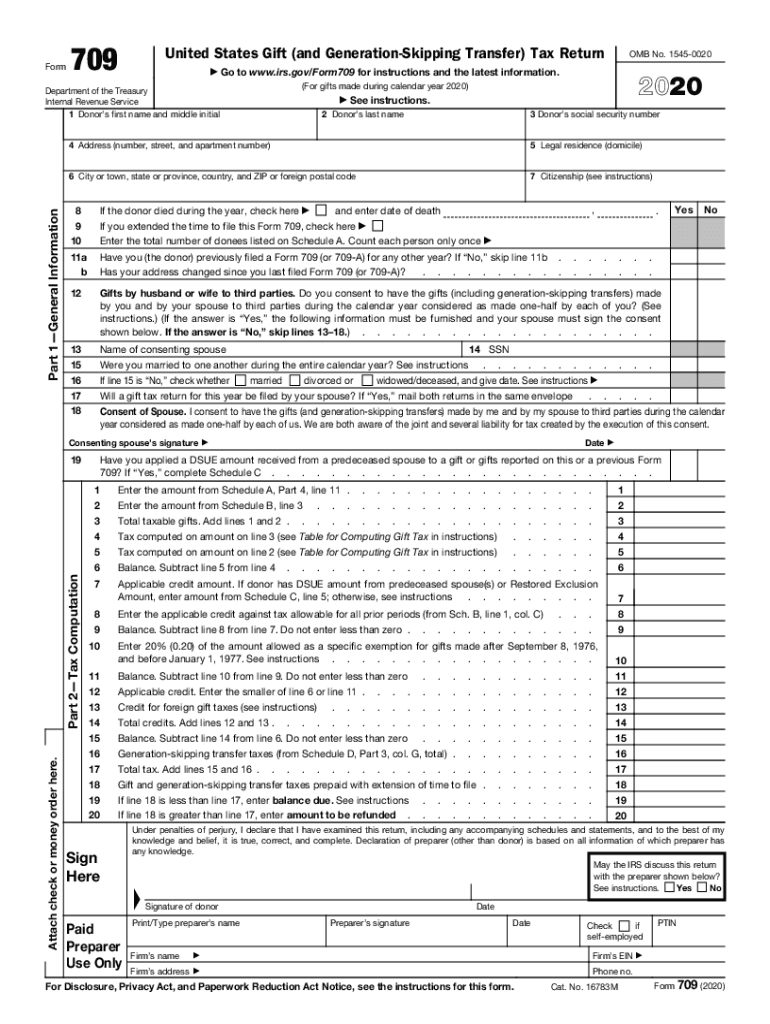

Definition and Context of Form 709

Form 709, the United States Gift (and Generation-Skipping Transfer) Tax Return, is a crucial document used to report gifts that an individual has made during the calendar year that exceed the annual exclusion amount. Additionally, it helps in documenting generation-skipping transfers, where gifts are given to a person who is two or more generations younger than the donor. The form captures essential details such as donor and donee information, and it calculates applicable gift taxes. Understanding this form is vital for ensuring compliance with federal tax laws.

Key Elements of Form 709

- General Information: This section requires basic details about the donor, including name, address, and taxpayer identification number.

- Tax Computation: Calculations to determine the taxable amount of the gifts and the corresponding taxes.

- Schedules: Various schedules are included to detail taxable gifts and generation-skipping transfers, providing a comprehensive overview of the transactions that occurred during the year.

How to Use Form 709

Filing Form 709 is necessary for individuals who have made significant gifts or specific generation-skipping transfers. It is crucial to fill out all relevant sections accurately to ensure compliance and avoid penalties.

Step-by-Step Completion Guide

- Gather Information: Collect all necessary details about gifts made throughout the year and details of the recipients.

- Fill General Information: Enter the donor’s personal details accurately to avoid processing issues.

- Calculate Gift Tax: Use the schedules provided to work through the gift calculations and determine if any taxes are applicable.

- Compile Schedules: Provide comprehensive information in the schedules regarding each gift or transfer.

- Review and Sign: Verify all information before signing the document to ensure accuracy and completeness.

How to Obtain Form 709

Form 709 can be easily accessed through the IRS website in both digital and printable formats. It can also be obtained from tax software platforms that are compliant with IRS regulations.

Methods of Accessing Form 709

- IRS Website: Direct download from the official site ensures you have the most up-to-date version.

- Tax Software: Platforms like TurboTax or QuickBooks often include this form within their tax filing solutions.

- Tax Professionals: Accountants and tax preparers can provide copies during consultations or as part of their services.

Who Typically Uses Form 709

Form 709 is primarily used by individuals in the United States who engage in gifting behaviors that surpass the annual exclusion threshold set by the IRS, as well as those planning for estate taxes through generation-skipping transfers. This can include:

- High Net Worth Individuals: Typically those who make substantial gifts to relatives or charitable donations.

- Estate Planners: Individuals planning their estate succession strategies, often incorporating generation-skipping transfers.

- Legal and Tax Professionals: Advisors who aim to assist clients in compliance and tax planning.

Important Terms Related to Form 709

To comprehend Form 709, it is essential to be familiar with the terminology used within it. Key terms include:

- Donor and Donee: The individual giving the gift and the recipient, respectively.

- Annual Exclusion: The maximum amount that can be gifted each year without incurring tax obligations.

- Generation-Skipping: Transfers to a beneficiary significantly younger than the donor, often grandchildren or remote relatives.

- Lifetime Exclusion: A larger exemption covering cumulative gifts over a person’s lifetime, impacting estate tax.

IRS Guidelines and Filing Deadlines

Adhering to IRS guidelines and meeting filing deadlines is imperative when dealing with Form 709 to avoid penalties. Below are essential points about the guidelines and timelines:

Filing Instructions

- Due Date: The form must be filed by April 15 of the year following the gift transaction. Extensions may be requested by filing Form 4868.

- Guidelines Compliance: Follow the IRS instructions carefully to complete all sections accurately, ensuring compliance and avoiding delays.

Penalties for Non-Compliance

Failure to file Form 709 in a timely and accurate manner can result in significant penalties. These can include fines based on the amount of tax owed and interest on unpaid taxes. It is crucial to adhere to all filing requirements to avoid these punitive measures.

- Late Filing Penalty: Typically five percent of the unpaid taxes per month, up to a maximum of 25 percent.

- Interest on Unpaid Taxes: Accrued daily for any taxes not paid by the due date.

- For Fraud: More severe penalties, including additional fines or criminal charges, for willfully avoiding filing.

Digital and Paper Versions

Form 709 can be submitted in both paper and digital formats. Each has different requirements but ultimately serves the same purpose of reporting gifts and transfers to the IRS.

Advantages of Digital Submission

- Efficiency: Faster processing and immediate confirmation of receipt.

- Convenience: Easy to upload directly from tax software.

- Security: Online submissions often include encryption, providing a secure method of filing sensitive information.

Choosing the appropriate format based on individual preference and access to technology can streamline the filing process of Form 709.