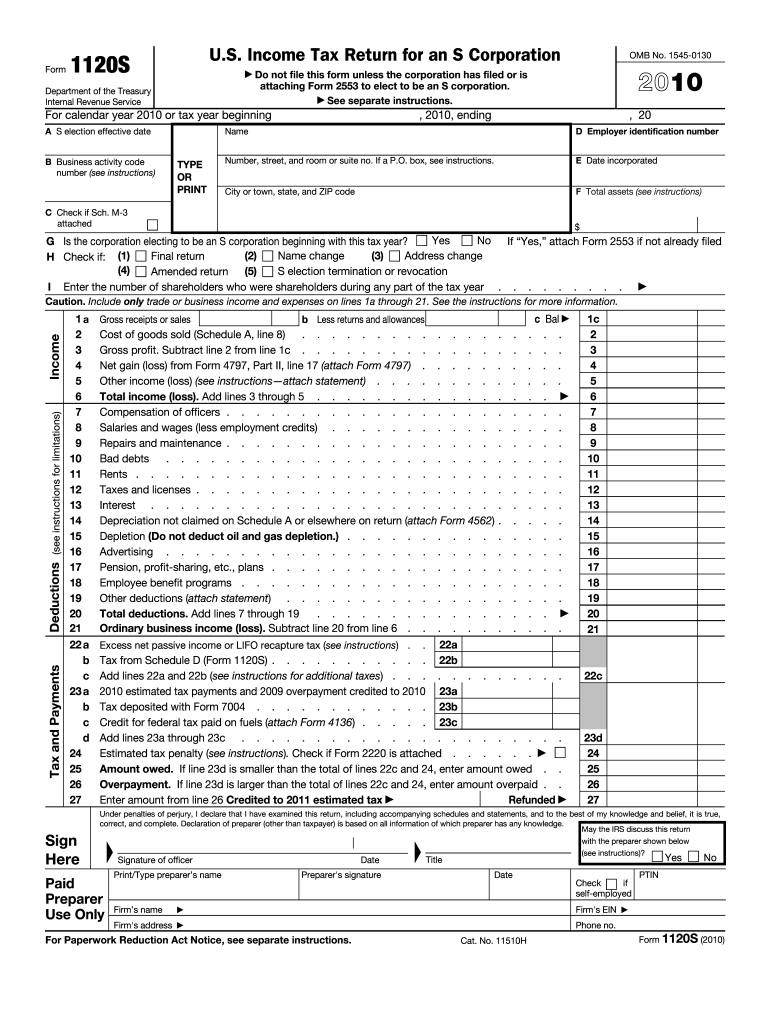

Definition and Meaning

The 2010 Form 1120S is the U.S. Income Tax Return form specifically for S Corporations for the tax year 2010. S Corporations are distinct in that they pass income, losses, deductions, and credits through to their shareholders for federal tax purposes, allowing them to report income on personal tax returns, thus avoiding double taxation on the corporate income. This form is crucial for documenting these financial activities accurately.

Key Sections of Form 1120S

- Income: Captures the S Corporation's income from sales or services.

- Deductions: Includes allowable company expenses subtracted from total income.

- Shareholder Information: Necessary details about each shareholder, including their distribution share.

- Balance Sheets and Schedules: Details on financial positions at the start and end of the tax year.

The form ensures compliance with federal tax laws and helps determine the correct tax liability for both the corporation and its shareholders.

How to Use the 2S Form

The 2S form is used by S Corporations to report financial data for the tax year. Proper completion is essential for accurate tax reporting and compliance.

- Gather Required Information: Assemble financial records, including income statements, balance sheets, and records of shareholder distributions.

- Complete Income and Deductions Sections: Enter details of revenues and expenses.

- Fill Out Schedule K-1: This must be completed for each shareholder, detailing their share of the corporation's income, deductions, credits, and more.

- Balance Sheet Preparation: Ensure beginning and ending balances are accurately reflected.

Following these steps ensures that the 1120S form accurately represents the corporation's financial activities.

Steps to Complete the 2S Form

Completing the 2S form can be systematic if approached methodically.

- Start with Corporation's Details: Fill in the corporation's name, address, EIN, and date of incorporation.

- Report Income: Document all sales, other income, and cost of goods sold.

- Account for Deductions: List every deductible expense, from salaries and wages to office supplies.

- Calculate Shareholder Distributions: Detail each shareholder’s pro-rata share of the S corporation’s items.

- Preparation of Schedule L: Ensure that assets, liabilities, and owners' equity are documented.

- Use Software Tools: Tools like TurboTax or QuickBooks help streamline the form-filling process by automating calculations.

Following these steps helps in accurate filing and compliance with IRS regulations.

Who Typically Uses the 2S Form

S Corporations in the United States are mandated to use the 2010 Form 1120S to report their financials for that specific tax year. Typically, businesses structured as S Corporations, which may include certain small businesses, family-owned companies, and domestic corporations, utilize this form.

- Small Businesses: Often elect S Corporation status to reduce tax burden.

- Family-Owned Companies: Use this status to manage internal financial distributions effectively.

- Professionals and Service Providers: Those in consulting, legal, or accounting fields sometimes choose S Corporation status for its tax benefits.

Important Terms Related to the 2S Form

Understanding the following terms is critical when dealing with Form 1120S:

- Pro-Rata Share: The portion of income or loss pass-through that corresponds to each shareholder's ownership.

- Pass-Through Taxation: A taxation method that lets the income be taxed at the shareholder level, not at the corporate level.

- Schedule K-1: An IRS schedule that reports each shareholder's share of the S corporation's income, deductions, and credits.

These terms ensure clarity in filing and comprehension of the form's requirements.

IRS Guidelines for the 2S Form

The IRS provides specific guidelines to ensure proper completion and submission of the 2S form:

- Deadlines: Must generally be filed by the 15th day of the third month after the end of the tax year.

- Eligibility Criteria: Must meet S Corporation criteria, including limits on the number and type of shareholders and stock classes.

- Filing Extensions: Allowed, but requires Form 7004 submission.

Adhering to IRS guidelines is crucial to avoid errors and potential penalties.

Filing Deadlines and Important Dates

For the tax year 2010, the 1120S form had a filing deadline typically set for March 15, 2011. However, extensions were available upon request through Form 7004, extending the deadline by six months.

Key Considerations:

- Plan for an Extension: Submit Form 7004 before the March deadline to avoid last-minute rushes.

- Prepare Early: Start collating necessary documents and information well before the deadline.

Timely filing prevents late fees and interest charges.

Penalties for Non-Compliance with the 2S Form

Non-compliance with the filing requirements of the 2010 Form 1120S can lead to significant penalties:

- Late Filing: Fines can accrue daily for late submissions without a valid extension.

- Incorrect Reporting: Inaccuracies could lead to audits or further investigations, resulting in additional fines.

- Failure to Provide Schedule K-1: Fines for not supplying shareholders with their K-1 documents in a timely manner.

Understanding these penalties motivates accurate and timely completion of the form.