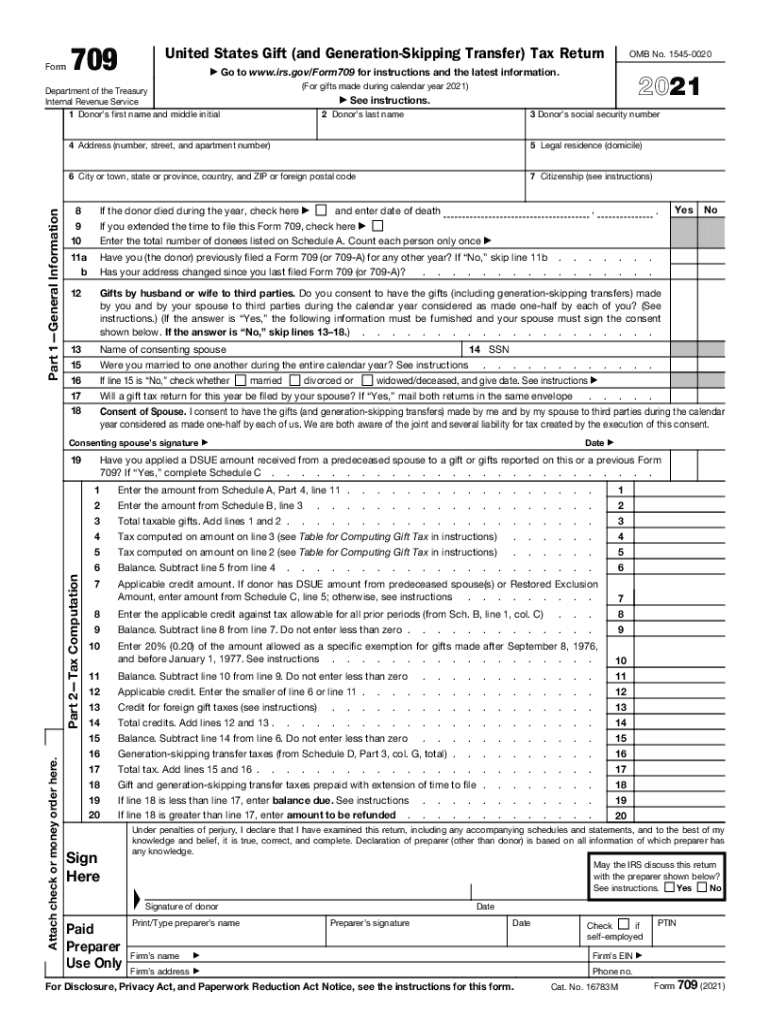

Definition and Purpose of IRS Form 709

IRS Form 709, formally known as the United States Gift (and Generation-Skipping Transfer) Tax Return, is used by individuals to report gifts given throughout the calendar year that exceed the annual exclusion limit. It's essential for documenting gifts and ensuring that any required taxes on those gifts are paid. The form covers gifts made to individuals or trusts, and the tax implications associated with those transfers. Understanding its purpose helps taxpayers comply with tax laws and utilize available tax benefits.

How to Use IRS Form 709

Using IRS Form 709 involves several detailed steps:

-

Determine if you need to file:

- Gifts to any one person over the annual exclusion limit require filing.

- Splitting gifts between spouses may necessitate a return.

-

Gather necessary information:

- Donor and donee information.

- Details of gifts, including type and value.

-

Complete each section:

- General information about gifts.

- Schedule A for computing taxes on gifts.

- Schedule C for generation-skipping transfers.

Ensure accuracy to avoid complications or penalties upon filing.

Obtaining IRS Form 709

IRS Form 709 can be accessed through multiple channels:

- Download directly from the IRS website.

- Request a paper form by calling the IRS.

- Use tax preparation software that supports Form 709.

Ensuring you obtain the most recent version is crucial for compliance with current tax laws.

Steps to Complete IRS Form 709

Filling out IRS Form 709 involves several key steps:

- Complete the identification section, including donor and donee details.

- Fill out Part 1 for gift tax computation, listing all gifts above the exclusion limit.

- Address any generation-skipping transfers in Part 2, if applicable.

- Sign and date the form, ensuring all information is accurate and complete.

Each step requires careful attention to detail to ensure compliance and correctness.

Eligibility Criteria for IRS Form 709

Individuals primarily use IRS Form 709 when their annual gifts exceed the exclusion limit. Specific criteria include:

- Making gifts above the annual exclusion to a single recipient.

- Engaging in gift splitting between spouses.

Understanding these criteria ensures that necessary filings are completed, protecting individuals from potential penalties.

Required Documents for IRS Form 709

Completing IRS Form 709 requires several documents and pieces of information:

- Details of all gifts made, including recipient information and gift value.

- Supporting documentation to substantiate the value of non-cash gifts.

- Legal agreements or supporting documents for complex gift arrangements.

Ensuring all required documents are gathered simplifies the filing process.

Filing Deadlines and Important Dates

Form 709 is generally due by April 15th of the year following the gift year. Extensions may be available, consistent with personal income tax extensions. Failure to file by the deadline without an extension may result in penalties.

Penalties for Non-Compliance

Failure to file IRS Form 709 when required can lead to penalties, including:

- Monetary fines.

- Increased scrutiny by the IRS for future tax returns.

- Potential interest on unpaid gift tax amounts.

Awareness of penalties underscores the importance of timely and accurate filings.