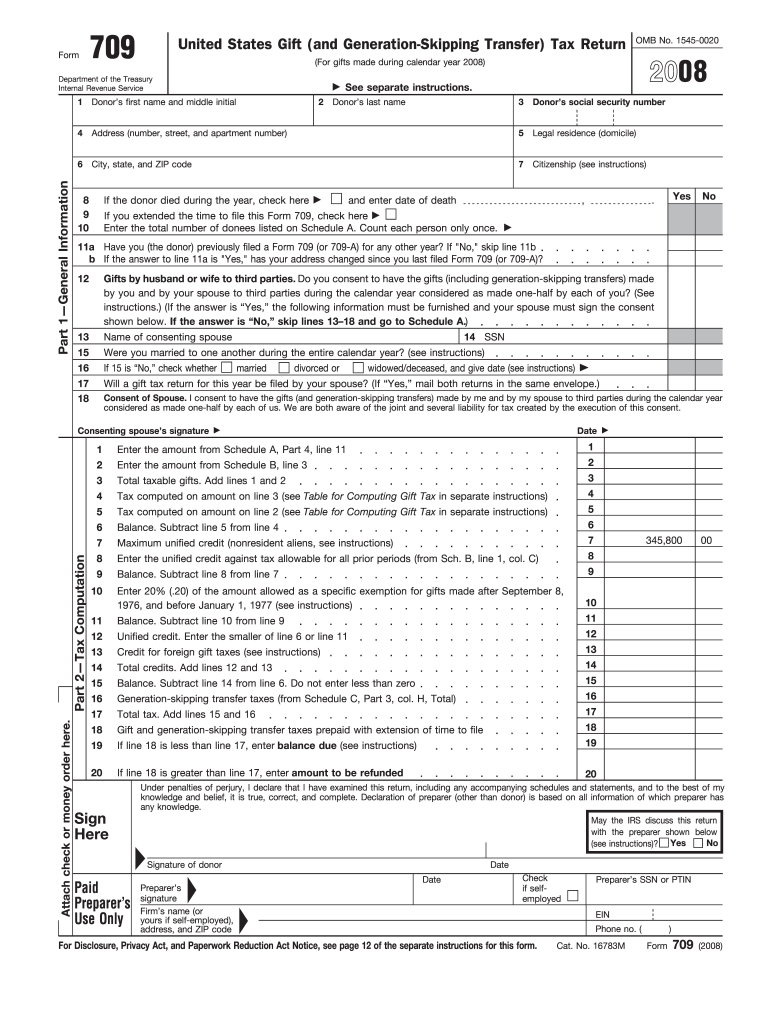

Definition and Purpose of the 2008 709 Form

The 2008 709 form, known formally as the United States Gift (and Generation-Skipping Transfer) Tax Return, is a crucial document for individuals who have made significant gifts during that tax year. Essentially, this form is used by donors to report gifts over the annual exclusion limit set by the IRS. The primary purpose is to detail gifts made by one individual to another, which may incur gift tax, and to track the lifetime cumulative amount given exempt from tax. This enables the IRS to assess tax liabilities based on the value of the gifts given and adjustments for any exemptions applicable to the donor.

Key Features

- Reporting Requirement: The form is mandatory for any individual who gifts more than the annual exclusion amount to a single recipient.

- Computation of Taxes: It includes calculations for any applicable taxes if the donor exceeds the lifetime exemption limit.

- Gift Splitting Option: The form allows married couples to combine their annual exclusion limits, enhancing the deductible amount and facilitating tax-efficient gifting strategies.

How to Use the 2008 709 Form Effectively

To utilize the 2008 709 form efficiently, donors need to be aware of the specific guidelines and requirements set forth by the IRS. This includes understanding the thresholds for reporting, what constitutes a reportable gift, and the various exemptions applicable.

Understanding Gift Types

- Direct Gifts: These are the most straightforward, such as cash transfers, real estate, or tangible items given directly to the recipient.

- Indirect Gifts: If the donor pays a recipient’s expenses, such as tuition or medical bills, those may also qualify as gifts.

Filling Out the Form

Accurate completion of the 2008 709 form involves several steps, including:

- Identify the Donor and Recipient: Fill out the details of both parties accurately to avoid any discrepancies.

- List of Gifts: Detail all qualifying gifts made throughout 2008, including monetary values and descriptions of the gifts.

- Applicable Exemptions: Make sure to include any relevant gift exclusions, such as those for tuition or medical payments made directly to institutions.

Steps for Completing the 2008 709 Form

Completing the form involves several critical steps to ensure compliance and accuracy. Here are the main steps outlined clearly:

-

Gather Necessary Information:

- Compile details about the donor, recipient, and the gifts made within the year.

-

Determine Reportable Gifts:

- Identify which gifts exceed the annual exclusion limit and must be reported.

-

Fill Out the Biennial Form:

- Complete sections A and B, providing personal information and details about each gift.

-

Calculate Gift Tax Liability:

- Use the computation sections to determine if any tax is owed based on the cumulative lifetime gifts.

-

Review and Submit:

- Ensure accuracy and completeness before submission, adhering to IRS deadlines.

Important Dates and Filing Deadlines for the 2008 709 Form

Filing the 2008 709 form requires attention to specific deadlines to avoid penalties:

- Filing Due Date: The form must be submitted by April 15 of the year following the gift tax year. For gifts made in 2008, this deadline is April 15, 2009.

- Extensions: Donors can file for an extension using IRS Form 4868, but they must still pay any estimated taxes owed by the original deadline to prevent penalties.

Penalties for Late Submission

Failing to file the 2008 709 form on time may result in penalties, including fines based on the amount of tax due, making timely submission critical for compliance.

Common Scenarios for Filing the 2008 709 Form

This form is primarily utilized by individuals who make significant gifts throughout the year. Common scenarios include:

- Parents Gifting to Children: Parents may wish to transfer wealth to their children through gifts, which often exceed the annual exclusion limit.

- Spousal Gifts: Married couples can use gift-splitting strategies, allowing them to give larger amounts together without incurring taxes.

- Estate Planning Strategies: Wealthy individuals may use the form to facilitate a tax-efficient transfer of assets as part of their estate planning.

Real-World Examples

- A parent gifts $25,000 to a child for a down payment on a house in 2008. Since the annual exclusion amount is $12,000, the excess $13,000 must be reported on the 2008 709 form.

- A couple decides to pay their son’s tuition directly to the university instead of gifting the money. Because this payment is made directly, it does not count against the gift limits and will not require reporting.

Important Terms Related to the 2008 709 Form

Understanding critical terminology is essential for effectively utilizing the 2008 709 form. Familiar terms include:

- Annual Exclusion Amount: The maximum value a donor can gift per recipient per year without triggering reporting.

- Lifetime Exemption: The cumulative amount that a donor can give during their lifetime without incurring gift taxes.

- Gift Splitting: A strategy that enables married couples to combine their annual exclusion amounts for tax purposes.

By familiarizing yourself with these terms, navigating the complexities of the 2008 709 form becomes significantly more manageable.