Understanding Form 4868 and Its Purpose

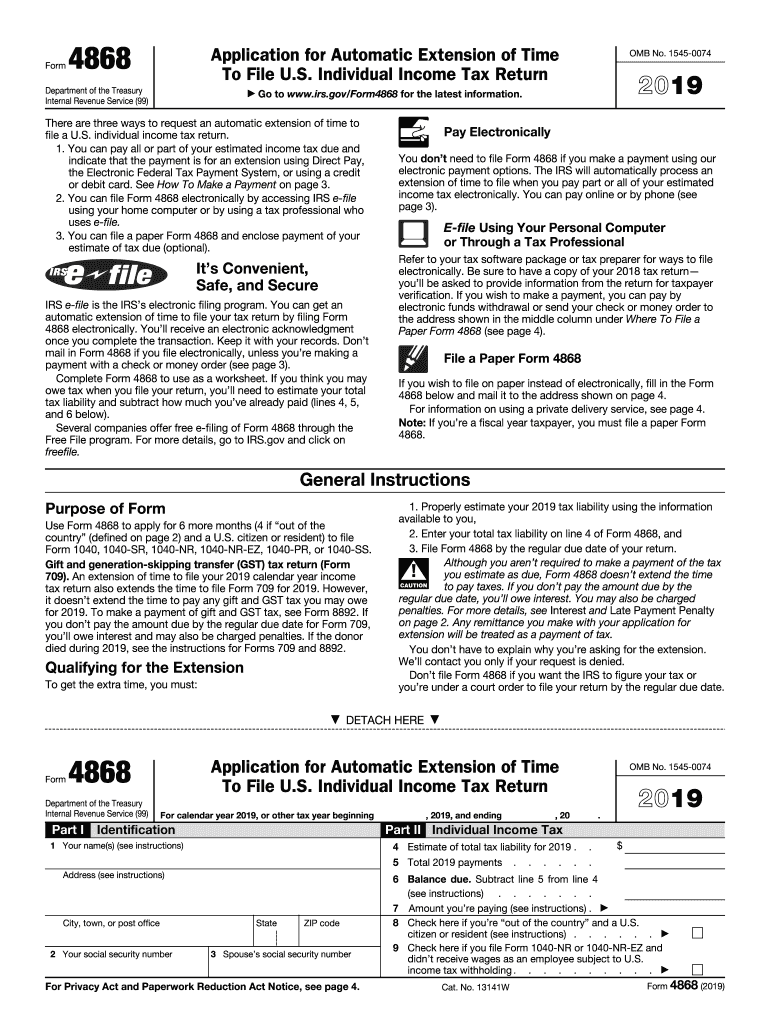

Form 4868 serves as an application for an automatic extension of time to file a U.S. individual income tax return. This form is essential for those who may need additional time beyond the regular tax deadline to prepare their returns. It's crucial to note that while Form 4868 grants an extension for filing, it does not extend the time allowed for tax payments. Taxpayers are still responsible for estimating and paying any taxes owed by the original due date to avoid penalties and interest.

This form is commonly used by individuals who may not have all the necessary documentation required to file their returns on time, such as W-2s or 1099s. Additionally, those anticipating complex tax situations—such as self-employed individuals or those with significant investment income—often utilize Form 4868 to ensure they can provide accurate returns without rushing.

The form can be completed online, making it a convenient option for taxpayers. By filing electronically, taxpayers can ensure immediate processing, leading to quicker confirmation of their extension request.

Steps to Complete Form 4868 Online

Completing Form 4868 online involves several straightforward steps designed to facilitate a smooth filing process.

-

Access the Form

Go to the IRS website or a tax preparation service that supports the e-filing of Form 4868. Ensure you have your personal information, including your Social Security number and income details, at hand. -

Provide Identification Information

Enter your name, address, and Social Security number or Individual Taxpayer Identification Number. If you're filing jointly, both spouses must provide their details. -

Estimate Your Tax Liability

Calculate your projected tax liability for the year. If you expect to owe tax, it's advisable to include an estimated payment along with your Form 4868 to avoid penalties. -

Select Your Payment Method

You may choose to pay any amount owed electronically during the e-filing process. Various options are available, including direct debit from a bank account or using a credit card. -

Review and Submit the Form

Before submitting, review all entries for accuracy. After ensuring all information is correct, you can submit the form electronically. Confirmation of your extension request will typically be provided shortly after submission. -

Follow-Up

Keep a record of your confirmation receipt for your records. This will serve as proof that you filed for an extension.

These steps ensure compliance with IRS regulations and provide a structured approach to filing for an extension.

Key Elements of Form 4868

Understanding the key elements of Form 4868 can aid taxpayers in ensuring that they provide all necessary information correctly.

-

Taxpayer Identification: This includes name, address, and Social Security number. These details are critical for the IRS to identify your tax records.

-

Estimated Tax Liability: Taxpayers must provide an estimate of their expected tax owed for the year. This figure plays a crucial role in determining whether payment is required at the time of filing the extension.

-

Payment Information: If you owe taxes, you must indicate how much you will pay when submitting Form 4868. This involves entering the amount to be paid and selecting a preferred payment method.

-

Extension Period: Form 4868 allows for a six-month extension to file your return, making it imperative to include this detail in the submission.

-

Signature and Date: An electronic signature (or typing your name in certain online forms) signifies that the information provided is true and complete.

Each of these elements plays a vital role in accurately processing the extension and ensuring compliance with IRS regulations.

Legal Use of Form 4868 Online

Form 4868 holds legal significance as it is recognized by the IRS as an official application for an extension. To ensure compliance, it is important to be aware of the following legal aspects:

-

Filing Deadline: The form must be filed on or before the regular tax return due date (typically April 15). Late submission may result in penalties.

-

Legitimacy of E-signatures: When submitting the form online, electronically signed extensions hold the same legal weight as handwritten signatures. This is reinforced by the IRS regulations concerning electronic filings.

-

Consequence of Non-Compliance: Failure to file Form 4868 in a timely manner can result in penalties, including an immediate assessment of late fees on any taxes owed amount. Understanding these implications can help taxpayers avoid unnecessary costs.

Being informed about the legal ramifications ensures that individuals utilize Form 4868 correctly and within the established guidelines.

Important Terms Related to Form 4868

Familiarity with relevant terminology can enhance understanding and accuracy when completing Form 4868.

-

Tax Return: This refers to the formal documentation of income, deductions, and taxes owed to the IRS. Form 4868 is a request to extend the time to file this return.

-

Tax Liability: This term denotes the total amount of tax that an individual is required to pay based on their income and deductions.

-

Extension: In this context, an extension refers to the additional time granted for filing a tax return. Form 4868 specifically grants a six-month extension.

-

E-filing: The process of submitting tax forms electronically through authorized platforms or software.

-

IRS: The Internal Revenue Service, the United States government agency responsible for tax collection and enforcement.

A clear understanding of these terms can help streamline the tax filing process and ensure accuracy in communications with the IRS.

Filing Deadlines and Important Dates for Form 4868

Awareness of key deadlines is critical for taxpayers seeking to file Form 4868 and avoid penalties.

-

Standard Filing Date: Form 4868 must be filed by the original tax return due date (April 15). If this date falls on a weekend or holiday, the deadline may be adjusted to the next business day.

-

Extended Filing Deadline: Upon successful application via Form 4868, taxpayers are granted an additional six months, making the new deadline typically October 15 for those who filed properly.

-

Payment Deadlines: Any estimated taxes owed must be paid by the original due date. This critical aspect is often overlooked, but paying taxes on time helps in avoiding penalties and interest on outstanding balances.

Attention to these dates assists taxpayers in navigating the complexities of tax compliance and ensures they fulfill all obligations properly.