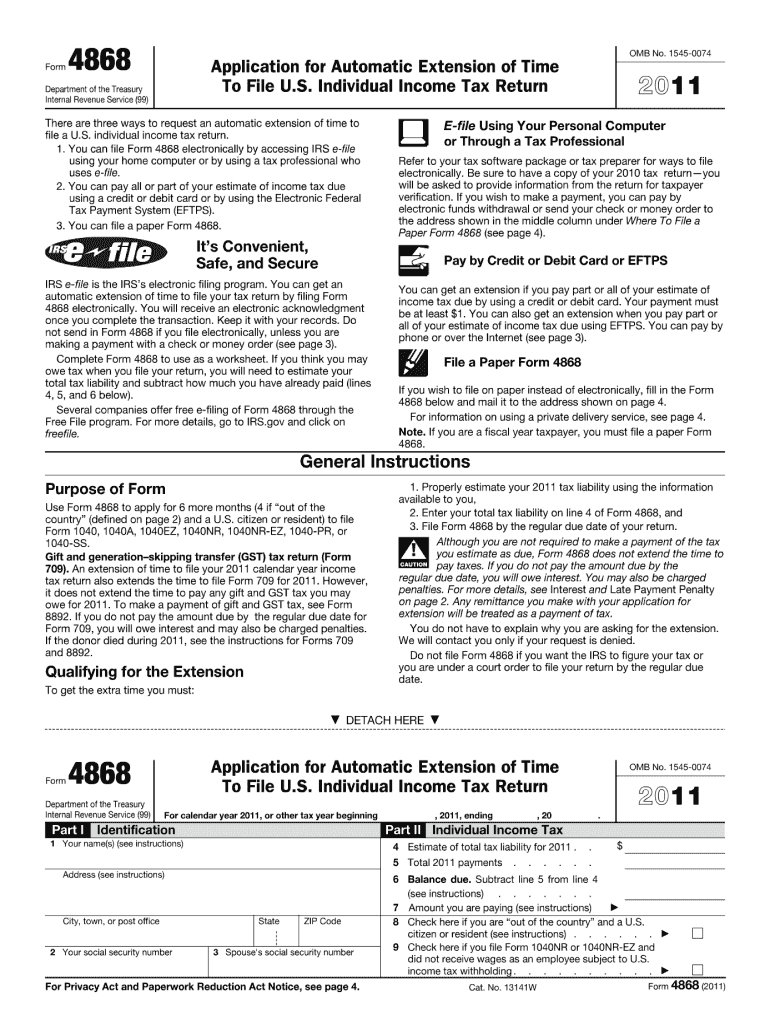

Definition and Purpose of Form 4868

Form 4868, officially titled "Application for Automatic Extension of Time To File U.S. Individual Income Tax Return," is a document provided by the U.S. Department of the Treasury, Internal Revenue Service (IRS). Designed for individual taxpayers, it allows them to request an automatic extension for filing their federal income tax return for the tax year specified, in this instance, 2011. By submitting this form, taxpayers can obtain an additional six months to file their return, extending their deadline from April 15 to October 15.

This extension provides a valuable resource for those who may need more time to gather necessary documentation, such as W-2s or other income statements, before filing. Importantly, while Form 4868 allows for an extension of time to file, it does not grant an extension for the payment of any taxes owed. Taxpayers are still responsible for estimating and paying any due taxes by the original deadline to avoid penalties and interest.

Steps to Complete the 4 Form

Completing Form 4868 requires careful attention to detail to ensure proper processing by the IRS. Follow these steps for accurate completion:

-

Provide Identification Information

- Enter your name, address, and Social Security number. If you're married and filing jointly, include your spouse's information as well.

-

Estimate Your Taxes Owed

- Calculate your total tax liability for the year and any payments you have already made. This step is critical to determine if you need to make a tax payment with your extension request.

-

Declare Your Payment

- Indicate the amount of tax you are sending with the form (if any) to the IRS. Remember, Form 4868 is primarily about extending your filing deadline, not your payment deadline.

-

Select Appropriate Filing Method

- Decide if you will file the form electronically or by mail. Both methods are acceptable, but filing electronically can expedite the process.

-

Sign and Date the Form

- Finally, ensure you sign and date the form to validate it. An unsigned form can lead to processing delays or denials.

Important Considerations

- The form can be completed using tax software or a hard copy.

- Ensure all information is accurate to avoid unnecessary complications.

- Keep a copy of the completed form for your records.

How to Obtain the 4 Form

To acquire Form 4868, you have several options:

-

Visit the IRS Website

The most straightforward way to obtain the form is by downloading it directly from the IRS website. The form is available in PDF format, which can be printed and filled out. -

Order from the IRS

You can also request a physical copy of Form 4868 by calling the IRS or submitting a request online. However, this method may take longer, especially during peak tax season. -

Access through Tax Preparation Software

If you're using tax software such as TurboTax or H&R Block, these programs often allow you to access and fill out Form 4868 directly within the application.

For the tax year 2011, be sure to specify the correct year when searching for the form to avoid downloading the wrong version. It's essential to utilize the accurate year’s form to ensure compliance and avoid possible penalties.

IRS Guidelines for Filing the 4868 Form

The IRS has set forth specific guidelines regarding the submission of Form 4868, which are critical for compliance:

-

Deadline for Submission

Form 4868 must be filed by the original due date of your tax return, typically April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. -

Filing with Payments

If you owe taxes, it's advisable to make an estimated payment along with the form to minimize penalties and interest suggestions. -

Electronic Filing Options

Taxpayers can file Form 4868 electronically using the IRS e-file system or through many third-party tax software providers. Electronic filing is often faster and confirms filing immediately. -

Penalties for Late Filing

If you fail to file the 4868 form by the deadline, you may face penalties. The IRS imposes a penalty for both failing to file your return and for any underpayment of estimated taxes.

Additional Resources

The IRS provides detailed instructions accompanying Form 4868, available on their website. This document explains common issues and frequently asked questions, offering valuable insights and assistance.

Common Uses of Form 4868

Form 4868 is predominantly used by individual taxpayers who need additional time to prepare their federal income tax returns. Specifically, it serves various groups:

-

Self-Employed Individuals

Freelancers and business owners, whose income may fluctuate, often utilize this form to give themselves time to organize necessary documents. -

Taxpayers with Complex Situations

Individuals who have multiple income sources, such as rental or investment income, may require extra time to compile and report accurate information. -

People Facing Unexpected Life Events

Major life changes, such as relocations or health issues, may disrupt the ability to file on time, making Form 4868 a practical tool. -

Individuals Seeking Clarity

Those who are unsure of their tax obligations can opt for this extension to ensure they file a complete and accurate return.

Using Form 4868 appropriately can lead to more organized tax filing and fewer mistakes, ultimately saving money on potential penalties.