimize errors, which could lead to delays or penalties.

Important Terms Related to the 2013 Form 540

Understanding key terminology associated with the 2013 Form 540 is essential for accurate completion.

- Filing Status: Refers to the classification for tax reporting, including options like single or married. Your status influences tax rates and credits.

- Adjusted Gross Income (AGI): The total income after deductions. This figure is critical for determining tax brackets and eligibility for various credits.

- Standard Deduction: A flat amount that taxpayers can deduct from their income, which varies by filing status and is typically less than itemizing deductions.

- Itemized Deductions: Specific expenditures such as mortgage interest or medical expenses that can be deducted instead of taking the standard deduction.

- Tax Credits: Direct reductions in the amount of tax owed. Examples include the Child Tax Credit and Earned Income Tax Credit.

- Withholding: Taxes deducted from wages by employers throughout the year, contributing to the total tax liability.

Familiarity with these terms aids in navigating the complexities of the tax system and ensures compliance.

Filing Deadlines and Important Dates for the 2013 Form 540

Timely filing of the 2013 Form 540 is crucial to avoid penalties. The standard deadline for filing your California state tax return is usually April 15 following the end of the tax year.

-

Filing Deadline: Typically April 15, 2014, for tax year 2013. If this date falls on a weekend or holiday, the deadline may extend to the next business day.

-

Extended Filing: Taxpayers who need more time can request a six-month extension, typically due by October 15, 2014. However, any taxes owed must still be paid by the original deadline to avoid interest and penalties.

-

Payment Due Dates: Any tax owed must be paid by the filing deadline, even if an extension is filed. This includes anticipated payments or balancing amounts.

Understanding these dates helps taxpayers manage their financial responsibilities and avoid complications with tax authorities.

Submission Methods for the 2013 Form 540

Taxpayers have various options for submitting the 2013 Form 540, allowing for flexibility based on personal preferences and situations.

-

E-Filing: Electronic filing is increasingly popular due to its convenience and speed. Tax software (such as TurboTax) can streamline the process, often including e-signature options, enabling instantaneous submission and confirmation of receipt.

-

Mail: Postal submission is also available, but requires ensuring correct postage and addresses. Forms should be mailed to the address specified in the instructions, categorized by whether a refund is expected or taxes are owed.

-

In-Person: Some individuals may prefer to visit designated tax offices or professional preparers for assistance with submission.

Regardless of the method chosen, it is vital to keep copies of the completed form and any supporting documents for personal records.

Examples of Using the 2013 Form 540

Various scenarios illustrate how individuals might use the 2013 Form 540 depending on their financial situations.

-

Single Professional: A single software engineer with a W-2 income of $80,000 will report this income and may qualify for the standard deduction. If they made contributions to a retirement account, adjustments will be made to AGI accordingly.

-

Married Couple: A married couple filing jointly with multiple income sources, such as one spouse working (W-2 income) and the other a freelance graphic designer (1099 income), need to combine their incomes on one return. They can benefit from available tax credits, such as the Child Tax Credit if applicable.

-

Self-Employed Individual: A self-employed consultant will report income from invoices and can take advantage of several deductions related to home office expenses and business supplies. This scenario requires careful documentation of business-related expenses for accuracy.

These examples demonstrate the diversity of taxpayers and the functionality of the 2013 Form 540 in addressing varied financial circumstances.