Definition and Meaning of IRS File

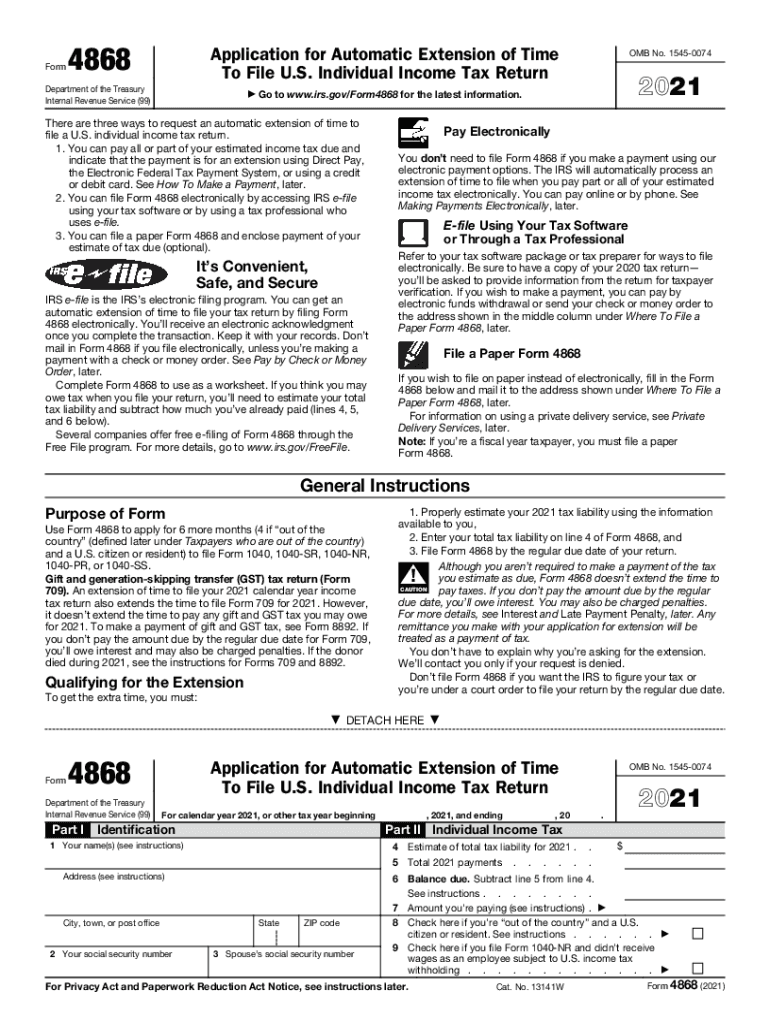

The term "IRS file" generally refers to documentation required or filed with the Internal Revenue Service (IRS), primarily for tax-related purposes. This encompasses individual tax returns, business tax filings, and extensions like Form 4868, which is an application for an automatic extension of time to file U.S. individual income tax returns. Understanding this term is crucial for both individuals and businesses, as IRS filings are integral to maintaining compliance with tax regulations.

How to Use IRS File

To effectively utilize IRS files, taxpayers need to be aware of their specific tax obligations and the forms associated with them. The process typically involves collecting required financial information, completing the necessary forms accurately, and ensuring timely submission to avoid penalties. For example, individuals filing for a tax extension can use Form 4868 to gain an extra six months to prepare their returns. However, it's important to note that filing for an extension does not extend the time for payment of any taxes due.

Steps to Complete IRS File

- Identify Required Form: Determine the specific IRS form needed based on your tax situation. For individuals seeking extensions, this is usually Form 4868.

- Gather Documentation: Collect all necessary financial records, including income statements, deductions, and credits, to complete the form accurately.

- Fill Out Form: Carefully complete the form, ensuring all information is correct to avoid processing delays.

- Estimate Tax Due: When completing Form 4868, calculate any taxes you owe to accompany your extension request, as the extension only covers filing time, not payment.

- Submit Form: Choose a submission method — electronic filing is often recommended for faster processing and immediate confirmation, while paper submission is also an option.

Who Typically Uses IRS File

IRS files are utilized by a wide range of taxpayers, including individuals, businesses, and self-employed professionals. Specific forms fulfill different needs—while Form 4868 is used by individuals seeking filing extensions, businesses might use other forms to report income, expenses, or request extensions. Understanding which form applies to your situation is crucial for compliance and to take full advantage of available tax opportunities.

Important Terms Related to IRS File

Understanding tax-related terminology is essential when dealing with IRS files. Familiar terms include:

- Extension of Time to File: Allows taxpayers more time to submit tax returns, but not to pay owed taxes.

- Estimated Tax: A calculation of taxes one expects to owe for the year, important for making timely payments.

- Taxpayer Identification Number (TIN): Crucial for identifying individual and business filers in IRS records.

- Filing Status: Determines your tax rate and standard deduction, influencing which IRS forms to file.

IRS Guidelines for Filing

The IRS provides comprehensive guidelines to assist taxpayers in filing forms accurately. These cover form instructions, available online resources, and critical deadlines. Taxpayers are encouraged to review these guidelines to understand filing requirements thoroughly. For instance, Form 4868 instructions outline submission to secure a six-month extension, emphasizing the importance of estimating and paying any taxes owed by the original filing deadline to avoid penalties.

Filing Deadlines and Important Dates

Key deadlines play a critical role in the timing of IRS file submissions. Most individual tax returns are due on April 15, unless an extension is filed using Form 4868, extending the deadline to October 15. Special deadlines may apply to other forms or taxpayer categories, such as quarterly estimated payments for self-employed individuals. Awareness of these dates is essential to ensure compliance and avoid penalties.

Form Submission Methods

Taxpayers have several options for submitting IRS files, each with its benefits:

- Online Submission: Using the IRS e-file service or authorized providers, this method offers speed, efficiency, and immediate confirmation of receipt.

- Mail Filing: Traditional postal service is available for those who prefer or require paper submissions. Ensure forms are sent to the correct IRS address for your location.

- In-Person: While rare for individual filings, certain business and complex filings may be submitted directly at IRS offices if necessary.

Penalties for Non-Compliance with IRS File Requirements

Failure to comply with IRS filing requirements can result in various penalties. Common issues include failure to file by the deadline, failure to pay taxes owed, or submitting incorrect information. These penalties vary based on the nature and severity of non-compliance but can include fines, interest on unpaid taxes, and potential legal action. Understanding these risks emphasizes the importance of accurate and timely IRS file submissions.