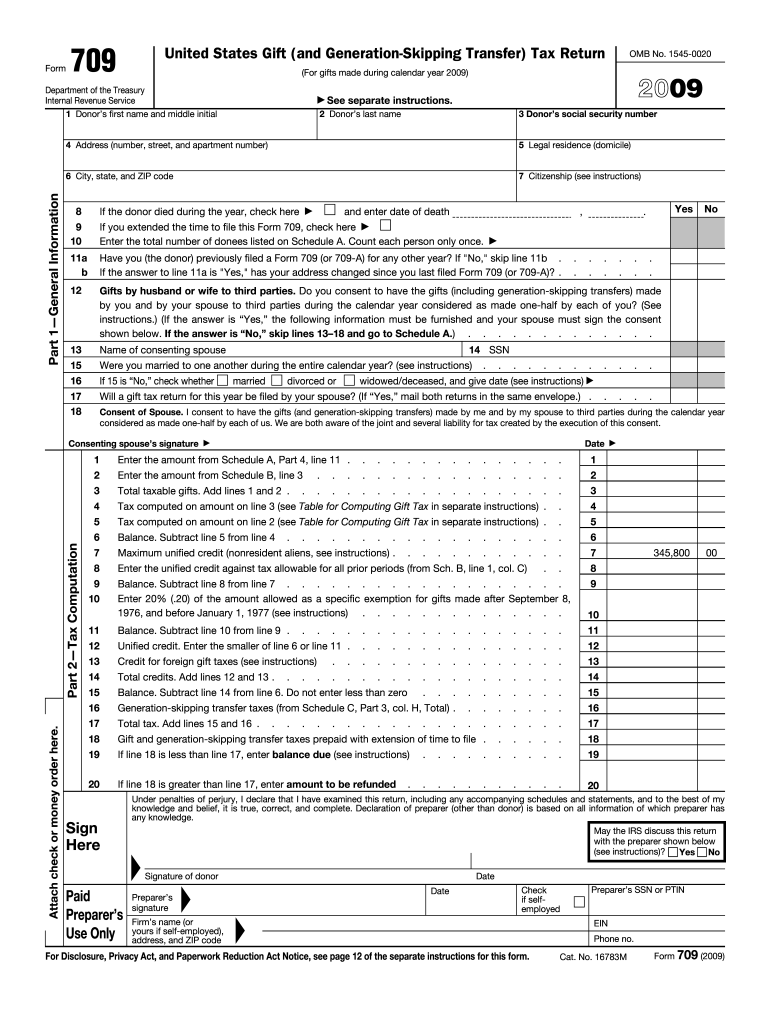

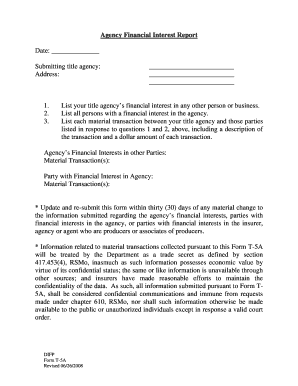

Definition & Meaning of the 2009 709 Form

The 2009 709 form, formally known as the United States Gift (and Generation-Skipping Transfer) Tax Return, is a crucial document for individuals who made gifts during the calendar year 2009 that exceeded the annual exclusion limit. This form is mandated by the Internal Revenue Service (IRS) for the purpose of reporting taxable gifts and calculating any owed gift taxes. Specifically, it serves to document the transfer of wealth from one individual (the donor) to another (the recipient) and to ensure compliance with federal tax regulations.

The form is divided into several sections, which include:

-

General Information Section: This section gathers basic details about the donor, such as their name, address, Social Security number, and information on any spouses if applicable.

-

Gift Details: Here, the donor must provide a comprehensive account of the gifts made during the year, specifying the nature and value of each gift.

-

Tax Computation: This segment assists in calculating any potential tax liabilities associated with the gifts reported and includes schedules to detail prior gifts and any generation-skipping transfers.

Understanding this form's significance is vital for anyone who wishes to manage their gift tax responsibilities effectively while maximizing potential tax benefits.

Key Elements of the 2009 709 Form

The 2009 709 form includes several essential components that individuals must accurately complete to comply with tax regulations. Below are the key elements:

-

Donor Information: Collects personal details of the donor, including identifying information and spousal details if applicable.

-

Gift Description: Requires a thorough account of each gift made, including:

- Type of gift (cash, property, stocks, etc.)

- Date of transfer

- Fair market value at the time of the gift

-

Calculating Tax: Donors must detail any taxable gifts and calculate any associated tax liability. This section includes a tax computation worksheet to aid in accurate reporting.

-

Exclusions and Deductions: Identifies any applicable exclusions like the annual exclusion amount and any deductions that affect the total taxable amount.

-

Signatures: The form must be signed by the donor and, if applicable, the spouse, certifying the truthfulness of the information provided.

Accurately completing these elements is crucial for minimizing tax liabilities and ensuring compliance with IRS regulations.

Steps to Complete the 2009 709 Form

Completing the 2009 709 form involves a systematic approach to ensure that all relevant information is captured correctly. Below are the detailed steps:

-

Gather Necessary Information: Collect all required details, including information about the donor, gifts made within the year, and supporting documents such as appraisals or valuations.

-

Fill Out Donor Information: Complete the sections that require personal details, including the donor's name, address, and Social Security number.

-

List Gifts Made: Provide a detailed list of gifts, ensuring to include:

- The type and description of each gift

- The date each gift was made

- The fair market value of each gift at the time of transfer

-

Calculate Tax Liability: Utilize the provided worksheets in the form to calculate any potential gift tax that may be owed. Be sure to account for the annual exclusion and any prior gifts.

-

Review for Accuracy: Double-check all entries for accuracy, ensuring that calculations align with IRS guidelines.

-

Sign and Date the Form: Once completed, the donor must sign and date the form, including a spouse’s signature if applicable.

-

Submit the Form: Follow the specified submission methods outlined by the IRS, ensuring that it is done before the deadline.

Completing the form accurately and timely is essential to avoid penalties and ensure proper reporting for any taxable gifts made.

Who Typically Uses the 2009 709 Form?

The 2009 709 form is utilized predominantly by individuals who engage in substantial gifting activities, particularly those exceeding the annual gift tax exclusion amount set by the IRS. Common users include:

-

High Net-Worth Individuals: Those with significant assets who wish to transfer wealth to heirs or charities.

-

Parents and Grandparents: Individuals who make gifts to children or grandchildren, especially in amounts that surpass the exclusion limits.

-

Estate Planners: Professionals advising clients on wealth transfer strategies, including strategies designed to minimize tax liabilities through gifting.

-

Trustees and Executors: Individuals responsible for managing and distributing assets from estates, particularly those involving generation-skipping transfers.

Understanding the profile of users helps clarify the necessity and application of the 2009 709 form in effective financial and estate planning.

IRS Guidelines for the 2009 709 Form

The IRS has established comprehensive guidelines that dictate how the 2009 709 form must be completed and submitted. Following these guidelines is essential to maintain compliance and avoid penalties. Key elements include:

-

Filing Requirements: Any individual making gifts above the annual exclusion limit for 2009 must file Form 709, irrespective of whether gift tax is owed.

-

Deadline for Filing: The form must be submitted by April 15 of the year following the gift (typically aligning with personal income tax returns), with extensions available under specific conditions.

-

Payment of Taxes: If gift taxes are owed, they must be paid along with the timely filing of the form to avoid interest and penalties.

-

Amendments and Corrections: If errors are found after submission, the IRS allows for amended filings, provided they follow the stipulated processes.

Adherence to these guidelines ensures that individuals meet their legal obligations and maintain accurate tax records.

Important Terms Related to the 2009 709 Form

Understanding key terminology related to the 2009 709 form can significantly aid in the completion and comprehension of the document. Some important terms include:

-

Gift Tax: A federal tax applied to an individual giving anything of value to another person, subject to certain exclusions.

-

Annual Exclusion: The maximum amount that can be gifted to an individual each year without incurring gift tax, which was $13,000 in 2009.

-

Gift Splitting: A provision that allows married couples to combine their annual exclusions to gift larger sums without incurring taxes.

-

Generation-Skipping Transfer: A transfer of assets to beneficiaries who are two or more generations younger than the donor, often subject to additional tax implications.

-

Fair Market Value: The price at which a property would sell under normal conditions; this valuation is critical when reporting gifts made.

Familiarity with these terms is vital for accurately navigating the completion and implications of the 2009 709 form.