Definition and Meaning of Form 2012 Application

Form 2012 Application is typically used for a specific purpose related to tax or legal documentation. While the exact use may vary, it is often associated with tax-related activities and may involve applications for credits, deductions, or other financial reporting obligations. The form serves as an essential tool for individuals or businesses seeking to fulfill particular regulatory or statutory requirements.

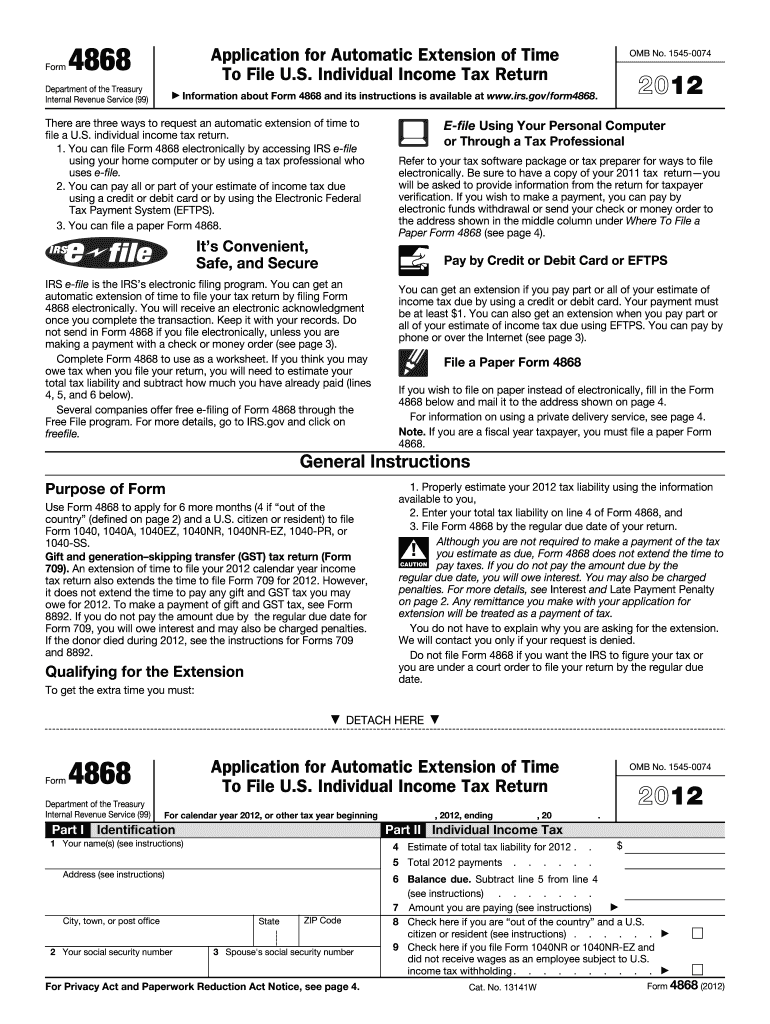

Key Components

- Purpose: Clearly outlines the intended use of the form within the context of tax or legal compliance.

- Parties Involved: Identifies who must complete the form, which can include individuals, businesses, or tax practitioners.

- Required Information: Specifies the data that must be entered, which can include financial figures, personal identification, or business details.

Steps to Complete the Form 2012 Application

Completing the Form 2012 Application involves a series of methodical steps to ensure accuracy and compliance. Here is a breakdown of the steps:

- Gather Required Information: Collect all necessary documents and data, such as personal identification, financial statements, or business details.

- Read Instructions: Carefully review any accompanying instructions to ensure full understanding of the form's requirements.

- Fill Out the Form: Enter the required information into the appropriate fields on the form.

- Review and Verify: Double-check all entries for accuracy and completeness to avoid errors or omissions.

- Submit the Form: Decide on the submission method and ensure timely delivery, whether electronically or by mail.

Common Mistakes to Avoid

- Omitting essential information can lead to delays or penalties.

- Errors in financial figures or personal details can cause discrepancies.

- Failure to understand the instructions may result in submission of incorrect data.

How to Obtain the Form 2012 Application

Acquiring the Form 2012 Application requires accessing specific platforms or institutions authorized to distribute the form.

Acquisition Methods

- Online: Many official governmental or institutional websites offer downloadable copies of the form.

- In Person: Forms may be available at local government offices or libraries.

- Mail: Request a copy by contacting the relevant authority by mail if online access is not available.

Importance of Using the Form 2012 Application

Filing Form 2012 Application is crucial for maintaining compliance with legal or regulatory requirements.

Benefits

- Ensures Compliance: Helps individuals or businesses remain within the boundaries of the law.

- Facilitates Financial Reporting: Provides necessary information for tax filing or financial obligations.

- Avoids Penalties: Proper use can prevent fines or other legal consequences associated with non-compliance.

Who Typically Uses the Form 2012 Application

This form is utilized by a variety of entities, though it largely depends on the specific requirements and context of the form.

Typical Users

- Individuals: Those who need to report specific financial data or claim a deduction.

- Businesses: Companies required to furnish tax-related information.

- Tax Practitioners: Professionals aiding clients in compliance and form submission.

IRS Guidelines for Form 2012 Application

IRS guidelines are fundamental in ensuring the correct and legal use of Form 2012 Application.

Key Guidelines

- Submission Deadlines: Critical to meet all deadlines to avoid late filing penalties.

- Documentation: Ensure all required documents accompany the form for a complete submission.

- Accuracy: Verify that all calculations and entries are correct to prevent issues with processing.

Filing Deadlines and Important Dates

Adhering to deadlines is vital to avoid late penalties and ensure processing within regulatory time frames.

Important Dates

- Primary Deadlines: Typically align with tax filing dates or specific submission requirements for applications.

- Extensions: In some cases, extensions may be available but require a separate application process.

Penalties for Non-Compliance with Form 2012 Application

Non-compliance can lead to various penalties which can affect individuals and businesses negatively.

Potential Penalties

- Financial Penalties: Fines or additional fees may be levied for late or incorrect submissions.

- Legal Consequences: Non-compliance could lead to further legal action or audits.

- Reputational Damage: Businesses may suffer reputational harm if seen as non-compliant with legal requirements.

By following these guidelines, individuals and businesses can effectively manage their obligations related to the Form 2012 Application, thus ensuring compliance and avoiding unnecessary complications.