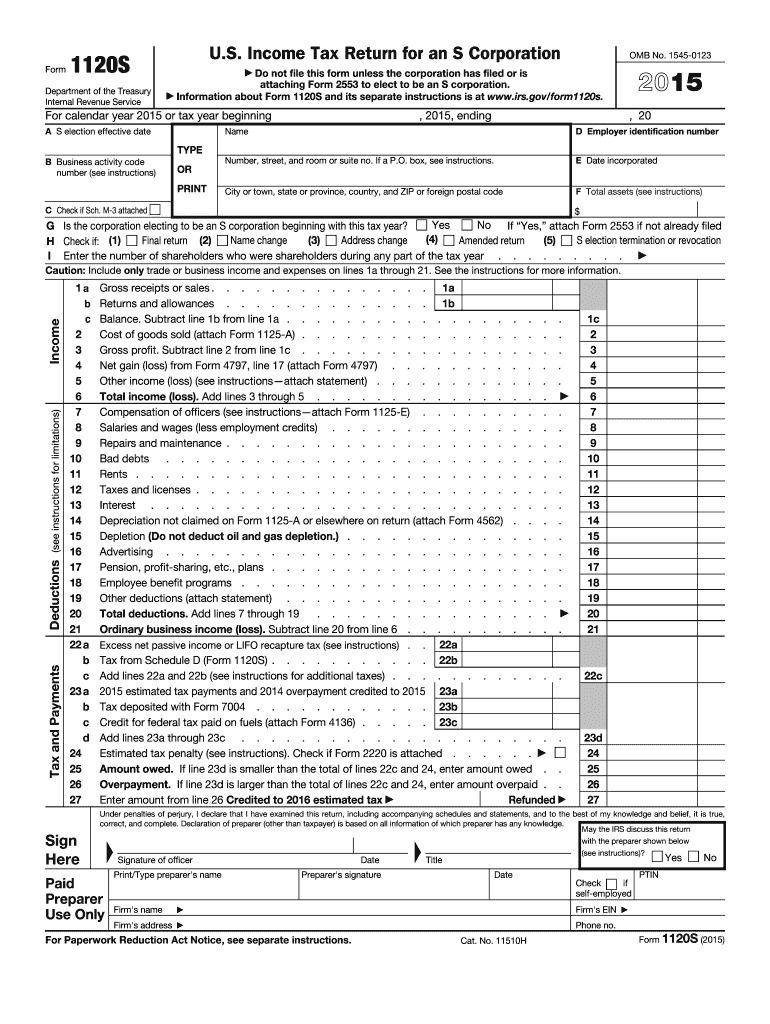

Definition and Purpose of the 2S Form

Form 1120S, formally known as the U.S. Income Tax Return for an S Corporation, plays a vital role for corporations that choose to be taxed as S corporations. This designation allows the corporation's income, deductions, and credits to pass through to shareholders, who then report these on their individual tax returns. The 2015 version pertains specifically to the 2015 tax year, encompassing all corporate financial activities relevant to that period.

S corporations benefit from certain tax advantages, such as avoiding double taxation on income, which is typical for traditional C corporations. An S corporation's income is reported once at the shareholder level, which is reflected in the details filled in Form 1120S. This form includes various sections to document the company’s income, deductions, tax credits, and shareholder information, serving as an essential document for fulfilling federal tax obligations.

Steps to Complete the 2S Form

Filling out the 2S form requires careful attention to detail to ensure accuracy and compliance. The process typically involves multiple steps:

-

Gather Required Information: Collect essential data, including the corporation's Employer Identification Number (EIN), shareholder details, income statements, and records of expenses and deductions.

-

Complete the Main Body: Start with the income section to report the corporation’s revenue, cost of goods sold, and gross profit. Then proceed to the deductions segment, listing operational expenses and permitted deductions to calculate net income.

-

Attach Schedules: Various schedules are necessary to supplement the main form. These might include Schedule K for shareholder information and Schedule L for balance sheets reflecting beginning and end-year figures.

-

Double-Check Entries: Review all entries for clarity and accuracy to ensure they align with supporting documents. Pay close attention to figures in the balance sheet and tax computation sections.

-

Finalize and Submit: After thorough review, sign the form and choose the preferred submission method, either electronically via IRS e-file or by mail to the appropriate IRS address.

Important Terms Related to the 2S Form

Understanding key terms related to Form 1120S can aid in accurately completing the form:

- S Corporation: A business entity that elects to pass corporate income, losses, deductions, and credits to shareholders for federal tax purposes.

- Shareholder: An individual or entity that owns shares in the S corporation and is responsible for paying taxes on their share of income.

- Schedule K-1: A form used to report each shareholder’s share of the corporation's income, deductions, credits, and other tax items.

- Pass-Through Taxation: A tax mechanism through which business income is reported on the owners’ personal tax returns, avoiding corporate taxes.

Filing Deadlines and Important Dates

Timeliness is crucial when managing tax forms. The deadline for submitting the 2S form was March 15, 2016, for calendar-year S corporations. For those operating on a fiscal year, the form was due three months and fifteen days after the end of their fiscal year. It's essential to adhere to these dates to avoid late filing penalties, including fines and accrued interest on unpaid taxes.

Required Documents for the 2S Form

To correctly fill out Form 1120S, a corporation must gather several key documents:

- Financial Statements: Income statements for the tax year 2015, detailing revenues and expenses.

- Expense Records: Detailed lists of deductible expenses, such as payroll, rent, and utilities.

- Shareholder Information: Details of shareholder distribution and contributions.

- Previous Tax Returns: Returns from preceding years to verify carryover amounts and for consistency.

Submission Methods for the 2S Form

Corporations can choose from several submission methods for the 2S form:

- Electronic Filing: Many corporations prefer e-filing due to its efficiency and speed. The IRS accepts returns through approved software providers.

- Mail Submission: Paper forms can be mailed to the IRS, although this method takes longer and carries risks of postal delays.

- In-Person Submission: While less common, forms can be delivered in person to IRS offices, provided they are postmarked by the deadline.

IRS Guidelines for the 1120S Form

The IRS provides specific guidelines to ensure correct completion of Form 1120S:

- Eligibility Criteria: Only eligible domestic corporations meeting certain conditions can file Form 1120S.

- Record Keeping: Detailed and accurate records must be maintained for all reported amounts.

- Compliance: Adherence to IRS instructions is necessary to avoid audits or penalties.

- Double Entry Verification: It is advised to double-check all entries, as accurate reporting minimizes the risk of errors and subsequent corrections.

Penalties for Non-Compliance with the 2S Form

Failure to comply with filing requirements for the 2S form can result in significant penalties. Late filing without reasonable cause incurs a penalty, usually a fixed amount multiplied by the number of shareholders for each month the return is late. Filing an incomplete or inaccurate 1120S can trigger audits and potential fees. Additionally, penalties may apply for failing to issue correct shareholder K-1 forms.