Definition & Meaning

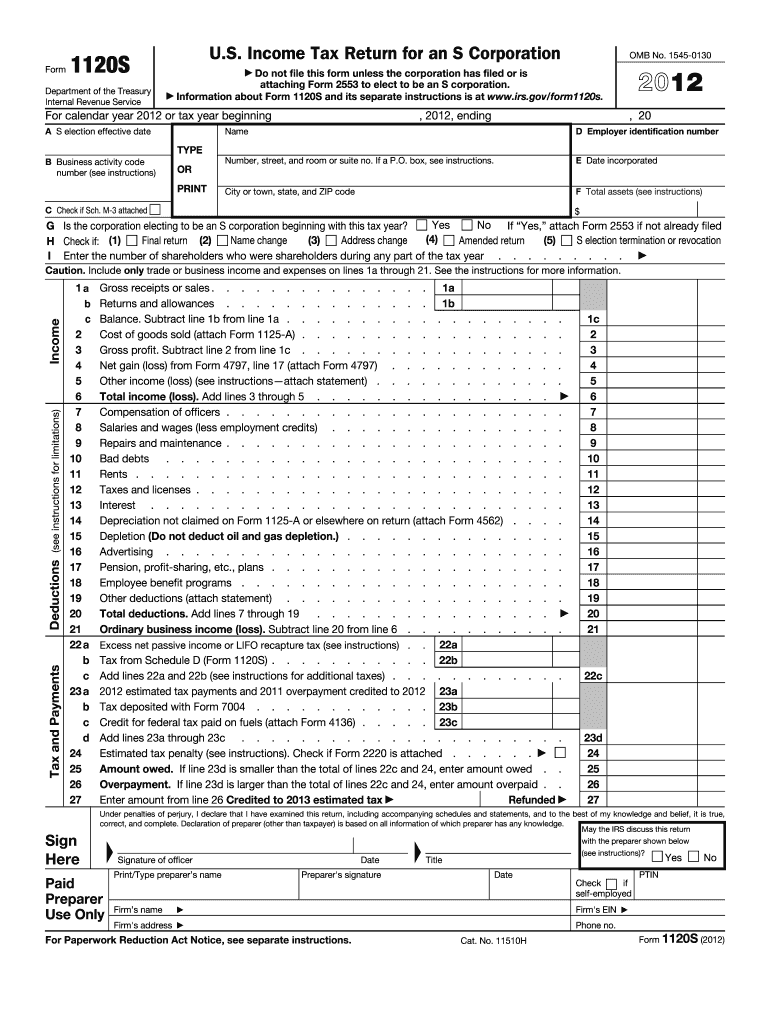

Form 1120S is the U.S. Income Tax Return for S Corporations, used by S corporations to report income, deductions, and tax liabilities to the Internal Revenue Service (IRS). The 2012 version of the form specifically relates to the tax year 2012. S corporations are pass-through entities, meaning the corporation itself doesn't pay income tax. Instead, income is passed through to shareholders, who report it on their personal tax returns. This setup helps avoid double taxation and is beneficial for small to medium-sized businesses.

How to Obtain the Form 1120S 2012

The 2012 Form 1120S can be acquired through various channels. The IRS website provides downloadable PDF versions of past years' forms, including 2012. Users can navigate to the IRS forms and publications section and select the desired year. Additionally, tax preparation software may have archival forms available for e-filing or print. Professional tax preparers and accountants often have access to historical forms, which can be provided to clients upon request.

Steps to Complete the Form 1120S 2012

- Gather Necessary Information: Collect details about your business income, deductions, credits, and shareholder information.

- Complete Basic Information: Fill in the corporation's name, address, Employer Identification Number (EIN), and date of incorporation.

- Report Income: Detail all income sources, including sales, service revenue, and other business receipts.

- Deductions and Credits: List allowable deductions, such as business expenses, and any qualifying credits.

- Shareholder Details: Provide the necessary information about each shareholder, including their ownership percentages.

- Review and Sign: Ensure all portions are filled accurately. The form must be signed by a corporate officer before submission.

Important Terms Related to Form 1120S 2012

- Pass-Through Taxation: A tax structure where the corporation's income is passed through to individual shareholders for tax purposes.

- S Corporation: A type of corporation that meets specific IRS requirements and is taxed under Subchapter S of the Internal Revenue Code.

- Shareholder: An individual who owns shares within the S corporation.

- EIN (Employer Identification Number): A unique number assigned by the IRS to businesses for identification purposes.

Filing Deadlines / Important Dates

The Form 1120S for the year 2012 was due by March 15, 2013. If March 15th falls on a weekend or federal holiday, the due date is the next business day. The IRS allows an extension to file through Form 7004, granting an additional six months if filed by the original due date. However, the extension is only for filing the return—not for paying any taxes owed.

Key Elements of the Form 1120S 2012

- Schedule K: This section summarizes the total income, deductions, and credits of the corporation, which will flow through to shareholders' individual returns.

- Schedule L: A balance sheet as of the beginning and end of the corporation's tax year, showing assets, liabilities, and shareholder equity.

- Schedule M-1: Reconciles income per books with income per return, highlighting differences such as nondeductible expenses.

- Shareholder Information: Individual details regarding each shareholder, their percentage of ownership, and distribution of income, losses, and credits.

IRS Guidelines

The IRS provides comprehensive instructions for Form 1120S, detailing everything from eligibility criteria to specific line instructions. Corporations should refer to these guidelines to ensure compliance with tax laws and regulations. The instructions also cover special circumstances, like changes in shareholder ownership and unique deductions for S corporations.

Penalties for Non-Compliance

Failing to file Form 1120S by the deadline can incur a penalty of $195 per month (or part thereof) for each shareholder, for a maximum of twelve months. There are also penalties for inaccurate information, such as underreporting income or omitting shareholder details. The IRS may levy interest on any unpaid taxes from the original due date of the return.

Software Compatibility

Popular tax software programs like TurboTax and QuickBooks are compatible with Form 1120S, including the 2012 version. These platforms offer step-by-step guidance, ensuring that all tax laws and declarations are followed correctly. Users can electronically file their returns, significantly simplifying the submission process compared to paper forms. Compatibility with these tools provides greater accuracy and efficiency in tax preparation and filing.